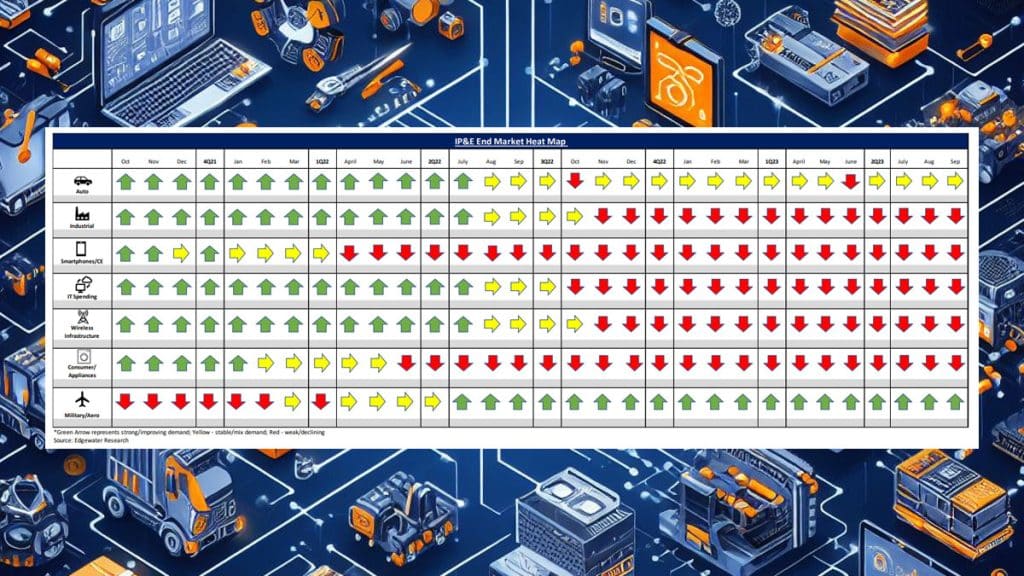

September 2023 collection of news summaries, survey results and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

Limited Change M/M; Inventory Digestion Continues to Progress Slower Than Expected; UAW Strike Adds Risk NT

Key Takeaways:

1. 3Q shipments seen tracking in-line, flat Q/Q with POP/POA weakness in distribution offset by more stable demand direct.

2. Bookings relatively stable Q/Q and mixed by end market with AI strength, stability in Auto and weakness in Industrial/Telco/IT.

3. 2H outlooks little changed; down in distis, flattish direct with added risk to 4Q N.A. Auto from the UAW strike.

Top 5 Channel Comments:

• We have seen no signs of improvement in bookings in Europe. Jul and Aug bookings were weaker than typical. In Sept we saw an uptick in week 1 but the pace moderated in week 2 so orders for 3Q are below expectations.

• Auto connector demand in Europe is stable Q/Q and up low-single digit Y/Y. Yazaki and Aptiv shipments are relatively stronger. TE is struggling a bit with shipments being weaker vs. the rest.

• TE is asking us to take on more Auto product, which is similar to the end of last year when they saw pushouts from direct Auto customers in Europe.

• After synching the data from distis, customers, and EMS, we made no progress in reducing inventory in 2Q, which is disappointing.

• Rockwell and other automation customers are telling us (a supplier) that they will be burning inventory through 1H24 so we should plan accordingly.

Other Key Takeaways:

4. Inventory globally seen as off-peak levels, but progress is slow, particularly for Industrial customers. Digestion projected into 1Q24 as inventory headwinds are seen as compounded by signs of softening end demand.

5. China/APAC still seen relatively weakest; supply chain less optimistic China rebounds meaningfully before 2Q24.

6. EMEA 3Q seen tracking seasonal; Sept order rebound disappointing; 4Q seen down Q/Q on weaker Industrial/Comm Transportation.

7. Americas more stable; 3Q seen flat to up Q/Q on Mil/Aero, AI strength, stable Auto offsetting Industrial/distribution softness.

8. Auto stable with EV strength offsetting moderation in ICE; some green shoots in China direct; N.A 4Q outlook cautious on UAW.

9. TE seen asking distis in Europe to take on additional Auto shipments, reminiscent of 2H22, and implying softer direct demand.

10. UAW strike lasting less than a month viewed as manageable, significant disruption if longer. UAW demands seen as adding considerable cost to OEM supply chains, likely to put incremental pressure on 2024 passive/connector/component pricing negotiations.

11. Industrial (ex-Energy/Medical) demand is still weak, projected down in 2H on increasing inventory digestion at customers and distis.

12. IT datacom seen as stable Q/Q with softness in traditional infrastructure offset by upside in AI. Traditional IT demand now seen soft throughout 2024 on inventory and AI cannibalization. Initial AI ramp seen in 4Q; Amphenol seen having 80% share at Telsa’s AI project.

13. CE/Mobile demand noted as stable but still soft broadly and seasonal for iPhone 15.

Conclusion:

IP&E fundamentals appear largely unchanged M/M, with the inventory digestion across the industry continuing to take longer than expected. Encouragingly, we have seen some pockets of improvements in orders, but those remain largely tied to individual market catalysts like AI and a seasonal uplift around new smartphone model introductions. While we have seen pockets of improvements, the inventory situation broadly has kept both sales and bookings expectations muted through year-end and likely through 1H24. While the long-term fundamentals remain positive, we remain guarded near-term as inventory remains stubbornly high and will likely take longer to rationalize.

Full report available from:

Dennis Reed, Sr. Research Analyst, Edgewater Research