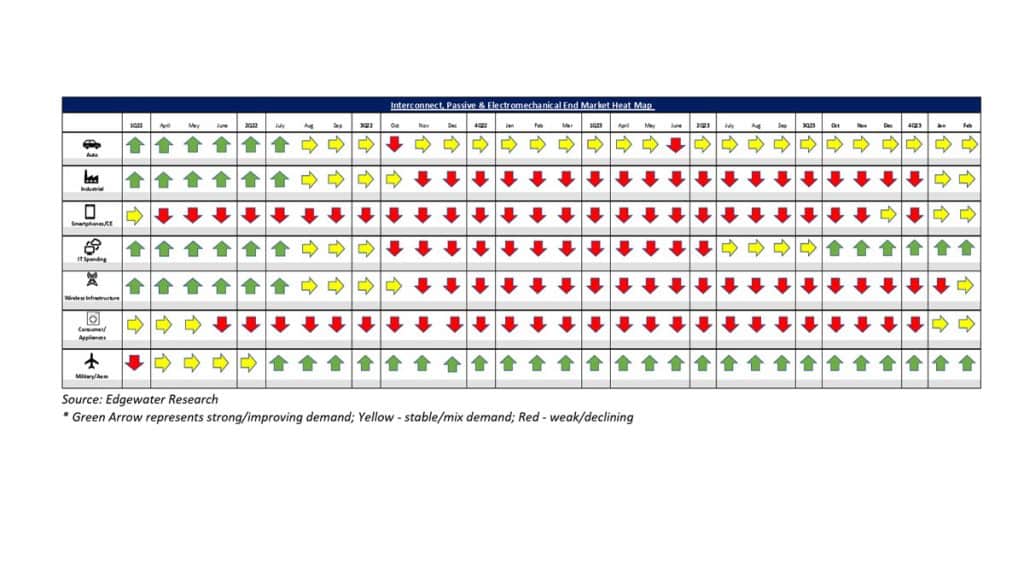

March 2024 collection of news summaries, survey results and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

What’s Changed/What’s New?

1. Signs of order improvements seen broadening across geos with N.A and SE Asia leading, Europe and China lagging.

2. Order uptick seen as gradual, pushing B2B up Q/Q close to 1, and most consistent in Industrial direct with pockets in disti/Telco.

3. Industrial customers seen requesting quicker order turnaround – interpreted as a strong sign of inventory progress. Orders scheduling beyond lead times, however, noted as still limited, suggesting confidence/outlook remains low/muted.

4. 1Q Datacom demand seen tracking ahead driven by AI upside. Datacom B2B seen upticking Q/Q on strong 2Q orders from hyperscale. CY24 AI connector revenue projected up 2-3x, traditional IT demand flat, translating into +15-20% outlook for Datacom.

Top 4 Channel Comments:

• We feel more optimistic compared to December and January. Back then, the IP&E industry started to question the 2H24 recovery. Today, there is more optimism regarding a 2H rebound due to a clearer line of sight of inventory improvement.

• We are finally seeing signs of normalization over the last 3 months. Customers are asking for faster deliveries. In July and Aug we had 25% of orders shipped within 30 days of receipt, now shipping 42% of orders within 30 days. This is the first sign of improvement which tells us that inventory at customers is either back to or approaching normal.

• Momentum in AI remains very strong, and we see upside in 1Q. Feb is typically down but this year Feb was a record month for us.

• Overall datacom bookings are tracking up low double digits Y/Y, while billings are up high teens YTD which supports our forecast for 15-20% growth in 2024.

Other Key Takeaways:

5. Overall 1Q demand seen tracking in-line; 2Q projected up low/mid-single digits with growing confidence destocking ends by mid-year. Supply chain incrementally more optimistic of stronger 2H demand, though visibility noted as remaining limited.

6. China demand still challenged on muted post-CNY activity, though first green shoots seen from distis after 6 quarters of destocking.

7. CY24 Auto forecasts little changed at +mid to high single digits underpinned by strong China Auto. Downside risk remains from slowing EVs with feedback pointing to flat CY24 demand from Tesla.

8. PHEV/HEV end demand seen as more stable in Europe.

9. 1H connector pricings seen as stable; recent increases in gold/silver costs seen as likely to push prices up again in distis on 7/1.

Conclusion

IP&E fundamentals continue to show signs of a classical cyclical bottoming pattern, and we are growing increasingly confident that the supply chain will likely complete its inventory destocking/digestion by mid-year. While B2B is not uniformly above 1 yet, we have continued to see improvements throughout 1Q with green shoot orders across multiple end markets, giving us more confidence about the potential for a 2H24 recovery.

Further improvement is needed, and we are closely watching the order trends to determine the timing and shape of the recovery entering the second half of the year. Currently, outside of AI, shipments look seasonal at best, which we would view as a positive development after several quarters of sub-seasonal performance. In addition to bookings/B2B ratios, we also remain constructive on industry pricing broadly, where outside of select lower-margin markets, predominantly in Asia, the pricing environment has remained benign despite the inventory correction.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research