“We hope that the absolute bottom has been reached!” Engelbert Hopf, Markt & Technik interviewed Rüdiger Scheel, Vice President Mobility at Murata Europe, who assures that Murata can supply the automotive industry with significantly more MLCCs and other passive components – only the missing semiconductors prevent it. In order to be prepared for increasing demands in the future, production is being massively expanded around the world.

Markt & Technik: Mr. Scheel, in the last few months the situation in the automotive sector seems to have worsened rather than relaxed. How do you perceive the current situation from Murata’s point of view?

Rüdiger Scheel: We hope that the bottom has now been reached! Murata also buys semiconductors for various products himself. September / October was the period with the worst delivery performance of our semiconductor suppliers. Since then we have seen gradual improvements. We assume that there will be a significant improvement by the 1st quarter of 2022. Of course, not at the level that the delivery bottlenecks are completely resolved, but at least in such a way that a relaxation can be felt. We had planned our deliveries to the automotive industry at the best-case level – with a semiconductor shortage of 10 to 20 percent, this plan is of course not feasible. For this reason, it is currently just as difficult to make an exact forecast for the automotive industry for 2022, as our customers’ forecasts are based on planning without IC and raw material shortages.

To get an idea of the MLCC requirements of today’s vehicles – how high is the MLCC requirement of an average car today, and where are the requirements for the ramping up electric vehicles?

In a well-equipped car with a combustion engine but without driver assistance, there have been around 5000 MLCCs so far. Depending on the equipment, there are between 10,000 and 20,000 MLCCs in a Tesla 3 today. The electrification of the car and the driver assistance systems used are responsible for this. If a high-performance Nvidia or Intel / mobileye core is used in one of the high-quality equipped electric cars for real-time evaluation of the driver assistance sensors such as cameras, radar, ultrasound or lidar, then we can already move beyond the 20,000 MLCCs in the vehicle move. This number could increase even further in the next few years.

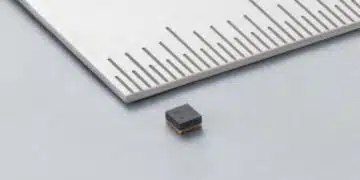

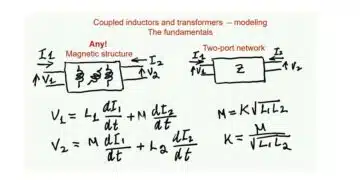

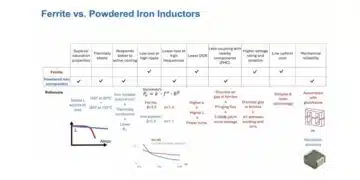

You don’t just supply MLCCs to the automotive sector. What is the situation like with inductors, for example?

While we currently do not have a shortage of MLCCs because the shortage of semiconductors means that our customers cannot process as many MLCCs as we can provide, the situation is somewhat different for inductors. In order to supply power-hungry processors, corresponding inductances are required. The demand for ferrite beats and ferrites is growing rapidly. When it comes to metal composites, we see enormous demand from the smartphone sector, especially in the area of small designs. In the area of higher performance, we are currently in the process of expanding our product range, for example for the automotive sector.

In which directions are the development trends for MLCCs for the automotive sector currently going? Higher capacities, more robust design, suitable for even higher temperatures?

Higher capacities in smaller designs are a steadily continuing trend. For MLCCs with XR7 / C0G material, operating temperatures of up to +125 ° C are standard. The next category would then be operating temperatures of up to +150 ° C. Of course, that doesn’t mean the MLCCs will exit at higher temperatures. Our products meet requirements that are well above those of the AEC-Q200. If standard temperatures of up to + 180 ° C emerge in the future, we would be able to specify in this direction, with appropriate consideration of the mission profile. When it comes to robustness, soft termination is used wherever it is necessary. One trend that is clearly recognizable, however, is the increasing demand for high-voltage SMD capacitors for the voltage range from 500 to 3000 V.

Murata introduced silicon capacitors this summer. Is this a capacitor structure only for the telecommunications sector or is it also conceivable for use in the automotive sector in the future?

From today’s perspective, this is a niche product. It is used wherever there are high demands on temperature stability and minimal capacitance drift. Of course, this solution is also suitable when it comes to highly integrated solutions to install the necessary capacities directly next to or under high-performance processors or ASICs. So far, corresponding solutions have gone into medical technology, for example. The silicon capacitors are being implemented by Murata Integrated Passive Solutions in France, the former IPDiA. In the automotive sector, we see future applications in power electronics.

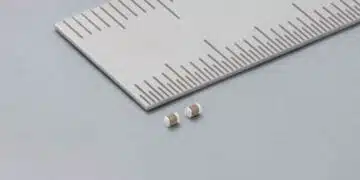

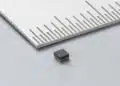

On the subject of new developments: What are the smallest MLCCs that you supply today? When could the next step in miniaturization follow?

Our smallest design, which we have been offering for two years now, is an MLCC of design 008004 with 100 nF and 6.3 V. In the meantime, however, we are also on the way to a capacitance of 1 µF. This development is being driven by the smartphone sector. There, components of this size go into power amplifiers and antenna switch modules. Our sweet spot, on the other hand, is currently 0201 – two sizes above. This 0201 is of course also available as an automotive grade, but customers there are currently still mainly busy with the transition from 0603 to 0402. A smaller design than 008004 is technically entirely possible, the decisive factor is primarily the necessary fine-grainedness of the ceramic powder, but I would not expect it for a few years.

… “don’t become a bottleneck for our customers!”

What is the overall importance of the automotive segment for Murata? How high was the share of sales recently? Which product segments come after automotive?

In the last financial year, the automotive share was 18 percent. It was already higher, but due to the corona pandemic and the million vehicles not built, the computer and telecommunications sales segments are well ahead of the automotive sector.

Murata is currently massively expanding its production capacities. Are there new production lines and plants for the automotive industry or is this expansion focused primarily on products for consumer electronics?

We are expanding production capacities for all areas of application in parallel. In the Philippines in particular, we have recently significantly expanded our production capacities. But of course the corona pandemic and its wake lockdowns and limited travel options have made things more difficult, for example the assembly of new machines or the start-up of new production facilities. In China, we are currently expanding our plant in Wuxi as an automotive MLCC location, thus expanding our production capacities to a relevant extent in the course of the next year.

MLCCs are likely to continue to generate the largest share of sales at Murata. Can you give us specific figures for the last financial year? Which products will follow after that?

Murata is now a company with almost 14 billion euros in annual sales. The MLCC division once again developed into the largest revenue generator in the last financial year. Followed by the area of HF modules and other products, to which we also include EMC filters and sensors in addition to inductors.

We are in the second half of your financial year 2021/22. What sales growth do you expect for the current financial year?

In total, Murata expects sales to increase by 6.5 percent for the current financial year. While products for computers and peripheral devices can show an increase of up to 20 percent and communication is growing by around 20 percent, the growth curve in the automotive sector is flat. It remains to be seen whether there will be catch-up campaigns in the automotive sector in 2022 with the relaxation in the semiconductor market. After all, around 10 million vehicles worldwide were not built due to the shortage of chips.

How much does Europe contribute to total Murata sales? How is the relationship to the other sales regions? Will the increasing production of electric cars in Europe help to make Europe more important for Murata in the future?

Traditionally, Europe’s direct share of sales is between 8 and 9 percent. If you add what is designed and decided in Europe, for example the production of German automotive suppliers in China, this proportion doubles. In view of the strong commitment to electric vehicles in Europe and the fact that these vehicles will be extensively equipped with driver assistance with regard to autonomous driving, we expect an annual growth of 10 to 20 percent in terms of unit numbers in Europe.

What is the current delivery situation for Murata? What were the delivery times before the pandemic? Do you expect the situation to ease soon?

Against the background of regional lockdowns and corresponding hygiene and logistics concepts in our plants, we currently have the situation very well under control, but that can change again very quickly. However, in the last few months we have been able to help customers who have been affected by delivery failures from other manufacturers.

What are your expectations for 2022? Do you expect the market to relax or will the current market situation continue?

This is a look into the crystal ball: We are assuming that the situation with semiconductors will gradually relax, but that the delivery situation will remain tense in 2022. Real relaxation is not expected until 2023. Our main task until then: not to become a bottleneck for our customers!

The original interview has been published first in German by Markt & Technik; published under permission from Markt & Technik