Source: TTI Insight article

by: Jeff Ray, TTI, Inc.’s Vice President of Corporate Product Management and Supplier Marketing

At the moment, multilayer ceramic chip capacitors (MLCCs) appear to be more readily available than they were in early 2018. Given these supplies, one could almost assume that the risk to manufacturers’ supply chains has subsided. That simply isn’t the case.

As we entered Q3 2019, the MLCC market was in “the eye of the storm.” Between a wave of products going through end-of-life and leaving production, and increasing need for components in high-consumption applications such as mobile devices, vehicles and Internet of Things devices, the MLCC market will tighten once more.

Whether they’re saying so outright or making subtle changes, MLCC manufacturers have started focusing their current capacity and future product roadmaps on certain vertical markets, case sizes and capacitance ranges. It is critical for customers to understand these paths and adjust their procurement strategies as needed.

The Complex MLCC Market

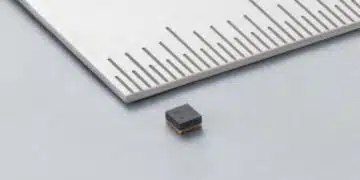

While MLCCs are considered lower technology electronic components, they are certainly not a “one size fits all” component. They are critical to the end products of today’s electronic industry, and as such, the MLCC market is full of complexities that make sourcing these components ever more complicated.

Let’s explore some of the potentially problematic areas within the world of MLCCs by breaking down the market into groups based on capacitance value (CV), case size and grade:

Capacitance value, for the purposes of this article, will be defined as Low CV and High CV. Low CV are MLCCs with a value of <1μF and High CV are MLCCs that are 1μF or greater

Case sizes can range from 008004 to 6560, but in North America the more prevalent case sizes are from 0201 to 1210. Small case size MLCCs will be 0402 and smaller and large case MLCCs will be 0603 and greater.

Commercial vs. Specialty – There are two fundamental grades of MLCCs: commercial MLCCs are standard components, while specialty MLCCs have automotive-rated and/or flexible terminations that resist cracking in applications with shock and vibration.

The good news from a sourcing perspective is that if your bill of materials calls for low CV, small case size, commercial grade MLCCs, the market is fairly available to you right now. Due to recent softness in the Asia-based consumer market and End-of-Life (EOL) production runs, there is an abundance of this type of MLCC in the market today.

However, the demand for these components will pick up in the back half of 2019 and increase in 2020 as the global market strengthens. Some potentially problematic areas within the low CV MLCC sphere are specialty grade, small case size components and commercial grade, large case size MLCCs. Although the 12-to-16-week lead times for MLCCs in these categories may seem to indicate a level of market normalcy, availability for certain values continues to be constrained and I recommend that you verify the delivery dates of your orders for these components.

Challenges persist in large case size (0805-1210), specialty grade, low CV MLCCs. Capacitor manufacturers saw very low ROIs in low CV MLCCs for many years, and with the volumetric consumption of ceramic material used being directly proportional to the size of the MLCC, adding capacity for these products is less attractive for manufacturers.

Along with the increased difficulties of producing specialty grade MLCCs, availability will remain tight for the foreseeable future. As of this writing, lead times range from 22 to 45 weeks.

Serious, Ongoing Constraints

In the area of high CV MLCCs, the market is somewhat similar to the low CV market, with some noted exceptions.

Components with a higher CV rating tend to come in larger case sizes, and not all manufacturers have the technological capability to produce high CV MLCCs in volumes and, more importantly, with high quality. As a result, the manufacturing base for high CV MLCCs is more narrow, particularly in the specialty MLCC category.

Small case size (0201-0402) commercial and specialty grade high CV MLCCs, as well as large case sizes (0603-1210), are comparatively available today with lead times of 18 to 35 weeks. However, as previously mentioned with Low CV MLCCs, this availability is due to a softer Asian consumer market and will not continue throughout the back half of 2019. We will see the market only continue to get tighter as we go into 2020.

The most problematic area in the current market remains large case size (0603-1210) specialty grade high CV MLCCs. Out of the thousands of parts within this category, roughly 80 part numbers are still constrained to allocated. This is an area where the manufacturing base is most limited, especially for MLCCs with CV ratings above 10μF. Overall lead times for this category currently range from 24 to 45 weeks.

End Market Demand is Outpacing Current Capacity

Every sign points to end-customer demands and subsequent application requirements for high CV specialty grade MLCCs moving faster than manufacturers can produce product. Although many MLCC manufacturers are adding capacity and upgrading their capabilities to compete in this area, some are at least one manufacturing generation behind. It could be two to five years before reliable production quantities are available.

Meanwhile, customers may have some flexibility on case sizes based on the pad layouts in their designs, but migrating from large case size MLCCs to smaller case sizes can be a difficult, expensive and time-consuming process.

For customers in the transportation, medical and military markets, there can be additional issues because their end product life cycles can be very long and the qualification processes are lengthy. Add to this the fact that future high-tech growth is likely to cause more demand and, in turn, more constraints, and it becomes clear that the MLCC storm has not passed.

TTI is the world leader in the distribution of MLCCs, and we have aligned with the leading manufacturers to provide our customers with a safe passage through the turbulent MLCC market.