Source: EPS news

August 30, 2018 By Barbara Jorgensen

Electronic component supplies are only going to get tighter as 2018 approaches calendar Q4. Demand remains at or above normal levels in the automotive, IoT, and industrial markets; capacity ramp-up may not bear fruit until the end of the year or 2019; and tariffs are likely to unravel an already-stressed supply chain.

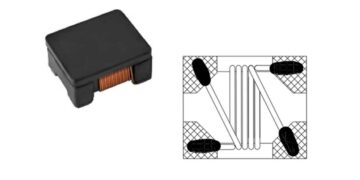

Investment firms Morgan Stanley and Stifel, in their most recent market updates, found the ongoing electronic component shortage appears to be getting worse. “Lead times remain elevated across a number of components, including capacitors, resistors, memory, and certain discretes, according to our analysis of distribution data,” Stifel reported in a July 16 update. “We continue to see signs of double ordering as customers scramble for parts. The multi-layer ceramic capacitor (MLCC) shortage is the most severe, with many parts seeing order-rescheduling requests from customers waiting on MLCCs or other parts.”

The latter is particularly vexing for OEMs and EMS providers that may have to delay production while waiting for commodity parts. Component manufacturers are not expanding capacity for low-cost devices that have been around for decades – the very parts in highest demand.

Michael Knight, president of TTI Semiconductor Group

“Passive component makers are adding capacity for the products that the business of the future is going to need; not the legacy products,” said Michael Knight, president of TTI Semiconductor Group (TSG). “We are talking about products that have been relatively unchanged for 20 to 30 years, and suppliers that have limited capital expenditures to invest. Do you invest in products whose days are numbered, or do you invest in next-generation products?”

Capacity conundrum

Capacity constraints are impacting TTI along with other distributors. At the same time, Knight notes that a long period of adequate supply has driven IP&E prices and margins into the ground. Suppliers as well as distributors have been battling over margins for some time – and customers have been reaping the benefits of ongoing price erosion.

But technology transitions take time. “Adding capacity now is unlikely to make a difference in MLCCs,” said Andy King, president, global components, for Arrow Electronics Inc. “[Passives suppliers] haven’t added a new MLCC fab in in years. There’s limited capital; and from what I’ve been reading suppliers are not making a lot of money in legacy products. But we also have demand acceleration—we have twice as many MLCCs in a product than in its previous version – and some suppliers have realigned what products they will be in and the products they will no longer be in. There has been limited capital for capacity to increase until recently, and it will take a while to come on line.”

Although supply is tight, distributors say they are managing to get the parts their customers need. “Is everybody ramping to the levels we aspire to?” King said. “In most cases, no. Companies that used to flex their production up or down at a moment’s notice – that’s no longer the world we live in. We see demand pulling more units into the marketplace, but [suppliers] can’t just knit new production capacity. There’s no question there’s pain, which is why we make sure what we get is the right amount of products to the extent that we can. And we are achieving that with most parts.”

Lead times to extend further

Experts across the electronics industry do not expect lead times to abate in Q3 or Q4. (Additional information is available through TTI). Companies that are expanding capacity, such as capacitor maker AVX, expect supply will continue to lag demand.

“As capacity begins to come online at the end of this calendar year and into 2019, we might see a softening of the over-demand but not to the degree of easing of the constraint,” AVX President and CEO John Sarvis told analysts. “Additionally, there is a lack of clarity as to when the capacity for the industry as a whole will actually come online due to testing and qualification times. Many variables will impact the depth and breadth of the shortage such as future growth demands, cost and the speed which additionally capacity will be available.”

Stifel’s poll of suppliers and distributors found that 49 percent of capacitors are considered “highly constrained;” as are 35 percent of resistors; and 9 percent of discretes. However, 41 percent of discrete suppliers are quoting lead-times of 15 to 18 weeks and 14 percent are quoting 26-week lead times or longer.

“In some cases, suppliers aren’t even quoting lead times and instead are placing customers on allocation,” Stifel reported. “Pricing is also going up. We have heard of some OEMs getting allocation on a weekly basis, forcing them to reschedule production runs when they can’t get enough supply.”

These shortages are having a domino effect on other components. Forty percent of respondents to Morgan Stanley’s quarterly survey expect connector lead times to go up by more than six weeks. The firm also noted that lead times for analog ICs and MCUs continue to climb. In analog, 55 percent of respondents cited lead time extension; in MCUs, 43 percent saw lead-times expand. Component companies that don’t have supply problems may cite their peers as a risk factor for the rest of the year.

Risk factors increase

There are also additional risks. During periods of component shortages, counterfeiters flood the open market with fake, damaged, or re-labelled parts. Independent and hybrid distributors, that aren’t franchised for all the brands they sell, have enhanced their anti-counterfeit efforts.

Independents may source from component suppliers, OEMs, EMS providers, and other distributors. Tracing a component to its original factory is one way of proving its authenticity. “We are very transparent about component traceability,” said Sasan Tabib, CEO of hybrid distributor Chip One Exchange, “so customers can adjust their testing levels if need be.”

Chip One categorizes devices based on their traceability and Chip One’s experiences with its component sources. Category 1 devices retain their traceability documentation. “These are components for which we don’t have a high level of concern,” said Tabib. “Category 2 devices aren’t 100 percent traceable but come from suppliers Chip One has a high level of confidence in.” As customers move farther down the list, “buyer beware” becomes the dominant guideline. “We are very upfront with customers,” said Tabib. “If components come from a vendor we’ve never worked with, we let the customer know upfront. If there’s anything visibly wrong with the components we won’t even ship them; for others we strongly recommend stringent testing.”

“Nothing good” to report on tariffs

Stifel’s analysis of U.S. tariffs’ impact on the supply chain is “nothing good to report.” Even in mid-July, there were minor disruptions and confusion across the supply chain. “We learned that some electronic component suppliers and distributors are working with U.S. customers to shift shipments and inventory warehousing to locations outside of the United States, in particular Mexico and Canada where they can move into the U.S. through free trade zones,” Stifel said. Companies with heavy sales exposure to Europe nd Asia are evaluating relocating their Chinese production facilities to other low-cost countries, the firm added.

In its analysis, Stifel found:

- The threat of tariffs led to some pull-in orders in the June quarter, particularly through distributors, according to its checks, and there could be similar lift for parts that are on the second list of tariffs.

- Given that most manufacturing is conducted outside the United States in lower cost regions, supply chain’s logistics are currently being re-routed to bypass the United States as much as possible.

- Suppliers with heavy end market sales exposure to Europe and Asia are examining ways to decrease manufacturing footprint and minimize supply chain routing in the United States.

- The very same companies are evaluating relocating their Chinese production facilities to other low-cost countries such as the Philippines, Vietnam, and Mexico. Furthermore, capital investments to increase Chinese manufacturing facilities are being reevaluated given the negative import tariff implications into the United States.

- Certain suppliers noted that their ERP systems have now been reconfigured to generate a separate tariff invoice separately to their bill-of-materials (BOM) and billed accordingly to their customers. Previous long-term contracts are being renegotiated with customers, but customers in general have been receptive to paying the additional tariff invoice, with some certain exceptions.

- Suppliers expect distributors to assume the tariff responsibility.

- Distributors expect tariff costs to be passed onto customers. However, distributors remain concerned that a separate Tariff BOM will enable customers to indirectly calculate a distributor’s cost basis and margin spread, which is generally proprietary.

Andy King, president, Arrow Global Components

Arrow Electronics, which already manages millions of SKUs, is using its capabilities to assist customers. “We are communicating with our customers and letting them know immediately about any parts or usage [requirements] that will impact their orders,” said King. “We also discuss the parts we know that they will use later; and we are putting processes in place to manage the devices that flow into the U.S. and flow to multiple marketplaces. In some cases, we are realigning those supply chains to get products to where the customer needs them. In all cases we provide 100 percent visibility.”

Distributors are passing tariff-related costs on to their customers. “Arrow is diligently following Section 301,” the company wrote to customers, “and we view the tariffs as a regulation promulgated by the U.S. government, similar to a tax imposed in the purchasing of products. As such, going forward, those costs should be absorbed by the purchasing party.”

For the rest of 2018, buyers can expect tighter electronic component supplies, higher prices, and likely, more disruptions as the industry re-routes its supply chains.