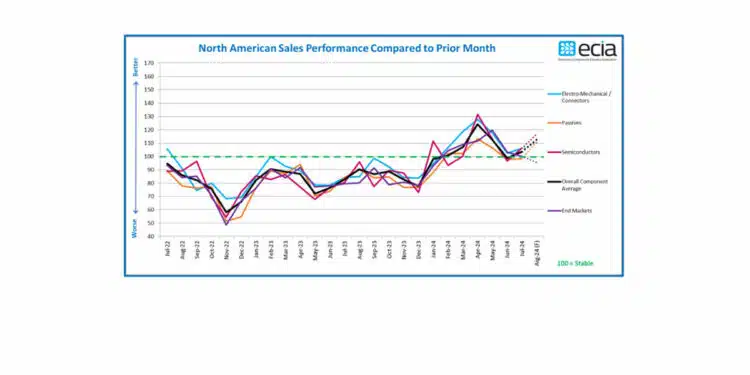

North American ECIA’s Electronic Component Sales Trend Sentiment ECST recovered slightly with modest move into positive territory in July 2024.

Following two months of sliding electronic component sales sentiment measurements that left the overall product index in negative sentiment territory, the component index recovered slightly into positive territory with a 4.5-point rise in July.

While the score of 103.4 is just above the threshold of 100, this recovery up to a positive range is encouraging as the market moves into the second half of the year. The reversal in momentum is expected to continue. Looking toward August, survey respondents set expectations for an accelerating recovery in sentiment up to a 112.7 index score. While the survey often projects a stronger improvement than is achieved, any level of continued upward improvement in the market would be a valuable indicator of continued positive momentum.

Semiconductors delivered the strongest increase in its rating with a jump of 9.6 points to top 106 and expectations of continued improvement looking toward August with an index score of nearly 117. Electro-Mechanical/Interconnect components, which sustained a positive reading above 100 in June, showed a slight improvement of 3.4 points in July. Expectations for the August index measurement come in above 110.

The index score for Passive components was essentially flat between June and July as this segment remained in negative sentiment territory. All three Passive components segments are struggling equally with scores between 97 and 100. On the bright side, Passive component sales sentiment is projected to improve the most in August with an improvement of over 13 points.

This hopeful start to the second half of 2024 should be sustained through Q3 based on the outlook from the last quarterly survey. The Q3 outlook in the last quarterly survey shows 53% of participants projecting growth in Q3 with 18% expecting growth between 3% and 5%. All three product categories are forecast

to deliver index scores above 110 in August.

In a reversal of typical patterns, Manufacturer Representatives delivered average scores in the overall product index that are aligned with the overall average and only slightly behind the scores from Distributors. The most surprising survey result between the three groups is the strong optimism of the Manufacturer Representatives with an average index score forecast of over 125 for August. At the same time, Manufacturers and Distributors remain cautious with average scores only slightly above 100.

In a concerning development, the index score for the overall end-market for electronic components fell to 100 in July and is forecast to continue its fall with a forecast of 95.5 in August. After flying high in the first half of year with high index scores, the Industrial Electronics market fell back to Earth in July as it delivered a score just slightly above 100. While Avionics/Military/Space scores continue to measure strong positive sentiment, the scores have been falling for three months following the high achieved in April and are expected to continue to slide in August.

With the exception of these two market segments, every other market delivers index scores just above 90. (Telecom Mobile Phones scores below 85 in July.) The most encouraging development is the positive momentum that is being built in Automotive Electronics. It delivered a strong improvement in its score, achieving 96.1 in July and is expected to push up to 105.9 in August. The air of uncertainty in the electronics and electronics components industries remains as does the key question – Is the progress being achieved in the world of technology able to support improvement in the electronics markets despite the troubling economic environment.

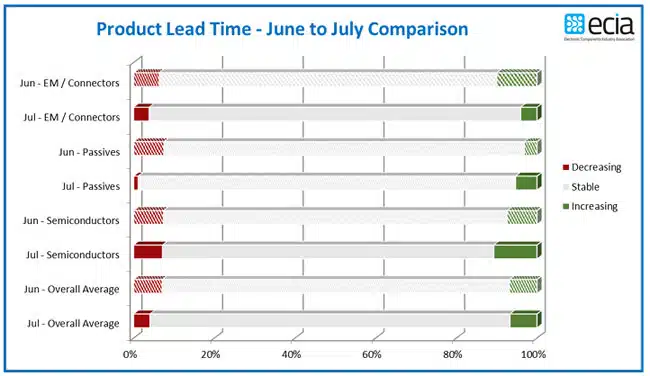

The overall lead time status reported by the ECST continues to shift toward a strongly stable position. Decreasing lead time reports for Passive Components are essentially zero for July. Increasing lead time reports in July were only reported by 5% or less of survey respondents for Electro Mechanical/Interconnect and Passive Components. Semiconductors saw a slight increase in reports of increasing lead times. DRAM and Data Flash are the drivers of this lead time increase. Stable lead-time reports continue to dominate as the share of respondents reporting stable lead times grew yet again with 89% reporting stable lead times in July compared to 86% in June and 80% in May,