Dennis Zogbi, Paumanok Inc. publishes on TTI Market Eye supply chain update for December 2022. The article shows electronic materials price trends for passive electronic components.

Passive Component Raw Material Index Rises Sharply in December 2022

Passive electronic components are raw material intensive. Raw materials consumed in the production of mass-produced, surface mount passive components usually come in the form of engineered powders and pastes. These powders and pastes make up the largest variable cost associated with the production of capacitors and resistors. This is why Paumanok Publications, Inc. has tracked the price and availability of specific ceramics and metals consumed as dielectrics and resistive elements for the past 35 years.

The chart below shows the long-term trend in the costs to produce passive components. The trend in December is up sharply led by increases in multiple metals products through November and December 2022; with price increases in nickel and copper showing a substantial upturn in pricing over the past 60 days. The reader will note that the entire index has demonstrated substantial volatility since the conflict in Eastern Europe created price volatility in mission critical “choke point metals,” impacting primarily the variable costs to produce capacitors and inductors, which are ubiquitous parts consumed in all electronic circuits.

How Materials Impact Passive Electronic Component Costs to Produce

Raw materials are the most expensive variable cost associated with the production of passive components. Any fluctuation in price or availability for these key feedstocks can have a negative impact on profit margins. As Figure 1.0 illustrates, raw material prices for passive components are on the rise again in the December quarter of 2022 following a downward price trend in the later part of 2021 due to government quantitative easing.

The index shown in Figure 1.0 above is comprised of the following materials:

Nickel: Nickel is the primary electrode material consumed in high capacitance multilayered ceramic chip capacitors (MLCC). The fluctuations in nickel price are primarily the result of competition for the metal with the steel industry, where it is used as a hardener. Nickel supply is in turn important for the production of X5R, Y5V and X7R MLCCs, which are the capacitors of choice for the operation of smartphones, tablets and TV sets. The market has shown extreme volatility in 2021 and 2022 due to supply chain problems and speculation due to its substantial sourcing from Eastern Europe, which is immersed in conflict. The price of this metal, which is key for energy storage solutions, is expected to continue to rise in 2023. Expect the price of MLCCs to follow to absorb any small increases experienced in their nickel electrode paste supply chains.

Copper: Copper engineered powders are consumed in the production of MLCCs as well, as the termination material consumed in conjunction with the nickel type electrode. Therefore, copper and nickel are an important type of base metal duo. Copper is used in some MLCC electrode systems because, unlike its counterpart nickel, it is non-magnetic. The price of this metal, which is key for energy storage solutions, is expected to continue to rise in 2023. The market has shown extreme volatility in 2021 and 2022 due to supply chain problems and speculation due to its substantial sourcing from Eastern Europe. Expect the price of MLCCs to follow to absorb any small increases experienced in their copper termination paste supply chains.

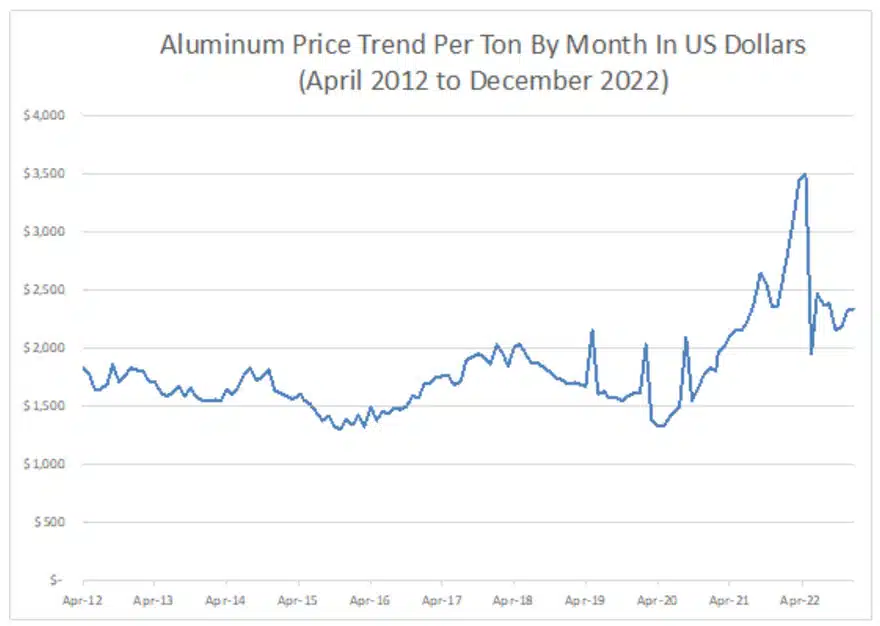

Aluminum: Etched anode and cathode foils are consumed as the dielectric layers of aluminum electrolytic capacitors the world over. Aluminum comes from bauxite, which is a mined material and whose price is easily calculated. Aluminum is abundant in the Earth’s crust and its price has been historically stable. Aluminum electrolytic capacitors are important components consumed in power supplies, television sets, computers and power electronics, including renewable energy systems. The market has shown extreme volatility in 2021 and 2022 due to supply chain problems and speculation due to its substantial sourcing of processing in Eastern Europe.

Zinc: Zinc is used as an additive in ceramic chip capacitors and as the primary ingredient in the production of metal oxide varistors, which are consumed for circuit protection components in all known AC-line voltage equipment.

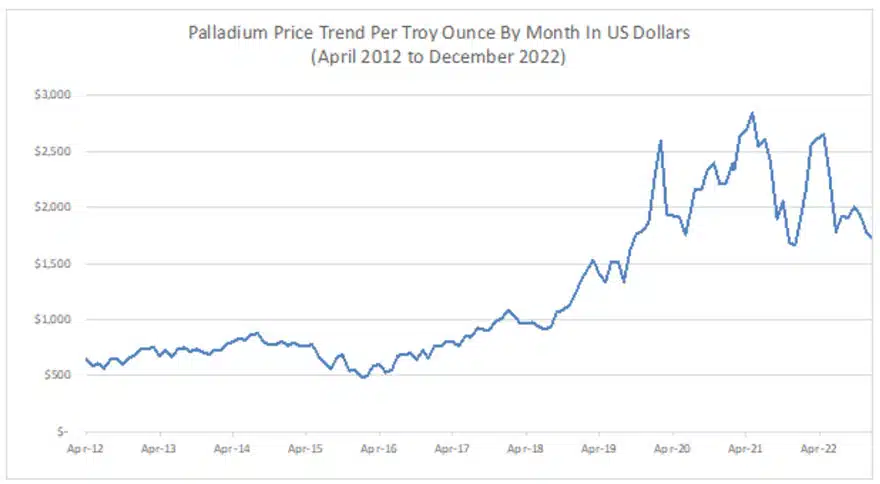

Palladium: Palladium is a platinum group metal that is mined in South Africa and Russia, among other locations, and is consumed primarily for auto-catalysts but also for jewelry and as the primary electrode material in precious metal based MLCCs, which are in turn used in high reliability, high temperature and high voltage product markets globally. Historically, palladium has proven a difficult raw material partner for the MLCC supply chain because of its price volatility, which is compounded by it being a significant commodity metal subject to outside speculation on price.

Ruthenium: Ruthenium is a precious metal that is similar to that of palladium, but its primary purpose is to be consumed in all thick film chip resistors and resistor networks produced worldwide. The price of ruthenium has shown extreme volatility because of its association with palladium mining activities in South Africa. The reader should remember that reliance on ruthenium for all mass-produced thick film chips is a weakness that threatens the entire high-tech economy.

Tantalite: The majority of tantalite metal used in the production of tantalum capacitors came from Central Africa in 2022. Other known tantalite resources are located in Australia, Brazil and Canada. Tantalite’s primary use is as capacitor grade tantalum metal powder for consumption in capacitor anodes. Tantalum capacitors are consumed in communications networking equipment, smartphones, automotive, medical and defense electronics. Tantalite and tantalum ores have demonstrated volatile pricing in the past but have remained relatively stable in price during the current market shortages. The reader should know that the lessons learned from the tantalum supply chain have been and will continue to be valuable as OEM brands insist on transparency on all material supply chains. Tantalum pricing has been stable in comparison to other dielectric materials since 2019.

Silver: Silver is consumed as a termination material for many electronic components but primarily for MLCCs that employ precious metal electrodes. MLCCs with precious metal electrodes and silver terminations are in turn consumed in high voltage, high temperature and high reliability MLCCs for similar end-use market segments. Silver prices jumped up in December 2022 due to speculation in South American markets.

Oil: Crude oil pricing is of interest because it sets the stage for so many other commodities but is also included because any wild swings in its supply would impact the plastics industry, which in turn would impact the film dielectric capacitor segment. Film capacitors are consumed in both DC and AC circuits and are primarily associated with power related equipment, lighting and home appliances. Oil prices have remained stable in November and December 2022.

Raw materials impact the overall costs to produce passive electronic components and in fact dielectric materials, electrode materials and termination materials represent the largest variable cost” associated with the production of electronic components. Any fluctuation in price or availability for these key feedstocks can have a negative impact on profit margins for electronic component producers, but seldom does a component manufacturer or their customers in OEM and EMS output have long term visibility on the various sub-levels of the supply chain.

The upward trend in materials price in the Passive Component Raw Material Index matches the forecasts from Wall Street in December 2022 warning of price increases in raw materials due to increasing pressure to speed up a transition away from fossil fuels by investments in infrastructure and electric mobility.

Palladium Price Trend From 2012-2022

Palladium is a platinum group metal that is mined in Russia and South Africa, among other locations and is consumed primarily for auto-catalysts but also for jewelry and as the primary electrode material in precious metal based MLCCs, which are in turn used in high reliability, high temperature and high voltage product markets globally.

Such high feedstock pricing impacts costs to produce for many small MLCC manufacturers and this is the primary motivating factor behind the movement to alternative electrodes and alternative MLCC designs in many end-markets where it has not been used before such as fossil fuel engine electronics, defense, space and oil and gas electronics.

The recent spike in palladium price is alarming from a cost issue and the continuation of supply has become a concern as key markets compete for the metal.

The metal price has reacted in a volatile way as a result of the pandemic and subsequent conflict in Eastern Europe.

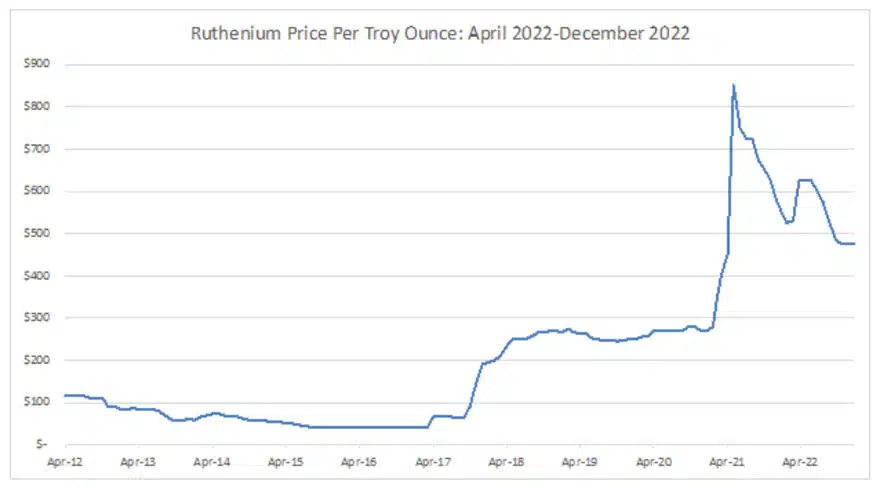

Ruthenium Price Skyrockets into Uncharted Territory

Resistors represent a significant volume of worldwide consumption for ruthenium metal (with additional uses as a cracking catalyst, a hard disc drive coating and as an esoteric chemical compounds). Therefore, the metal is very sensitive to any changes in resistor supply and demand in the global high tech economy and its signpost on the current market conditions should not be overlooked by the precious metal market analyst.

Ruthenium has experienced a significant price increase from $40 to $850 (U.S. dollars) a troy ounce, back down to $475 per troy ounce this December 2022, to correspond with supply and demand of thick film chip resistors. This price volatility has caused customers to seek alternative resistor designs also based upon thin film nickel. Unfortunately, the economies of scale of manufacturing for thin film resistors are a small fraction of thick film chips, one of the largest volume products produced in the world (measured in the trillions of pieces). The thick film chip resistor is one of the riskiest supply chains in the world because of its “rendered nature” and its large-scale reliance upon a rare precious metal that is the by-product of another industry (platinum) and therefore subject to forces outside of its market control.

The overall price trend for ruthenium between April 2012 and December 2022 has seen extreme instability and volatility in direct correlation to shortages of chip resistor products (See Figure 1.2 and the MarketEYE April 2021 article on ruthenium supply).

Nickel: The Prime Alternative to Precious Metals in Passive Components

Nickel is the primary electrode material consumed in base metal electrode multilayered ceramic chip capacitors (BME MLCCs). The fluctuations in nickel price are primarily the result of competition for the metal with the steel industry, where it is used as a metal hardener. Nickel supply is in turn important for the production of X5R, X6S, Y5V and X7R MLCCs, which are the capacitors of choice for the operation of smartphones, computers and home theatre equipment.

The overall price trend for nickel between April 2012 and December 2022 has been remarkably and comparably stable. (See Figure 1.3). The historical stability of price for nickel is a great selling point for its use in MLCC electrodes to displace palladium/silver (Pd/Ag) designs. The reader should note that it is the rapid shift of materials pricing within existing contracts that have caused the most negative impact on profitability over time.

The most successful passive component manufacturers have the tendency to purchase raw materials when the prices are lowest and consume them when the materials price is at its highest, therefore, in affect “manufacturing profitability” by converting the added-value of the materials when they offer the greatest opportunity for profit from the vendor.

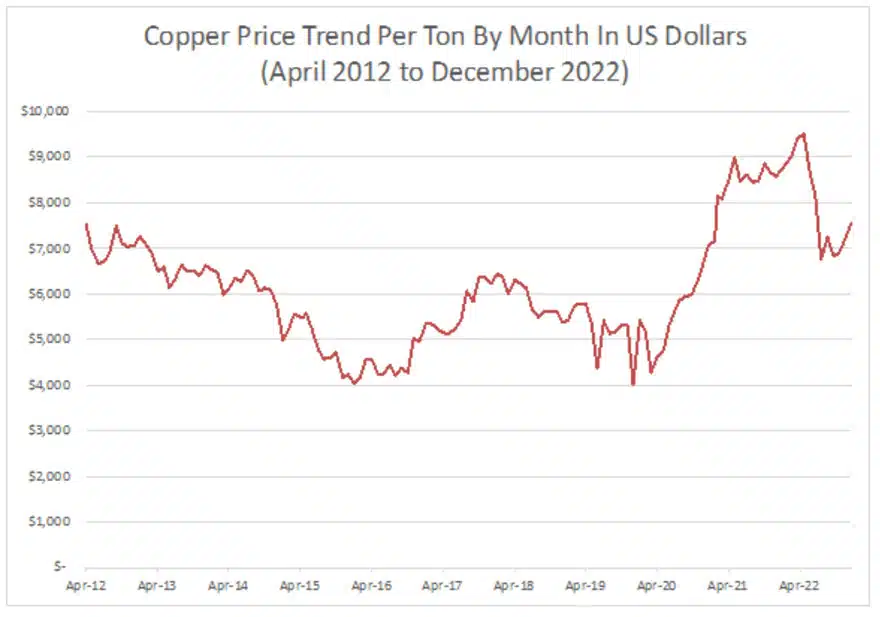

Copper: Nickel’s Passive Helper Metal

Copper-engineered powders are consumed in the production of MLCCs as well but as the termination material consumed in conjunction with the nickel type electrode (a base metal must be paired with another base metal in the MLCC design). Therefore, copper and nickel are an important type of base metal duo. Copper is used in some MLCC electrode systems because, unlike its counterpart nickel, it is non-magnetic.

The overall price trend for copper between April 2012 and April 2020 was historically stable; however, from May 2020 to December 2022 the price of copper skyrocketed to historical highs because of its use as a conductor, a next-generation-enabling metal for infrastructure and electric drives. It’s price fluctuation in 2021and 2022 should be of keen interest to researchers of high capacitance MLCC operations as competition for copper between industries will drive up future MLCC termination costs.

Due to the fact that base metal type MLCCs are produced in the trillions of pieces and the termination pastes have high volumes of metal per MLCC body, the volume of copper consumption in MLCCs is significant and growing at a consecutive rate over time in concert with MLCC demand.

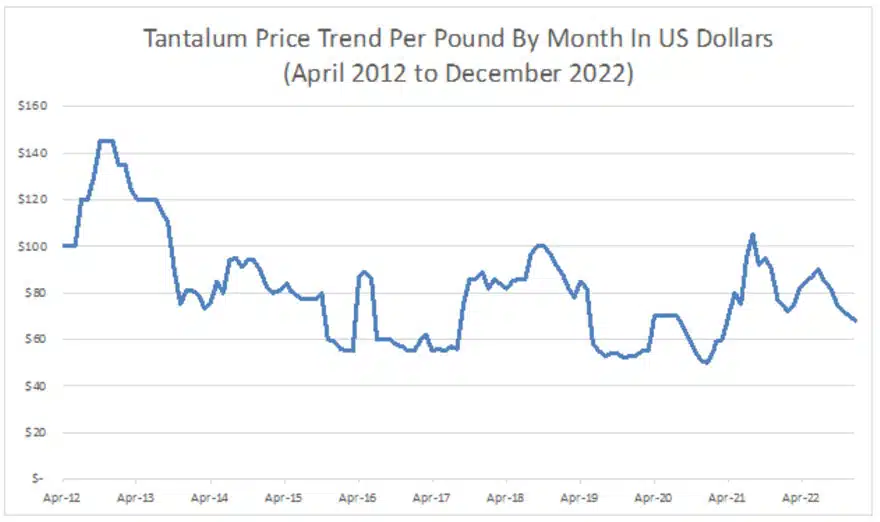

Tantalum: No Stranger to Danger

Paumanok Publications, Inc., estimates that the primary raw materials consumed in the production of tantalum capacitors are capacitor grade tantalum metal powder and wire, which is engineered from high purity tantalum ores and concentrates. Tantalum, a rare metal; represents a significant portion of the variable costs to produce tantalum type capacitors.

Tantalum is mined as ore and almost always in conjunction with other metals. Tantalum ore mining is most profitable when the parts per million of the producing mine is very high and the ore can easily and cost effectively be separated from other minerals it is mined with (through magnetic or gravity separation). It is then sold to intermediate producers of capacitor-grade tantalum metal powder and wire who further chemically separate the pure tantalum from the various other elements found in conjunction with the metal during mining.

Tantalum-capacitor-grade powder is produced by limiting the impurities (such as oxygen, potassium and nitrogen) in the mixture so a high degree of purity is inherent in the final product.

The outlook for tantalum materials is positive because this special metal overlaps in its capacitance values with high cap BME MLCCs and are therefore subject to growth based simply on their known performance characteristics and their ultra-small case size and solid performance in digital electronics.

The tantalum ore metal used in the production of tantalum capacitors comes from Central Africa. Other known tantalite resources are located in Australia, Brazil and Canada. Tantalite’s primary use is as capacitor grade tantalum metal powder for consumption in capacitor anodes. Tantalum capacitors are consumed in communications networking equipment, smartphones, automotive, medical and defense electronics.

The overall price trend for tantalum ore between April 2012 and December 2022 has been down to stable, with prices plunging in 2019 to challenge recent five year lows (See Figure 1.5). Tantalum ore materials show recent price fluctuations that correspond with increased consumption of tantalum capacitors to offset shortages of BME MLCCs and for its (polymer tantalum) use in battery electric vehicle propulsion systems.

Aluminum Foils for Electrolytic Capacitors

Aluminum capacitors require a variety of raw materials in their construction, including etched anode foil, etched cathode foil, separator paper and electrolytes. However, these raw materials have comparably lower pricing than most alternative dielectric materials on a pound-for-pound basis. Etched anode foils represent the most expensive component involved in aluminum capacitor construction, followed closely by etched cathode foils. This fact explains why most of the larger aluminum capacitor manufacturers have in-house capabilities to produce their own etched anode and cathode foils, which ultimately helps the capacitor manufacturer to control costs. Rolls of etched anode and cathode foil are rolled together with specialty paper, separating the two metal foils. The paper is soaked in the electrolyte and the entire cell is placed in an aluminum can with lead wires attached and gaskets placed atop the can.

Aluminum comes from alumina, also known as bauxite, and this material is also used as the primary substrate material for almost all thick film chip resistors and many of the axial and radial leaded resistors as well.

Aluminum remains in abundant supply and its price, while subject to variations, remains relatively stable over time. Aluminum consumption should remain at a steady state of growth as more of it is used in automotive bodies of the future.

Etched anode and cathode foils are consumed as the dielectric layers of aluminum electrolytic capacitors the world over. Aluminum comes from bauxite, which is a mined material and whose price is easily calculated. Aluminum is abundant in the Earth’s crust and its price has been historically stable. Aluminum electrolytic capacitors are important components consumed in power supplies, television sets, computers and power electronics, including renewable energy systems. The overall price trend for aluminum between April 2012 and May 2021 was stable, with prices spiking in 2019, 2020, and 2021 due to trade tensions between the U.S. and China, but which have also quickly returned to normalcy (See Figure 1.6).

Summary and Conclusions: Materials Markets and Outlook for 2023

The current trend suggests price increases for key “choke point” metals in 2023 with emphasis upon nickel, copper and aluminum, subsequently impacting the costs to produce ceramic capacitors, ceramic inductors, aluminum electrolytic capacitors and all fixed resistors due to their use of alumina substrates. This should create increase in global market value of between 4 percent and 8 percent compared to 2022.