08/31/2018 by Dennis M. Zogbi

The multilayered ceramic chip capacitor is ceramic and metal that have been combined in a creative way on a massive scale. This article asks a question that has been asked repeatedly since the shortage of MLCC began…

Today Paumanok is tracking a shortage of multiple types of passive electronic components that we have tracked for 30 years continually, but with continued emphasis on a specific “spoke in our wheel” component called the multilayered ceramic chip capacitor market (MLCC). The Paumanok brand was developed by myself in 1988 when I was at University in New York and received my first contract from a highly respected manufacturer of value-added and application specific ceramic components located in the Carolinas of the United States. The project was to study the global market for a type of non-linear resistor known as a “varistor”, which is used for overvoltage protection in electrical and electronic circuits, and to determine whether a new style of a small case size, ultra-small multilayered stacked varistor would work well in the emerging electronics industry. At the time, varistors were key elements in all infrastructure electrical circuits, for lightning protection in power transmission and distribution equipment, and at the point of demarcation of the electrical line for production and advanced manufacturing facilities.

The raw material- zinc oxide- which is common to all varistors; had reached a point of refine in its engineered powder form that enabled the creation of surface mount components that could withstand touch activated electrostatic discharge (15 kV- Bam!). The company that encouraged this process in 1988 encouraged me to study the multilayered ceramic capacitor industry soon after, as well as the plastic film capacitor industry and the aluminum electrolytic capacitor industry. Other vendors in resistors and inductors encouraged me to expand my offerings in market research data into the thick and thin film resistor markets and into the magnetic components space.

Paumanok, Passives and Economic Rendering

Another unique aspect of my business (Paumanok) is that for years I had developed rich data sets on the same specific industry, the same specific line items, and eventually achieved month-to-month reporting capabilities on 60 individual sub-categories of passive components and their respective materials supply chains (CRL Complete), and risk to the end-markets and key product lines in which they were consumed.

In 1988, I noted that there were only a few industrial market research companies engaged in research on the fledgling market for portable and stationary electronic components and sub-assemblies, and of the five I had surveyed, all were moving to study the big money semiconductors, the silicon product groupings, while none were studying the mass-produced parts, which were considered “unsexy, inexpensive” MLCC type components. In doing so, I became a rendered economist, someone who studied parts that no one else wanted to study. The markets were not big in value, and the return on investment was limited; but the risk to the supply chain because of the ubiquitous nature of the MLCC and the fundamental need for capacitance and resistance, that the potential risk factors were enormous and required continual global monitoring.

The Ubiquitous Nature of Passive Components

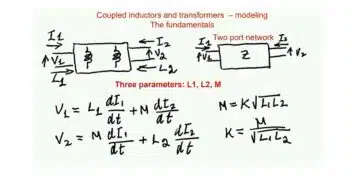

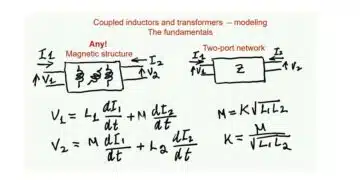

One aspect of a rendered economy is to engage in a product line that is not in danger of going away (at least any time soon), due to a scientific principal or maxim which anchors the market down in a way that cannot be easily manipulated or changed. In the case of passive components, both capacitance and resistance are required for an electronic circuit. In other words, you cannot have an electronic circuit without capacitance or resistance (Inductance is not always required, but is still notable for its comparative mass production to silicon parts).

Massive Economies of Scale

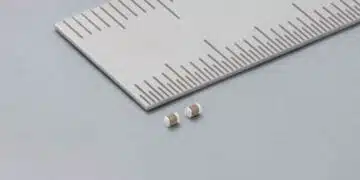

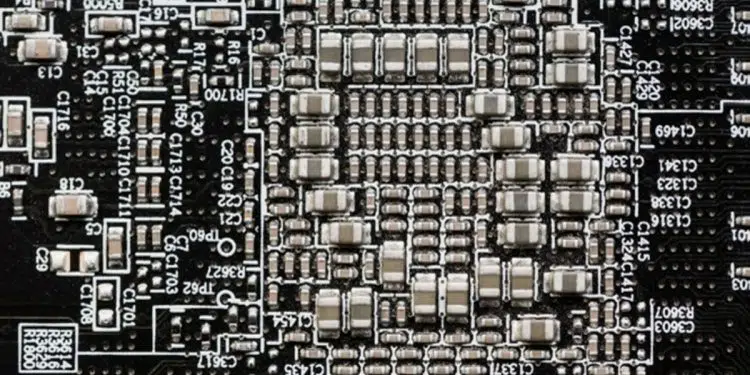

I enjoy looking back at the first time I made a detailed analysis of the global market for MLCC (which was in 1988) and am amazed that even in that year, how large the volume of consumption was, – in the billion-piece range, and today production starts for passive components are well into the trillions of pieces. The reader should note that the scientific maxim requiring capacitance and resistance paid off in a massive way for those who had engaged in such a rendered economy, year’s of mediocre returns on investment, punctuated by frenzied rallies and massive value upcycles. Moreover, the major brands in passives have never changed in 30 years. Who had chosen to render in 1988 is still rendering in the passive component today. The collective ROI is impressive, especially when the massive growth spurts evident in the market are observed and taken into consideration. The economies of scale required to compete are overwhelming and the technology required to master borders are a “black-art” and this is where I begin to hint at what the worst it is that can happen in a shortage of ubiquitous parts. The important equation at this point is in understanding economic rendering at the board level- If the volume of consumption for all components on all the printed circuit boards ever produced is 100%, then 87% would be passive components, and of those there would be only three real “work-horses” MLCC, Thick film chip resistors and ferrite beads.

One Level Down in Passives You Find Some Workhorses

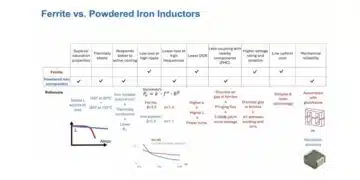

The three workhorses in passive components are the MLCC, the thick film chip resistor and the ferrite bead. They require annual economies of scale of such vastness that they are in fact the largest product line produced by mankind, larger in fact than any other product produced anywhere- including nuts, bolts and washers. One level below that are the basic raw materials, which are fundamentally ceramic and metal that have been combined in a creative way.

And You Also Find Some Show Horses

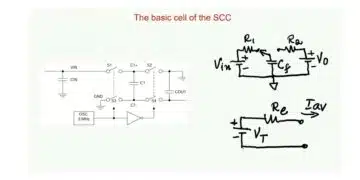

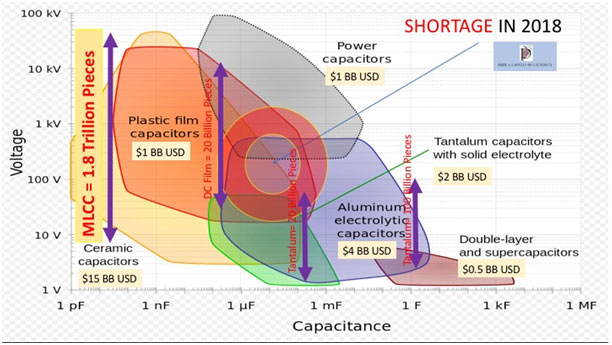

There are also other product lines in capacitors, resistors and inductors that offer the design engineer unique variations on what is possible in the ultimate performance of the end-product. These include aluminum capacitors, tantalum capacitors, plastic capacitors, carbon capacitors; nickel resistors, and ceramic core inductors. These additional product lines offer variations in capacitance, resistance and inductance per cubic centimeter of base material. They also offer variations on voltage, case size, tolerance, temperature and frequency that allow for new ways in which the need for capacitance, resistance and inductance can be achieved at the most optimal of levels. It is important to demonstrate in the following chart how other capacitor products can be used in the overlapping regions as alternative reference designs to MLCC. This strategy has impacted the revenue streams of vendors who compete on the periphery of the MLCC market in 2018.

I include this important variation in the market dynamics, because the value of these variations (See Figure 1.0) for example, is large in dollars, but they do not offer anywhere near the massive economies of scale that are apparent in MLCC, thick film chip resistor and ferrite bead- and the massive economies of scale required to compete actually becomes a barrier to any additional competition in the space.

And Then You See the $ BOM and It’s Flipped

In a rendered economy, it’s the size of the business that keeps it moving forward, but at no time after the past 30 years have passive electronic components represented any more than 3% of the value of consumption for the “Bill of Materials” for any given electronic product line. So, the volume of consumption represents 87% of the electronic component content of any given printed circuit board, but the value of that consumption accounts for only 3% of any given BOM. This sets the stage for the worst that can happen. When a product line that represents only 3% of the BOM, but 87% of the volume of consumption, gets overlooked in budget meetings, and subsequently overlooked as a risk factor.

How Could We Let This Happen?

I have been asked for rapid transit history lessons in how MLCC became so prevalent in the supply chain and why the capacitance requirement in electronics were not achieved through other materials methods, or at least a more balanced approach to the printed circuit board was achieved, a more equitable distribution of parts. I had to advise that the reason why MLCC became so prevalent was that it was the most cost effective solution to achieving the capacitance signature required in portable electronics and the only product line that could support such massive economies of scale (tantalum chip production capacity for example is only 1.1% of that of MLCC on a global basis).

Source: Paumanok Publications, Inc. State of The Industry for The Tantalum Niobium Conference in Kigali, Rwanda- Oct 2018.

Figure 1.0 Mapping Out The Parts Shortage in Capacitors in 2018

MLCC Shortage-A Perfect Storm of Value Creation

Figure 1.0 above shows how MLCC ceramics accomplish the largest capacitance requirements on the global market in terms of both value and volume. The first reaction of a customer who is exposed to a rendered economy is to throw money at the problem, to spend whatever it takes to guarantee that there will be no shortage of parts for the holiday build out. They also begin to understand the nature of the risk and buy more parts than they need to ensure continuity of supply but also because it’s a wake-up call that something so “paper-clip” can shut down the line.

MLCC: What’s the Worse that Can Happen?

The worst that can happen is that customers cannot build their printed circuit boards because they cannot achieve the required capacitance signature due to a shortage of parts. This will occur when the customer does not receive MLCC at the shipping dock. This happened once before back in the 2000 shortage when many products in computers and automobiles did not get produced because of a shortage of tantalum capacitors. Today the variables include the massive economies of scale required for market entry, the advanced nanotechnology required to produce high-capacitance MLCC, and the keen interest in just-in-time delivery (especially in Asia) where shortages may not be fully realized yet because it’s such a small part of the BOM that it goes noticed until it is too late and the entire production line goes down for the want of a part that typically costs less than 1 U.S. cent. And that is the worst that can happen in a “rendered” type economy.

Summary and Conclusions

- 30 years of data show the market experiencing shortages before and acting in a similar manner to 2018

- Passive components account for more parts than any other man-made product line

- MLCC, Thick Film Chip Resistors and Ferrite Beads require massive economies of scale

- The ROI is historically Limited, with limited value growth, punctuated by frenzied upcycles and parts shortages

- Capacitance and resistance is required in an electronic circuit

- The number of vendors who compete is limited (Same brands over 30 years!!!!)

- The number of new market entries is also limited

- The worst that can happen is factories cannot meet demand because of MLCC parts impacting so many end markets in 2018