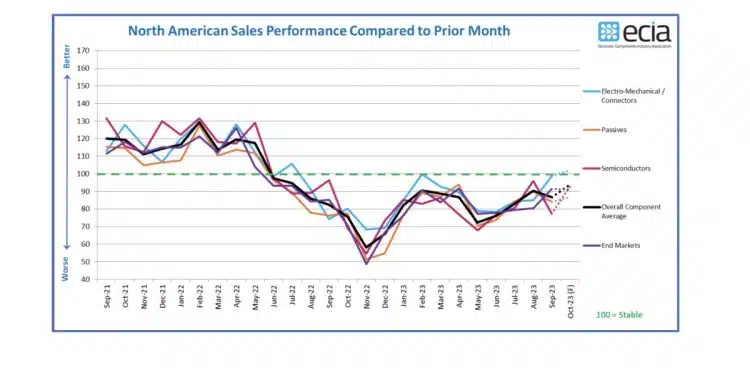

ECIA’s Electronic Component Sales Trend Sentiment (ECST) for September 2023 sales sentiment survey show the overall electronic component

markets index struggling to sustain improvement.

The latest overall score dipped 3.6 points to 86.7 in September. Despite the disappointing September results which fell short of expectations, the industry continues to sustain a positive outlook.

Looking toward October, survey participants project industry sentiment will improve to 94.0, the highest level since July 2022 and only 6 points below the threshold of 100 indicating sales growth. However, actual results have typically fallen short of expectations in recent months.

The most encouraging results in September were reported for Electro-Mechanical / Connector components. This category improved by 13.8 points to reach 98.7 for September and the outlook calls for this segment to break into positive growth territory in October. Unfortunately, Semiconductors lost all their gains from August and fell back to a score of 77.4. Hope in the future continues to boost the outlook for Semiconductors in October with an anticipated increase of 15.7 points. While the change was more modest, Passive components also saw their August gains evaporate in September with

expectations of slight improvement in October.

Even though the September survey results present a setback in the struggle to recover, the electronic components industry is still positioned to potentially reach a breakeven point by the end of the year with the potential for return to broad-based growth at the beginning of 2024.

The chasm in sales sentiment between manufacturer representatives and manufacturers and distributors persisted in the September survey. A major disconnect began in April and widened in June and July before narrowing somewhat in August and September. However, there is still a stark difference

in perspectives. The index scores from Distributors are at or above 100 for nearly every category in September. The Manufacturer scores are also strong and come in around 100. By contrast, the manufacturer representative scores range between 44 and 87. Given that the Distributors report such positive results it is difficult to attribute this difference to the need to resolve inventory balances. Nevertheless, Manufacturers and Distributors see a world fairly aligned with end market demand while Manufacturer Representatives appear to be struggling significantly in the current market.

The overall end-market index saw a healthy jump up to 91.4 in September and sustains this level in the October outlook. The scores and improvements are uneven across the different markets. Avionics/Military/Space sustained and improved its score above 100. Medical Equipment and Industrial Electronics achieved scores in the mid to high 90s in September. The most positive result from the end market survey is the expectation of large improvements in the index in every category including some double-digit increases expected for October.

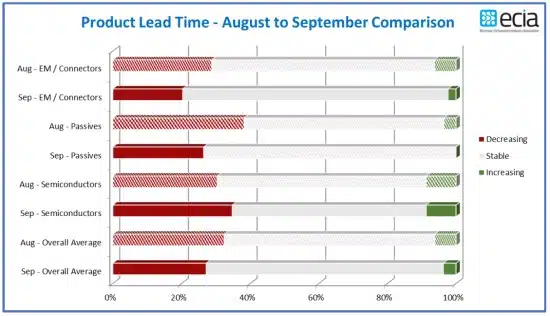

The picture for product lead time trends has developed into an extremely healthy view. Stable lead times dominate the responses with stable average lead times jumping from 61% in August to 69% in September responses. There were zero reports of increasing lead times for every Passive component category in September. In addition, there were zero reports of increasing lead times in the MPU, MCU and Discrete categories. Once again, the lead time results provide some of the most positive outcomes in the ECST survey.