Taipei, May 2 Yageo Corp., Taiwan’s largest passive electronics component maker, expects to complete its acquisition of American rival Kemet Corp. in the third quarter of this year after securing approval from China’s anti-trust authorities.

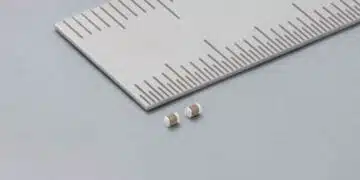

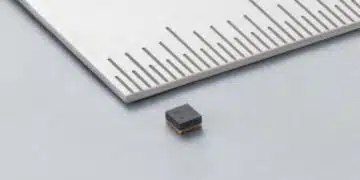

Yageo, which produces components such as chip resistors, inductors and multi-layer ceramic capacitors (MLCC), earlier this week received the greenlight from China’s Anti-Monopoly Bureau for its plan to acquire Kemet, the last approval the Taiwanese firm needed to proceed with the deal.

Before China’s approval, Yageo was given the go-ahead on April 23 from the Committee on Foreign Investment in the United States, which is an inter-agency committee authorized to review certain transactions involving foreign investment in the U.S.

On April 15, the Taiwanese firm received approval from Taiwan’s Fair Trade Commission, which said the acquisition would not impose any material adverse impact on competition in the market.

At the end of January, the deal, which was announced by Yageo in November 2019, received approval from anti-trust authorities in countries including Germany and Austria.

In the deal, Yageo will spend US$1.64 billion to acquire Kemet, founded in 1919 and headquartered in Fort Lauderdale, Florida, offering a broad range of capacitors, including ceramic capacitors, film capacitors and tantalum capacitors.

Yageo said after securing approval from China, it and Kement are gearing up to conduct preparatory work and aim to complete the acquisition in the third quarter.

Kemet has a workforce of 14,000 worldwide and owns 23 production sites in 22 countries, including the U.S., Europe and Asia, according to Yageo.

Yageo said after the acquisition, the Taiwanese firm expects to double its sales and see its profit rise sharply by about 80 percent, which will help the suitor further consolidate its position as the third largest MLCC in the world and maintain its share in the automotive electronics market.

Yageo is currently the third-largest MLCC supplier in the world, with approximately 13 percent of the global market.

The deal is expected to boost Yageo’s capacitor production to 50 percent of the company’s total sales.

Yageo has said it intends to grow through acquisitions. In 2018, the company acquired U.S.-based Pulse Electronics Corp. for NT$22 billion, a deal that also set the company’s sights on automotive electronics and 5G applications.

featured image: Yageo Chairman and CEO Pierre Chen