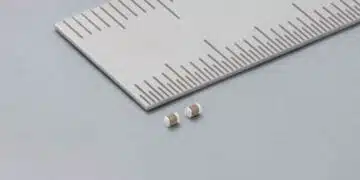

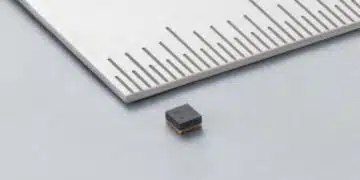

Yageo Corp (國巨), the world’s No. 3 multilayer ceramic capacitor (MLCC) supplier, yesterday reported a 2.63-fold sequential growth in net profit last quarter, as rising demand for high-capacity passive components used in 5G smartphones, servers and computers boosted gross margin.

The company expects the growth momentum to carry into this quarter, given growing demand for 5G-related applications, work-from-home and online learning trends, as many countries around the world have implemented lockdowns and containment measures to curb the spread of COVID-19.

Yageo said it is boosting capacity utilization from 50 percent last year to cope with rising customer demand.

Supply of passive components has been constrained since the runup to the Lunar New Year holiday, and Yageo’s inventory last quarter dropped to about 30 days from its normal level of 90 days.

Despite the pandemic, demand is still outpacing supply this quarter, Yageo said.

“The company’s operations, orders and shipments remain normal. The resumption of work at Chinese factories has also gradually improved,” the company said in a statement.

Yageo usually sees a gradual uptrend in revenue in the first two quarters of a year, before hitting a peak in the third quarter.

MLCC makers are widely expected to see a 20 percent sequential growth in revenue this quarter, the Chinese-language Commercial Times reported last week.

Yageo’s net profit soared to NT$2.35 billion (US$78.6 million) in the first quarter, compared with NT$893 million in the fourth quarter last year, but declined 9.27 percent annually.

Earnings per share rose to NT$5.51 last quarter from NT$2.1 a quarter ago, but dropped from NT$6.11 a year earlier.

Gross margin climbed to 40.3 percent last quarter from 33.5 percent the previous quarter due to rising prices.

Separately, local peer Walsin Technology Corp (華新科技) yesterday announced a capacity expansion plan amid a persistent supply crunch.

The company said it is to invest NT$668 million to acquire manufacturing equipment and facilities from Walton Advanced Engineering Inc (華東科技) in Kaohsiung.

The two companies are subsidiaries of Walsin Lihwa Corp (華新麗華).

Walsin Technology aims to “expand capacity orderly and to increase the company’s market position in the advanced products [MLCC] segment,” company spokesperson Lee Ting-chu (李定珠) told a media briefing.

The company reported a first-quarter pretax profit of NT$946.28 million, the lowest in 11 quarters. The figure represented a quarterly decline of 34.29 percent and an annual slump of 68.87 percent.

Its board of directors yesterday approved a proposal to distribute cash dividends of NT$5.5 per common share, representing a payout ratio of 40.09 percent, based on the company’s earnings per share of NT$13.72 last year.