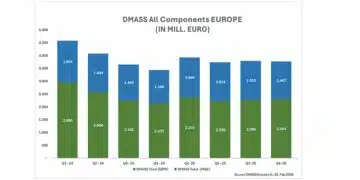

Q2-2024 European Components Distribution (DMASS) reports lower revenue in second quarter 2024. Outlook 2024: consolidation in semiconductors will continue, IP&E stabilizing.

According to DMASS European components distribution declines by -26.9% to 4.09 billion Euro. Semiconductors decline 33.1% to 2.62 billion Euro while Interconnect, Passive & Electromechanical (IP&E) decline to 1.48 billion Euro (-12.9%). DMASS Europe represents ~85% of European components DTAM.

Hermann Reiter, Chairman DMASS Europe: “Due to still high inventory levels and macro-economic uncertainties, a return to growth in 2024 for distribution is unlikely. As Europe does not benefit from the AI hype but is highly dependent on industrial and automotive, we hope for the next EU commission to continue to support the digital, mobile and energy transformation laid out in the Fit-for-55 program.”

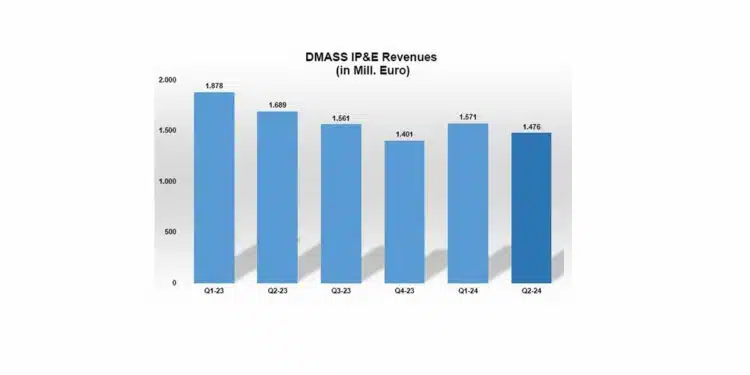

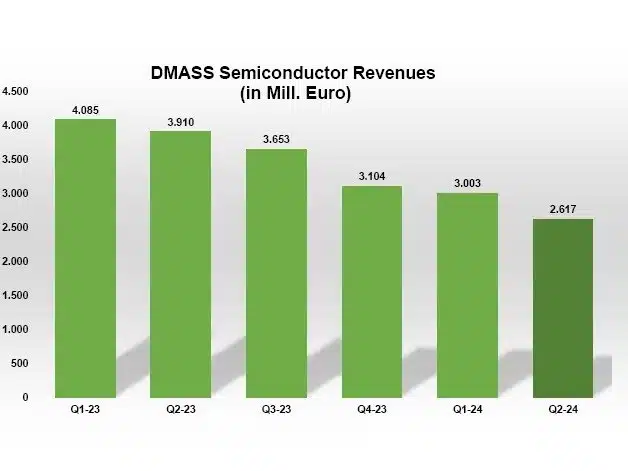

The contraction of the European components market continued in the second quarter of 2024, and the distribution industry was particularly affected. According to DMASS Europe e.V., the European components distribution market recorded a decline of 26.9% in the second quarter of 2024 across all components, with consolidated sales ending at 4.09 billion Euro. While IP&E (Interconnect, Passive and Electromechanical) components seem to normalize faster with a minus of only 12.9% to 1.48 billion Euro, Semiconductors continue to bear the consequences of the massive growth in the last 3 years. Semi sales declined by 33.1% to 2.62 billion Euro (minor rounding error included).

Hermann Reiter, chairman of DMASS: “When it came to sales, the second quarter hopefully did not surprise anyone. The low bookings of 2023 are now turning into equally low revenues. Due to still high inventory levels, especially in the semiconductor field, and due to macro-economic uncertainties, a return to growth in 2024 for distribution is unlikely or could happen earliest at the end of the year. However, as we can see, parts of the market – IP&E (Interconnect, Passive and Electromechanical) – have started to normalize already, so our confidence that 2025 will see a return to growth is very high. What makes us a bit nervous is the low visibility within the supply chain and the lack of longer-term procurement strategies. We hope that the industry isn’t making the same mistakes as in 2020.”

Semiconductors (Q2):

Semiconductor distribution sales in Europe shrank by 33.1% to 2.62 billion Euro, the lowest sales value since Q4/2021, but way above pre-CoVID times. Quite notable were also regional differences, as shown in the table, with Germany as the biggest market contracting significantly more than most bigger countries. UK, France, Iberia and Eastern Europe “did better” than average.

At the product side, almost all sectors were equally weak. Exception: Programmable Logic took a massive dive of -48%.

Interconnect, Passive and Electromechanical Components (Q2):

In IP&E, the slowdown decelerated from -16.3% in Q1/2024 to -12.9% in Q2/2024, the actual numbers, however, came in lower than Q1. Q2 ended at consolidated sales of 1.48 billion Euro. Electromechanical components did significantly better than Passives and Power Supplies. Regionally, Germany and Austria performed worst, while France, UK, Nordic and Eastern Europe ended much better than average. (see tables).

| Product Group IP&E | Total k€ | Change Q2/Q2 |

|---|---|---|

| PASSIVES | 539.971 | -17,05% |

| ELECTROMECHANIC | 835.609 | -8,20% |

| POWER SUPPLIES | 100.491 | -21,44% |

| DMASS IP&E Total | 1.476.071 | -12,61% |

| Country/Region IP&E | Total k€ | Change Q2/Q2 |

|---|---|---|

| UK | 165.076 | -6,58% |

| IRELAND | 12.553 | 8,65% |

| GERMANY | 314.347 | -22,83% |

| FRANCE | 152.314 | -5,60% |

| ITALY | 158.962 | -11,37% |

| SWITZERLAND | 45.030 | -13,96% |

| NORDIC | 134.318 | -7,14% |

| BENELUX | 74.263 | -12,79% |

| IBERIA | 89.483 | -12,35% |

| AUSTRIA | 37.836 | -28,30% |

| RUSSIA | 0 | -100,00% |

| EASTERN EUROPE | 203.404 | -8,45% |

| ISRAEL | 30.817 | -13,26% |

| TURKEY | 33.251 | -2,33% |

| OTHER | 24.416 | 1,98% |

| DMASS IP&E Total | 1.476.071 | -12,61% |

Chairman Hermann Reiter concluded: “We sincerely hope that Q2 has been the bottom of the current market consolidation, and that customer confidence will come back soon. Our long-term optimism for electronics in general and components in particular is unwavering. However, with the current macro-economic challenges, we hope for some help from politics. Frankly speaking, as Europe does not benefit from the AI hype but is highly dependent on industrial and automotive, we hope for the next EU commission to continue to support the digital, mobile and energy transformation laid out in the Fit-for-55 program. Europe has a huge opportunity to create a sustainable society with the help of future-oriented technology.”