During the third quarter of 2023, German component distribution experienced a small decrease in sales and a less favorable order situation, as reported by FBDi.

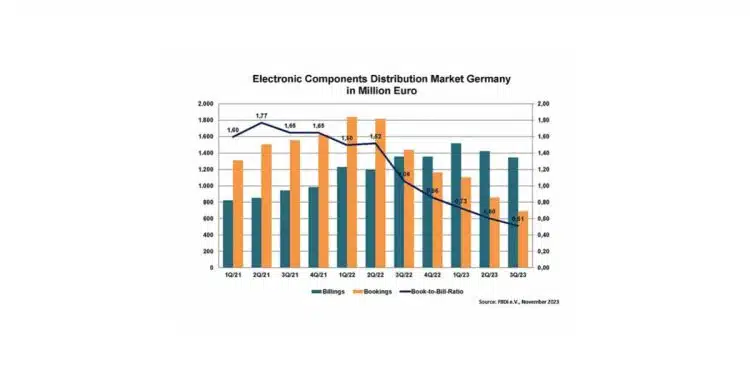

The decline in German components distribution’s bookings continues. Unsurprisingly, it starts to being reflected in revenues. Although the third quarter ended at a relatively high sales level, with 1.34 billion euros (-1%), the slowdown in bookings continues. Orders were down by more than 50% compared to the record year of 2022. The book-to-bill ratio was 0.51.

Semiconductors continued to perform strongly. Sales remained surprisingly stable with an increase of 5.7% to 953 million euros. However, the record sales of the last four quarters are now being reflected in high customer inventories, leading to an expected decline in bookings. Other product areas have been consolidating for some time. Passive components shrank by 13.7% in the third quarter to 160 million euros, while electromechanics including connectors fell by 12.1% to 150 million euros. Power supplies also declined by 14% to 40 million euros. Other components such as sensors, displays and assemblies followed a similar trend. The breakdown of sales by component remained relatively unchanged: semiconductors 71%, passives 12%, electromechanics 11%, power supplies 3% and the rest also 3%.

FBDi Chairman Georg Steinberger:

“The trend of the last quarter is continuing, the consolidation after almost three turbulent years is as expected as it is inevitable. Although a significant number of components is still difficult to obtain, general availability has improved significantly. We expect 2023 to end slightly positive for distribution overall. However, patience is required for 2024, as the turnaround in orders will depend not only on stock levels, but also on the situation in the end markets.”

Commenting on the situation, Steinberger says: “Anyone speculating on falling prices at the moment could be disappointed, as manufacturers are facing high energy prices and financing costs, which they will certainly try to pass on to the market. Our expectation at the moment is that there will be more capacity reductions and postponements of production expansions. Personally, I think this is healthier as it would be irresponsible to return to the previous price fight behaviour in the supply chain.”

According to Steinberger and his FBDi colleagues, the future basically looks like this: “The electronification of all areas of society continues to progress. Some industries may be somewhat cautious at the moment due to the economic situation, but the demand for semiconductors and innovative component solutions will remain high in the long term. Even the general geopolitical situation – however critical at the moment – will not change this. But, our industry also needs to be more aware of its responsibilities and become much more active in the fight for sustainable business”.