Source: Global Technology Management Group article

by Tim Sullivan, Business Technologist Expertise in AI, Datacenter, 5G & WiFi Communication, and Internet of Things (IoT).

Tim Sullivan discusses impact of “cheap” commodity such as MLCC to overall supply chain issues in his article “Supply Chain Management: The Power of a Penny” published on Global Technology Management Group website. The article was inspired by a Daniel Wolfe article that appeared in Quartz ( https://qz.com/1575735/ ) on March 21, 2019 under the title “The global shortage of capacitors impacts all consumer electronics”. An excerpt of this story also appeared on the EPCI European Passive Components Institute web site on that same date that grabbed Tim’s attention.

How a commodity component with a price less than 1¢ results in $100+ million in lost revenue

This article highlights the mandate for Supply Chain Management to meet two key objectives; product availability AND cost minimization. These goals are interdependent and must be balanced.

Our world is filled with amazing electronic products. Smart phones, smart watches, smart homes, and smart cars are all based on innovative hardware and advanced software. These latest achievements in hardware and software capture the attention of buyers and creators of these new products.

Lost in the excitement and allure of this new tech are basic components needed to bring all these new things to life. In this environment of Smart things, people still make Not-so-Smart decisions.

GoPro lost $144 million in revenue due to components that cost < 1¢!

GoPro CFO Brian McGee admitted that sales were reduced by 800,000 units in 2018 due to a market shortage of components that cost less than a penny. According to a report by Daniel Wolfe at Quartz ( https://qz.com/1575735/ ), McGee stated that GoPro could have sold 5 million units of its flagship product in 2018. Unfortunately, GoPro’s production volume was limited to 4.2 million units because of a global capacitor (MLCC) market shortage.

Let’s use this information to estimate the financial impact beyond the 800,000 units in missed 2018 sales. The latest flagship product is the GoPro Hero 7 and it is offered in 3 models with suggested retail prices of $199, $299, and $399. If we attribute all missed sales to the mid-range model with a target resale price of $299 and project a $180 wholesale price for this product, then top line revenues were reduced by $144 million.

GoPro reported $32 million in net profits from $377 million in revenues during Q4 of 2018. This translates to a net profit margin of 8.5%. Applying this same 8.5% net profit ratio to $144 million in missed revenues yields a loss in net profits of $12.2 million in 2018 from an 800,000 unit reduction of a 5 million unit market opportunity.

GoPro posted a $94 million loss for the year of 2018. These 800,000 units in lost sales due to a component that costs less than a penny can be translated into a missed opportunity that would have reduced GoPro’s 2018 losses by 13%.

How does a part that costs < 1¢ cause so much financial damage?

Look inside the design of electronic devices and you will find a collection of old and new components. Costs for these devices will range from less than one cent to many dollars. There are no unimportant or extra components. Each and every component must be present to manufacture a working product. This means that no single component is more important than any another component. The lack of one single component that may cost less than a penny can result in substantial lost revenues and profits.

How are commodities such as MLCCs (mis)managed?

Commodities, such as MLCC (capacitors), are usually managed by Contact Manufacturers (CMs) who are empowered to drive down costs with incentives to keep portions of cost reductions. There are no incentives to minimize leadtimes. Leadtimes are viewed as non-controllable market forces. The pinch of longer leadtimes are passed along to OEMs as well as price increases during times of constrained supply. Hidden in this situation of a market shortage is a conflict with CMs’ customers. CMs benefit from higher component prices through increased revenues for purchasing of components with higher prices.

CMs charge fees for acquisition of materials and these fees are based upon percentages of fully landed purchase prices. As component prices rise, the absolute dollar figure paid for purchasing increases.

There are no incentives for CMs to get better than market leadtimes nor negotiate long term prices for global commodity shortages because higher prices drive higher CM revenues from increased acquisition costs.

Commodities are purchased, they are not managed.

CMs consolidate commodity requirements for all their customers and auction off this aggregated demand on monthly, quarterly, semi-annual, or annual bases. In markets where supply exceeds demand, this strategy works well.

When market demand exceeds supply, this strategy collapses on itself as prices escalate and leadtimes stretch out. OEMs are the losers because the unavailability of a low-cost basic component such as MLCCs, with costs less than a cent, prevent manufacturing of their hardware products.

How can the basic economic model of Supply and Demand be overlooked?

Two factors are responsible for looking past the realities of the relationship between Supply and Demand. The main driving force is a disconnection between OEM business priorities and financial incentives for their internal production operations. This situation is combined with a secondary impact that comes from differences in accounting between development and production.

No one is actively managing commodities.

Effective OEM Supply Chain Management requires satisfying the dual mandate of surety of supply and cost minimization. When it comes to individual compensation for members of an OEM Supply Chain Management team, cost reduction targets and surety of supply for select, critical components determine payouts of personal financial incentives.

Management of non-critical components (commodities) is delegated to CMs. These CMs have not been part of the partnership building process between OEMs and Suppliers. Additionally, CMs lack volume commitments from OEMs that would enable them to establish long term supply agreements for commodities. CMs do not manage commodities; they buy them.

The impact of accounting on Supply Chain Management.

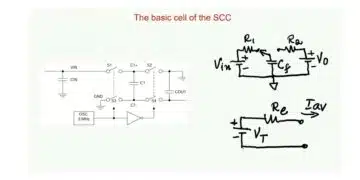

There is a secondary impact on (mis)management of commodities that flows from accounting. Companies that design hardware typically have rigorous processes for selecting components for use in their products. These firms maintain a collection of approved suppliers and database of approved components from these suppliers. Terms such as Approved Vendor List (AVL) and Approved Parts List (APL) are common shorthand for acceptable design options. Wherever possible, designers are directed to use devices from an APL or from a firm on an AVL.

Customers and their supply partners both make substantial financial investments to establish and maintain their business relationships. Given the cost of creating a business relationship, it is in the best interests of both buyers and sellers to maximize the volume of business. For valid monetary reasons, customers work to minimize their supplier base and maximize their expenditures with each supply partner.

Adding New Supply Partners

When a device is needed and it is not available from an existing supply partner, the Supply Chain Management team and design team work together to fill the void. This begins a costly process that requires a survey of available options, creation of a target list of possible partners, interview and assessment of potential partners, selection of partners, qualification of suppliers’ factories and products, and negotiation of supply agreements. Adding a new supply partner is a costly endeavor in terms of time, manhours, and hard currency.

From an accounting standpoint, the addition of a new supplier and product(s) during the development of a new hardware product are usually classified as Research and Development expenses. It is not unusual for the onboarding of a new supplier to take more than a year and expenses to exceed hundreds of thousands of dollars.

The successful completion of this process results in qualified suppliers and qualified components. A qualification process validates the ability of a supply partner to produce a component and provide production volumes. The final phase of onboarding a new supplier is validation in an actual product.

When OEM New Product Introduction (NPI) processes are completed, the Supply Chain Management team transition day-to-day interactions with suppliers of commodities to OEM production management teams that further delegate management of these commodities to CMs. The observation has been made that CMs do not manage commodities. At this point, financial investments made in OEM/Supply Partner relationships for commodities cease. No funds are allocated to manage commodities and that means no one manages them.

Commodities can be managed.

A VP of Supply Chain at a well-known maker of computer products taught me an important lesson. I share this lesson with my customers that want the lowest price in the market. The advice from this wise individual was a request for one of the best, not THE best price, in the market. In exchange for a competitive price that was not the lowest, he extracted a commitment for upside support during times of allocation.

Based on experience, he knew that a time would come where one or more of the commodity components he bought would go on allocation. When that happened, he received preferential treatment and generous allocation of available capacity. This is a leader that instilled in his team the value of meeting the complete responsibilities of the Supply Chain organization – surety of supply and cost minimization.

OEMs that wish to avoid the trap of failing to ship their products due to limited availability of low-cost commodity components have options; but no free options. All components are critical when one part can prevent building and shipping products.

Accept this fact and allocate manpower and system support to manage ALL components. Don’t drop business relationships with supply partners for commodities when qualifications and NPI activities are completed. Add minimum volume and upside figures into agreements with some form of financial benefit to a Supply Partner. This will ensure you get your unfair share of supply during times of allocation.

How do I know these things?

This analysis of effective Supply Chain Management includes personal experience working with customers purchasing Logic, Memory, CPUs, and MCOs from Signetics (now NXP), Wafer Starts and Memory from Fujitsu, Op Amps and MOSFETs from Fairchild, and MLCCs from AVX. Customers that established true partnerships were able to get their unfair share of supply during times of allocation. Customers that focused on price and activities such as reverse auctions were shocked when target prices were not met and required capacity was not available at any price.

The “Golden Rule” applies in both business and personal affairs.

The inspiration for this article examining the challenges in Supply Chain Management was inspired by a Daniel Wolfe article that appeared in Quartz ( https://qz.com/1575735/ ) on March 21, 2019 under the title “The global shortage of capacitors impacts all consumer electronics”. An excerpt of this story also appeared on the EPCI European Passive Components Institute ( https://passive-components.eu/gopro-limited-on-consumer-camera-sales-due-to-mlcc-shortage/ ) web site on that same date. I would like to extend my thanks for these articles from Mr. Wolfe and the EPCI.

The full article can be downloaded in pdf on Global Technology Management Group website here.