Source: EPS news

by Barbara Jorgensen. The fortunes of the electronics supply chain can change on a dime. Following two years of severe component shortages, demand is weakening, and inventories are too high, a March study found. One global distributor describes the environment as “normalizing” but cautions there’s still a lot of instability in the 2019 forecast.

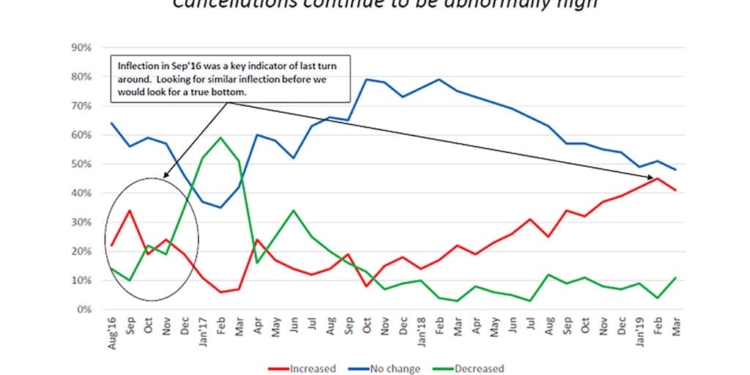

“Based on our survey results and conversations with various supply chains; we believe the industry has yet to see a true bottom as demand continues to be weak and inventories continue to be viewed as too high,” according to Technology Partners Consulting. “Additionally, there’s concern over the macro environment especially in China. We would want at least another month of positive improvement along with an initial positive outlook before we would believe we are at a bottom in this cycle.”

TPC in March surveyed more than 12,000 electronics industry professionals worldwide.

“’Normal’ these days certainly includes a level of instability,” said Tobey Gonnerman, executive vice president of global trade for distributor Fusion Worldwide. “The widely documented growth in board-level component consumption, along with explosive demand across growth sectors like IoT and automotive, has further complicated the supply chain. In general, the hyper-shortage issues of 2018 have subsided, and an increase of excess has followed.”

This pattern is typical after a prolonged shortage, he added. “The excess is the result of double-bookings, aggressive pull-ins and over-buying to create safety stock. Many are bullish about the second half of this year so we’re expecting strong demand and the inevitable gaps as well.”

The demand outlook for Q2 ticked up slightly, according to TPC, with 32 percent of respondents expecting demand will weaken (vs. 35 percent in February) and 23 percent expecting better quarter over quarter (QoQ) growth – up from 19 percent.

“In general, it feels like we’re in the eye of the storm,” Gonnerman said. “We don’t feel like the back-end of it will be stronger than the front that already came through, but certainly there’s increased market instability in the forecast.”

Lessons from the millennium

In the late 1990s, a boom-bust cycle in electronics resulted in inventory levels that took years to burn off. A correction this time won’t take nearly as long or be as dramatic. Although TPC cites “abnormally high” cancellation expectations in March, just-in-time, lean and build-to-order practices have left the supply chain in relatively good shape. Additionally, electronics distributors have flagged customer orders that seem historically high.

“The electronics industry seems to be slowly coming out of crisis mode,” an industry executive told the Institute for Supply Management. “Lead times and costs have leveled out in some commodities, and dynamic random-access memory (DRAM) prices are actually coming down.”

If demand weakens as expected, cancellations could quickly drive up inventory levels, according to TPC. Forty-one percent of TPC’s March respondents saw cancellation rates increase over the past 30 days. This indicates customers are trying to drive their inventories lower due to the belief of a weaker Q2.

Fusion, an independent distributor, hasn’t suffered from significant cancellations at all, said Gonnerman.

However, some end-markets are still feeling the squeeze from limited electronic component availability. “Business remains very strong amid rumors of a slowdown, but forecasts do not indicate this,” a transportation equipment executive told the ISM. “Electronics are at tight capacity from manufacturers, with no [change] in the near future.”

This is the electronics industry, after all.

No relief in MLCCs

Normally, higher inventory levels mean component prices come down. However, this supply cycle is already different from others. Some interconnect, passive and electromechanical (IP&E) device manufacturers have used the recent disruption to transition from legacy to leading-edge products. MLCC supplies, according to Fusion, will remain unbalanced for some time.

MLCC manufacturers are focusing on small case sizes and are pushing large case sizes out of production. These changes will lead to new product designs and an eventual increased demand for small case sizes. Until then, industries still using large case sizes will face ongoing supply issues, particularly on 0805, 1206, 1210 cases, Fusion said.

The ease or difficulty in transitioning to a different case size depends on the user, said Gonnerman. “I don’t think there’s a one size fits all answer to this – MLCCs are so widely used. There are so many different end products and applications and technologies – the transition for some could be quite easy. For others, it’s an extensive and arduous process – cost, time, resources, customer contracts, size, performance, workability – are all so variable and comprehensive.”

Some MLCC applications must stick with larger case sizes due to value/tolerance/voltage or a combination of factors, Gonnerman added. “I believe the manufacturers will certainly continue to support those products where a smaller case size replacement isn’t possible.”

Murata is reducing its backlog in small cases sizes but not the large case sizes that are in demand, Fusion reported. Murata is still taking orders for MLCCs in large case sizes, but current lead-time forecasts are 20+ weeks. Distributors have been notified that their cost will increase 10 percent for all case sizes of the GCM series, Fusion added.

Samsung has stepped in to fill large case size demand, focusing production on case sizes 0805 and above. Fusion expects price increases on large case sizes beginning in Q3 to take advantage of the decreasing production for larger case size by Murata.

Taiyo Yuden is competing with Samsung in the large-case size MLCC market. “However,” Fusion said, “the company plans to consolidate production to certain voltages because of the increased orders from previous Murata customers. For 1206 and 1210 packages, Taiyo is going to focus more on automotive, artificial intelligence, IoT and 5G markets to support growing demand. At the same time, Taiyo is planning to reduce their production capacity for general-purpose large-case size MLCCs.”