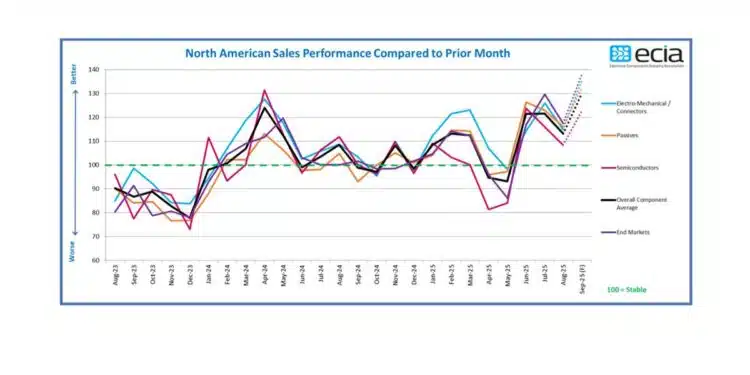

Component industry pulse ECIA survey results for August sales sentiment decline from July but remain solid; quarterly results show optimism through end of 2025.

The August Industry Pulse survey results fell short of expectations from the July survey. The overall index dropped from 121.6 to 113.2 between July and August.

The July survey had projected an outlook for August of 127.5. While it’s not uncommon for actual results to fall short of expectations, this was a significant miss. Despite the disappointing July results, optimism remains high as survey participants predict a strong jump in September.

The overall average score for September is projected to be 130.2. The three major component categories are moving in sync. They all fell by a similar amount in August and are all projected to improve by a similar amount in September.

Passive and Electro-Mechanical components achieved the highest scores in August, with index scores of 116.1 and 115.0, respectively. Semiconductors scored 108.3 in August. The end-market index scores align with the component category scores, with results slightly above the product segments.

In recent surveys, ECIA began measuring sales sentiment compared to the same month in the previous year. These results are even more encouraging than the month-to-month perspective. The year-over-year average product index score ranges from 142.4 to 141.1 in June and August, with a brief increase to 151 in July. The overall end-market score compared to last year also shows strong results. The index score averages between 140.0 and 145.2 over the last three months.

The most encouraging results come from the Q3 2025 Industry Pulse survey. It shows solid optimism from Q3 through to Q4 2025. The continued sales sentiment momentum revealed by both the August and Q3 surveys is very encouraging. Sixty percent of survey respondents expect positive sales sentiment for Q3, with that figure remaining at 59% for Q4. Only 6% and 7% of respondents saw declining sales sentiment in Q3 and Q4, respectively. Electro-Mechanical components showed the strongest scores for Q3 and Q4.

Semiconductors are projected to experience a significant improvement in Q4, leading to a positive outlook. However, the reliability of economic reports on the US economy remains uncertain. The overall economy appears to provide a solid foundation for industry growth through the end of 2025, but this depends on the economist’s perspective.

Manufacturer Representatives reported the most robust sales sentiment in August across all component categories. Distributors also showed a significant improvement in their reported scores for August, aligning more closely with the overall average for all groups. In contrast, manufacturers exhibited growing pessimism in July and August, which further intensified in their September expectations.

On a positive note, every individual end-market surpassed the 100-point threshold in July, with the Industrial and Avionics/Military/Space segments leading the way at 129.6 and 141.3, respectively. Only Consumer Electronics fell below the 100-point threshold at 97.2. The outlook for August suggests that every market is expected to deliver scores significantly above 100. The consistent positive results from June through September and the Q4 outlook reinforce the optimistic picture these results present.

Reports for lead time scores continue to indicate a stable environment, despite a noticeable increase in reports of increasing lead times. Participants reporting increasing lead times decreased slightly from 23% on average in July to 20% in August. Less than 1% reported decreasing lead times on average. Overall, stability prevails, with 80% of participants perceiving a stable environment.