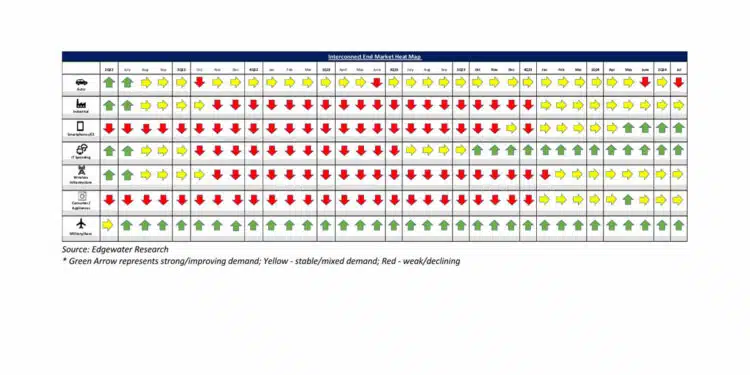

August 2024 collection of news summaries, survey results and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

Navigating mixed end market trends, with industrial/auto slower while AI/IT datacom remains robust with no impact seen near-term from Nvidia platform delay.

What’s Changed/What’s New?

1. 3Q outlook mixed by end market, with Industrial moderating, traditional IT datacom better, the rest little changed.

2. 2H24 IT datacom forecast projecting +20% seq. growth on strengthening traditional IT, pull forward in some AI ASIC projects, and increased Hopper orders, which appears to more than offset headwinds from Blackwell delays and loss of content in the NLV72.

3. Industrial datapoints weaker on softer than expected July orders in Europe and N.A. across direct customers and distribution.

Top 3 Channel Comments:

• Our bottom-up analysis of customer orders and backlog made us cut our 2H numbers in N.A. 2H now appears down vs. 1H. We see softness in most markets in distribution; bookings in July stepped down meaningfully for us.

• We (semi supplier) have seen a 20% reduction sequentially in 3Q Auto orders from China customers. Customers appear to have built some inventory and they are cutting back on production. Our B2B was positive over the past 3 quarters, but 3Q B2B is down to 0.87x.

• Our Industrial interconnect business is down 30% Y/Y, and we see only limited signs of improvement in N.A. Europe’s demand is very weak right now. Rockwell just told us they have enough inventory to last them another 6 months.

Other Key Takeaways:

4. Auto feedback in the West soft, but consistent with our July update. 2H global Auto demand still projected flat to down sequentially.

5. 3Q China Auto orders noted as weaker, down by >20% QTD for some semis – a potentially negative read-through for IP&E.

6. Traditional IT datacom demand inflecting higher in 2H on refresh cycle at hyperscalers and improved buying velocity at Enterprise.

7. July Industrial order softness in Europe and N.A. seen driving negative 2H POS revisions in distribution.

8. Distribution inventory is seen as close to healthy, but Industrial customer inventory is still noted as headwind, with customers projecting digestion through year end.

9. iPhone connector demand seen as remaining strong in Jul/Aug.

Conclusions:

IP&E fundamentals remain mixed through August, with fundamentals varying widely by geography and end markets. By geography, Asia is showing the best relative near-term performance offset by more mixed operating environment in the Americas and clearly weakening environment in EMEA, most notably in Germany. The softness in EMEA can be partially explained by seasonality/summer holidays, however elevated inventory and broader economic concerns are weighing in addition to seasonality.

By end market, AI remains robust, with traditional IT Datacom noted as also improving in August and continued strength noted in smartphones, most notably the Apple supply chain and the Aerospace/defense industries continue outperform other markets. Industrial and Automotive, conversely appear to have moderated in the month, with concerns around end customer inventory and broader sluggish economic activity continuing to weigh on the recovery.

While the results are clearly mixed in August, our view of the recovery remains largely unchanged with the pace and velocity of the recovery remaining a question mark through 2H24. We continue to expect a bumpy recovery near term, though we remain encouraged about cleaner inventory entering 2025 and a return to more normalized growth.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research

Source: Edgewater Research