source: ttiMarketEYE news

05.03.2016 // Dennis M. Zogbi // Passives

Capacitors: Global Market Update: April 2016

The global capacitor industry, which for the purposes of this article includes ceramic, aluminum, tantalum and plastic film capacitors of all types and configurations, will accounted approximately $20 billion US dollars in global revenues for FY 2016 (Fiscal Year ending March) with almost two trillion pieces shipped. This article summarizes historical methods by which capacitor manufacturers have increased profitability in each capacitor dielectric over the past 30 years and concludes by creating broad categories that can be applied to the entire components industry.

In the worldwide capacitor industry, fixed costs represent about 20% of the costs to produce, while variable costs, those that fluctuate, represent a full 80% of the costs to produce; with vendors focusing on variable costs as the area to improve throughput of manufacturing. Variable costs include raw material costs, labor costs, variable overhead costs and variable manufacturing costs. Raw material costs represent the largest single cost factor in the production of capacitors regardless of dielectric, so the reader will notice that many historical methods for cost savings and increased profitability are related to management and manipulation of the costs associated with buying and processing raw materials.

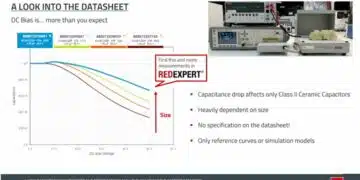

CERAMIC CAPACITORS: Best Practices for Increasing Profitability

Ceramic capacitors, are electrostatic components, and are produced in multiple configurations including surface mount, axial and radial leaded designs. Ceramic capacitors, especially the ubiquitous multilayered ceramic chip capacitor (MLCC) represents the largest capacitor by type consumed worldwide in FY 2016 in terms of both value and volume. All other capacitor markets are considered niche when compared to ceramic capacitors. Here is a summary of methods by which ceramic capacitor manufacturers have reduced their respective cost structures and increased profitability over the years.

In-House Production of Ceramic Formulations:

In ceramic capacitors, one method of cost-savings is for the manufacturer of the capacitor to produce composition type formulations in-house instead of sourcing them from the merchant market. Ceramic formulations include X7R, X5R, Y5V and COG type materials, as well as a variety of specialty formulations that can be manipulated for ceramic capacitors that would be used in specialty applications, such as high temperature, high voltage and high frequency circuits.

In-House Production of Advanced Barium Titanate:

Another method, practiced by Murata for example, is to have the in-house capability to precipitate advanced forms of barium titanate; such as those created by the chemical oxalate process. The added profitability comes from the fact that the company does not have to pay premiums to merchant market vendors of advanced barium titanate. Not many ceramic capacitor companies (or merchant market vendors) have this capability; but as Murata has noted to me, not only does it save money, but it allows advances in “green-sheet” thickness and processing that would not be available by sourcing advanced barium titanate from the merchant market.

Displacing Precious Metals with Base Metals in Electrodes and Terminations:

Another method of traditional cost savings has been to use lower cost nickel electrodes and copper termination powders instead of palladium electrodes and silver termination powders in any instance where there are a high number of internal layers to the multi-layered ceramic chip capacitor (i.e. in X5R, Y5V and high layer count X7R type ceramic capacitors). This trend has been ongoing (on an industrial scale) since 1993, but more recently we see nickel electrodes displacing palladium based electrodes in specialty markets such as automotive under-the-hood; defense, medical and oil and gas end-use segments, where previously customers had resisted such displacement because of the lack of lifetime performance data. However, base metal electrodes have been employed in real world MLCC applications for more than 20 years now, and this is prompting customers to finally consider alternative base metals in the interests of cost savings.

Tunnel Versus Batch Kilns:

Another method of saving money is in the use of massive tunnel kilns to fire large volumes of ceramic capacitors all at once instead of using smaller batch kilns. Primary vendors note that this process is largely successful when firing “high runners” or those capacitors that are consumed in large volumes. However, smaller batch kilns are still used, especially when the application is a specialty sub-set end-market that requires only a small number of pieces.

Developing Massive Economies of Scale:

Due to high volume associated with ceramic capacitor production, massive economies of scale can lower raw material purchases from the merchant market because of the vendor’s ability to buy in bulk.

Having Specialty Parts in the Portfolio to Offset Price Erosion Trends in Large Runners:

A well-balanced portfolio, one that allows the manufacturer to enter value-added and application specific ceramic capacitor markets where margins are high- to balance out lower margins in the mass-commercial markets, where margins are lower, is another strategy employed by vendors to increase overall company profitability.

Low Cost Regional Production:

Another method of cost-savings employed by global manufacturers of ceramic capacitors includes the intentional production of large volumes of ceramic chip capacitors in low cost production regions of the world (Philippines, Thailand and China are good regional low cost production bases for MLCC). Because the equipment to produce MLCC for example, is highly automated, a difference can be made in the overhead, variable labor and subsequent electricity costs associated with production. In FY 2017 it is expected that Japanese vendors will employ this tactic, and transfer production away from Japan to other Asian countries (i.e. Thailand, Singapore, Philippines, and Korea) in an attempt to avoid losses as the yen strengthens to the US dollar.

ALUMINUM CAPACITORS: Best Practices for Increasing Profitability

Aluminum capacitors, are electrolytic components, and are produced in a variety of configurations including radial leaded, axial leaded, vertical chip, snap-mount small can; large can screw terminal and organic polymer horizontal molded chip designs. Aluminum capacitors are largely wet designs, which mean they require an internal liquid electrolyte to operate. Some designs are solid or dry type, and employ a conductive polymer instead of a liquid chemical electrolytic to achieve the desired high voltage. Aluminum capacitors offer the design engineer a high capacitance, high voltage solution and a low comparable price. The interesting factor about aluminum electrolytic capacitors is that they contain multiple types of raw materials in their construction, including etched anode and cathode foils, electrolytes, cans, tabs, lead wire or terminals, rubber stoppers and footpads. Here is a summary of methods by which aluminum electrolytic capacitor manufacturers have reduced their respective cost structures and increased profitability over the years.

In-House Foil Forming and Etching:

Many of the top vendors of aluminum capacitors can etch their own anode and cathode foils as a way to cut costs. In-house etching of anode and cathode foils requires chemical expertise and low cost energy as etching and formation are technically demanding, electricity intensive practices. There is movement in the industry to etch and form foil in extremely low energy cost nations and this process is also designed to decrease costs because electricity consumption is a key cost factor in forming capacitor foil.

Low Cost Regional Production:

Another method of cost-savings employed by global manufacturers of aluminum capacitors includes the intentional production of large volumes of radial leaded and vertical chip aluminum capacitors in low cost production regions of the world (especially in China and Malaysia). In FY 2017 it is expected that Japanese vendors will employ this tactic, and transfer production away from Japan to other Asian countries in an attempt to avoid losses as the yen strengthens to the US dollar.

PLASTIC CAPACITORS: Best Practices for Increasing Profitability

Plastic film capacitors, are electrostatic components, and are produced in a variety of configurations including radial leaded, axial leaded, SMD film chip; small can and large can configurations. Because of extensive competition in the space due to ease of market entry, vendors are constantly attempting to cut costs, here is a summary of how some plastic film capacitor vendors cut costs and increase profitability:

In-House Film Metallization:

Captive metallization of capacitor grade dielectric film is an excellent way to increase profit margins and lower costs to over time. An increasing number of DC film capacitor manufacturers metallize their own thin films.

Low Cost Regional Production:

Another method of cost-savings employed by global manufacturers of plastic film capacitors includes the intentional production of large volumes of radial leaded plastic film capacitors in low cost production regions of the world (also with emphasis upon China and Malaysia).

TANTALUM CAPACITORS: Best Practices for Increasing Profitability:

Tantalum capacitors, are electrolytic components, and are produced in a variety of configurations including SMD molded chip, molded axial and radial; dips and hermetically sealed wet slug tantalum capacitors. Here is a summary of how some plastic film capacitor vendors cut costs and increase profitability:

Vertical Integration of Powder and Wire Production:

It is difficult to find cost savings for the production of tantalum capacitors, because unlike the other capacitors noted in this report, it is extremely difficult to produce capacitor grade tantalum metal powder because the chemistry involved is considered a “black art.” Also the number of active production facilities that can produce capacitor grade powder and wire is limited worldwide. However it should be noted that KEMET Electronic Corporation did in fact purchase NIOTAN of Nevada and integrated it into the manufacturing process for tantalum capacitors in FY 2013. The company has renamed the powder operations. Blue Powder Corporation. Tantalum capacitor manufacturers are also beginning to produce their own tantalum wire in-house.

Gas Infusion Instead of Dipping Process for Conductive Polymer Tantalum Capacitors:

A gas infusion process for conductive polymer tantalum capacitors generates a higher margin than the alternative monomer and polymer “dipping” process due to the excessive waste stream associated with impregnating anodes by chemical bath.

Summary and Conclusion

Capacitor manufacturers traditionally have employed a variety of methods to lower costs and increase profitability. The primary method has been to vertically integrate raw material processing into the capacitor supply chain and make them captive instead of paying premiums to the merchant market. Some vendors also believe that captive control over raw materials also leads to greater breakthroughs in technology.

Specific areas where vendors have improved profitability due to greater control over raw material usage and supply include:

- Producing advanced barium titanate and formulations in-house

- Displacing precious metals with lower cost base metals

- Etching and forming aluminum foils

- Metallization of thin plastic films

- In-house captive production of tantalum powder and wire

In addition to placing controls over variable raw material costs, capacitor vendors also address other variable costs associated with the following criteria –

- Moving mass production to low-cost regions of the world

- Creating massive economies of scale to obtain lower raw material costs through bulk purchases

- For ceramics, using tunnel instead of batch kilns for parts that are consumed in large numbers