Euroquartz Group’s sales and marketing director, Andy Treble, explains in his article published by Electronics Sourcing why the end of Covid-19 disruption may not see a quick return to market normality.

Post Covid-19, frequency component suppliers are facing perfect storm conditions as raw materials shortages and chip set suppliers vital to the industry struggle to keep up with increased demand.

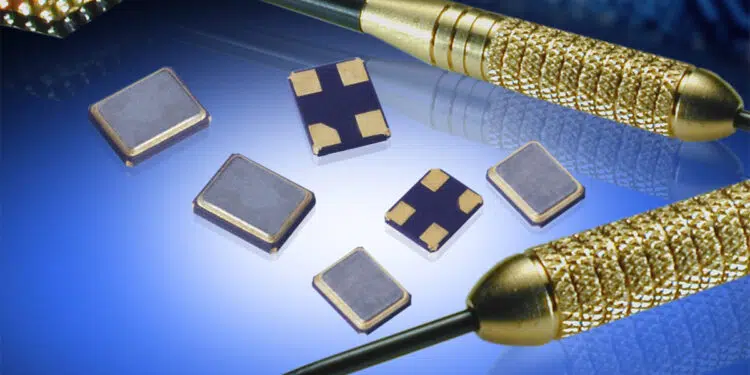

The electronics frequency market is currently seeing unprecedented shortages and lengthening lead times, along with rising prices. Crystal and oscillator manufacturers are faced with a virtually hopeless task. Raw material suppliers are not just extending lead times, cost is only being made available at the time of shipment. This means the cost base is permanently changing and providing buyers with a quotation has now become a task for educated guesswork.

Also, the truncated supply chain has created backlogs at factories which are reaching full capacity as piece parts finally arrive.

Besides these Covid-19 related issues, a fire in October 2020 at the AKM semiconductor facility in Japan—which produced some 80 per cent of the market’s TCXO chipsets—created havoc and continues to disrupt supplies almost a year later.

Contraction of automotive market business, which came to a standstill during the pandemic, forced manufacturers to close production lines. The return of buyers to this important sector has led to pressure on manufacturers to reopen, but this is not something that can be done overnight. Consequently, orders from this major sector have swamped the supply lines, dislocating supplies for the entire industry.

Meanwhile, 32.768kHz watch crystals—widely used across many applications—were also hit by a major factory closure resulting from a decision taken when demand was vastly reduced. These watch crystals used to be available on four-week lead times and now factories will not even offer quotations as they cannot predict when they will have enough material in place to satisfy demand, a situation likely to continue well into 2022.

Furthermore, certain larger sizes of ceramic crystal packages are in short supply as the world’s single manufacturer focuses on the smaller sizes for which there is a higher demand.

Many companies have also used current conditions to reduce their product ranges based on annual usage figures, meaning obsolescence notices are becoming almost a daily occurrence. For instance, many semiconductor houses are obsoleting 5V variants in favour of 3.3V and under. This has serious implications for defence sector designers and manufacturers with many systems still based on higher voltage rails established over many decades in TTL technology.

Overall, order books look healthy but the long lead times are dislocating cashflow and it could be said that the industry is facing a perfect storm.

Massive dependence on Asia for raw materials and components is focusing the minds of companies in the European sector and longer term there is an argument for re-shoring or near-shoring production.

It is felt by manufacturers that there is substantial duplication of orders in the supply chain, a result of panic buying in the market. However, the expectation of cancellations as these work through the system has yet to materialize.

The consensus seems to be that it will be Q4 2022 before things return to a more normal situation unless some or all the above factors are addressed sooner. By then, however, many parts that were previously available will no longer be in production as factories prioritize their more profitable lines.