The second quarter of 2023 of German component distribution (according to FBDi e.V.) shows a mixed picture in sales and a significant decline in incoming orders.

Not entirely unexpectedly, the second quarter of 2023 ended with good and bad news at the same time for German component distribution.

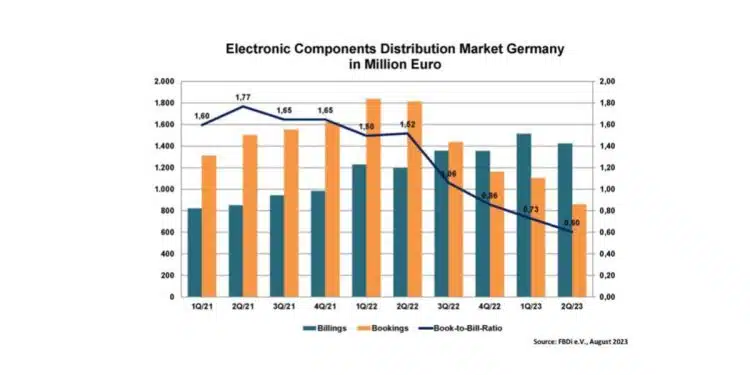

On the one hand, sales of distributors reporting in the FBDi increased by 19% to 1.42 billion euros compared to the second quarter of last year, and on the other hand, order intake fell by almost 53% to 859 million euros compared to the record order intake of Q2/2022. The book-to-bill ratio, which stood at 1.52 a year ago, fell to 0.6, the lowest level since the FBDi was founded.

Once again, semiconductors played the decisive role. At 1 billion euros, sales were only marginally below the record quarter of Q1/2023, but 31.5% higher than in the same period of the previous year. Orders, on the other hand, fell by a whopping 62%. In the other product areas, a certain normality has been established for some time: Sales of passive components shrank by 1.6% to 173 million euros, electromechanics by 4.8% to 159 million euros.

Power supplies grew by 3.5% to 43 million euros, while sales in the remaining product groups (sensors, displays, assemblies) weakened. The distribution of the sales pie shifted slightly towards semiconductors (70%), passives and electromechanics declined by 1% each (to 12% each), the rest remained almost the same.

FBDi CEO Georg Steinberger: “Almost nothing was surprising about this quarter, except the fact that the braking distance was a bit long after last year’s high-altitude rush. And indeed, even now there is no complete all-clear in terms of availability, because SiC and GaN components, for example, will probably still be in short supply until well into next year. Otherwise, customers’ warehouses are well stocked for the time being, and a rebound in incoming orders is likely to be a long time coming – how long, that’s the crucial question.”

The outlook for 2023 remains mixed, says Steinberger: “As several times in the past, we will have to deal with two different halves of the year, a good first and a less good second. All in all, it will be an almost balanced year, at least for distribution. We hope that after the reduction of excess stocks, normal market behavior will set in and that cycle-related overreactions will not occur again.”

Steinberger does not want to hide one fundamental thing: “The conditions in the market have changed, both geopolitical challenges and the market power of individual major global customers can disrupt entire supply chains, we have noticed that. And what could prove to be another problem is the subsidy arias, where billions and billions of taxpayers’ money are currently flowing into semiconductor production all over the world. Even if the attractiveness of semiconductors will continue to increase, it cannot be healthy if, as can be assumed according to research by the research company Knometa Research, no less than 230 fully functional 300 mm wafer fabs will be launched in 2027. This could grow into massive overcapacity.”