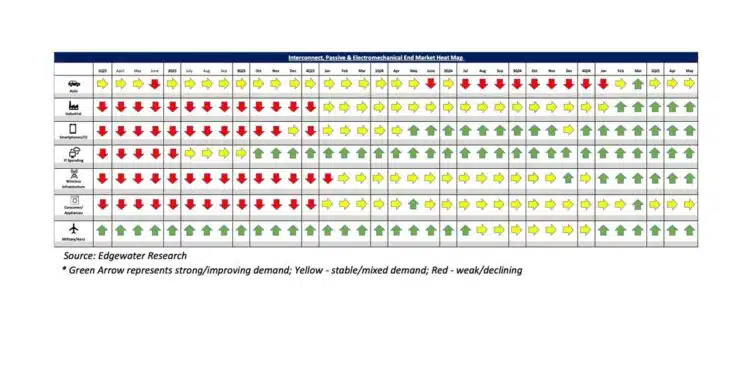

Edgewater researchers report Incremental Progress in Industrial; Auto Mixed & AI/NVL in Focus for 2H25. June 2025 collection of news summaries, survey results, and channel market insights on Interconnect, Passives components & Electromechanical Components from Edgewater Research.

What’s Changed/What’s New?

1. Demand trends better M/M but mixed by end market, with 2Q tracking ahead on recovery in distribution/Industrial and better than feared Auto tied to end demand pull-ins.

2. Order and B2B trends improving, translating into a positive 2H outlook driven by continued recovery in Industrial, Telco, traditional DC, ongoing AI momentum, partially offset by concerns of downside to current flattish Auto forecast.

3. NVL ramp progressing incrementally, but deployment challenges persist. CY25 racks still projected at 25-30K, contingent on further progress and smooth GB300 transition. Firm orders to component suppliers noted lagging Nvidia’s forecasts of 50-55K rack.

4. Initial Nvidia Kyber tests noted deploying passive copper backplane to connect canisters, with cable count estimated >10K vs >5K in GB200. Amphenol likely to retain the backplane and supply the midplane connectors; content potentially doubling vs the GB200.

Top 4 Channel Comments:

• 2Q interconnect demand is better than expected, with signs of recovery across most markets. The tariff reprieve clearly boosted shipments, but limited visibility makes it difficult to separate pull-ins vs. inventory normalization or underlying end-market demand.

• It is hard to predict NVL shipments this year. Builds are improving, but CSPs are still dealing with deployment and performance issues, and Nvidia is still making changes. The latest CY25 quarterly projections are 1K/6K/10K/12K, with continued progress and a smooth GB300 transition critical to achieving the 2H forecast.

• 3Q Auto orders so far suggest flat to down demand Q/Q, but we are preparing for a more pronounced slowdown, particularly towards the back of end of 3Q and into 4Q as pull-forward in end demand and output normalizes.

• Auto volumes, especially for new programs, remain well below expectations, leaving capacity idle as OEM delays stretch two to three years. While this poses near-term challenges, it’s also extending the life of existing, highly profitable platforms, where tooling is in place and productivity gains allow us to capitalize despite slower transitions.

Other Key Takeaways:

5. Amphenol seen shipping 100% of NVL backplane currently. TE still expected as 2nd source, but timing and allocation unclear.

6. Amphenol well positioned for NVLink Fusion scale-up, with Nvidia -qualified backplane seen as likely default choice.

7. Trn2 rack forecast still 35K for CY25, 50K through mid-26; forecast to component suppliers noted outpacing rack forecast. TE still sole-sourced for backplane cables, but as anticipated, ceding some connector share in 2H tied to AWS supply chain de-risking.

8. Trn3 reads noisy, with MP delayed to 2H26 amid SerDes issues prompting dual sourcing and second tape-outs from Alchip/MRVL.

9. 2Q Auto tracking ahead. 3Q outlook flattish, with concerns of downside to forecast on pull-in normalization in the West. EV/new programs in the West pushed out again, driving underutilization, but extending existing platforms, allowing for efficiency gains.

10. China Auto in-line for 2Q but 2H outlook moderating; Amphenol/TE still gaining share; foreign OEM demand seen stabilizing.

11. Tier 1 Auto pressured by OEMs to share tariffs; component suppliers passing through tariffs but facing pushback on metal inflation.

12. Industrial recovery continuing, led by N.A.; China better despite 2Q volatility, Europe shipments lagging, but orders improving.

Conclusion:

IP&E fundamentals continue to improve through mid-2Q25, with the industry firmly in recovery despite some near-term noise from potential tariff-driven pull-ins.

While these disruptions appear limited to select markets like Automotive, we remain optimistic given broadly clean inventory levels and stable end demand. With broad-based recovery trends intact and a strong AI outlook, we remain positive on IP&E fundamentals for 2H25 and into 2026—barring any material end-demand impact from geopolitical or tariff-related disruptions.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research