Source: TTI Market Eye, Paumanok Inc. article

by Dennis M.Zogbi, Paumanok Inc., published by TTI Market Eye.

MLCC and thick film chip resistor manufacturers are experiencing price increases in feedstock metals as they enter the fourth quarter of CY 2019. This MarketEYE article uses an economic model to discuss the potential impact that higher metals prices will have on mass-produced electronic components consumed in handsets, computers, TV sets and all other consumer and professional electronics.

Massive Quantities of Feedstock Metals Are Being Consumed

Labor disputes, mine closings, refinery closings and speculation have created unexpected price increases for key metals consumed in the mass production of passive components – in this instance, the mass-produced MLCCs and thick film chip resistors.

The key scientific principle surrounding passive component technology is that functionality is equivalent to the physical size or available surface area of the finished component. This in turn makes the volume of raw materials consumed in the production of passive components significant, especially for dielectric materials such as ceramic; however, a considerable volume of metal is consumed for electrodes, terminations and active layers of passive components. What’s more, the metals are far more expensive per gram when compared to the dielectrics, and therefore account for one of the most expensive portions of Cost of Goods Sold. Feedstock metals are the area where manufacturers of passive components have the greatest risk due to the variable nature of the passive component raw material supply chain – especially when it comes to feedstock pricing, which for these mass-produced components is outside the control of the high-tech economy, especially when it comes to nickel, palladium and ruthenium.

The Relationship Between Metals and Passive Components

Base metals such as nickel are used as the electrode materials in high-capacitance multilayered ceramic chip capacitors (MLCC); while palladium is used in certain types of high-reliability MLCC electrodes; meanwhile Ruthenium metal is used as the resistive ingredient in ruthenium oxide thick film metallization layers for thick film chip resistors.

“Variable costs” to produce MLCC and thick film chip resistors (which are the two mass produced passive components whose global output is measured in the trillions of pieces) amount to about 80 percent of Cost of Goods sold in various studies conducted by Paumanok Publications, Inc. on the “Competitive Analysis of Passive Component Manufacturers.”

The variable costs associated with raw materials make up the largest single cost factor associated with the cost of producing MLCC and thick film chip resistors and encompasses ceramic materials and electrode powders and pastes as well as other materials related to terminations and coatings. Other variable costs include overhead and labor, but historically, over 30 years, it has been the fluctuation in the price and availability of certain metals that has had the greatest impact on the MLCC and thick film chip resistor supply chains, and have posed the greatest risk of price increases for customers, or loss of profitability for component manufacturers.

Figure 1: Fixed and Variable Costs to Produce Passive Electronic Components Source: Paumanok Publications, Inc. Variable raw material costs include dielectrics, electrodes, terminations, additives, epoxies and electronic glass for the purposes of this article.

Capacitor Operating Margins

Operating margins for capacitors have averaged about 25 percent in various Paumanok studies conducted between 1990 and 2019, with emphasis on the mass-produced product lines of MLCCs and thick film chip resistors.

MLCCs and thick film chip resistors have a variable cost structure that differs from that of other component industries because of a heavy reliance on metals to produce the finished product. In many instances, raw material costs are outside the cost control of the passive component manufacturer. This is especially true of feedstock costs for the three metals impacting the passive component supply chain in 2019 – nickel, palladium and ruthenium – which are outside the control of most of the high-tech supply chain.

Variable Raw Material Costs

The variable cost associated with raw materials makes passive components somewhat unique: the supply chain must rely in whole or in part on outside merchant market vendors and engineered materials processors to supply the engineered powders and pastes used in passive components. Historically, changes in metal prices and availability have proven to be the greatest risk factors in the cost to produce capacitors and resistors.

In 2019, the prices of ruthenium, nickel and palladium have reached levels that have not been seen for years. The recent price hikes in these key materials should begin to impact prices for any new requests for quotes in the critical “just-in-time” December quarter, and for any yearly contracts established in January 2020.

Changes in Feedstock Pricing

In September 2019, Paumanok Publications, Inc. noted a sharp change in pricing for palladium and nickel in its monthly report tracking passive electronic components. Both of these metals are consumed in the production of MLCC electrodes. Meanwhile, the price of ruthenium (a precious platinum group metal) has also skyrocketed, maintaining its elevated price structure even though thick film chip resistor demand has waned.

Historically, higher metals prices have had an impact on the costs to produce MLCCs, but in the case of thick film chip resistors the price increase of 380 percent for ruthenium since August of 2017 should have a rather noticeable impact on pricing.

A 41 percent increase in the nickel price will also impact the costs to produce ultra-fine nickel electrode powder and pastes, and a 21 percent increase in the palladium price will have a marginal impact on price on PGM-type MLCCs used in high-temperature, high-voltage applications.

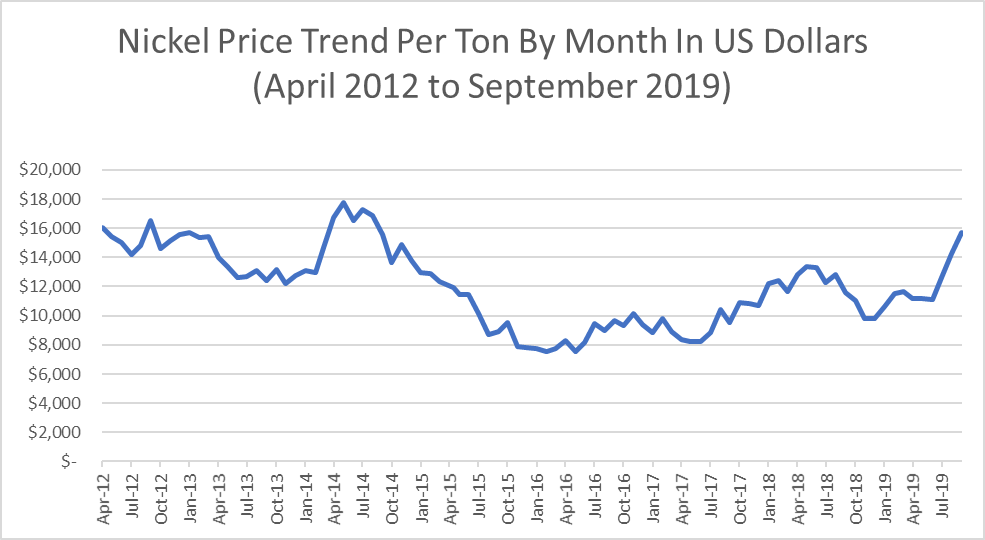

Change in Nickel Feedstock Pricing

Nickel prices jumped up to $14,272 a ton in August 2019 and then to $15,700 in September (up 41 percent since July 2019) and is concerning. Nickel is the electrode material used in high cap MLCCs.

Increases in nickel prices will have a direct impact on MLCC manufacturers in Japan, Korea, China and the Philippines. The nickel price has been most significantly impacted in 2019 by disruptions of the nickel supply chain in Indonesia where landslides cut off access to the Sulawesi Nickel Mine, and in September 2019, the Kalgoorlie Nickel Smelter in Australia was shut down following a fire.

Meanwhile, speculation increases that nickel will be the material of choice for many electric vehicle batteries. This has caused the nickel price to spike in September.

Figure 2: Nickel Price Trend Per Ton; Source: Paumanok Monthly Report On Passive Components – September 2019 Edition

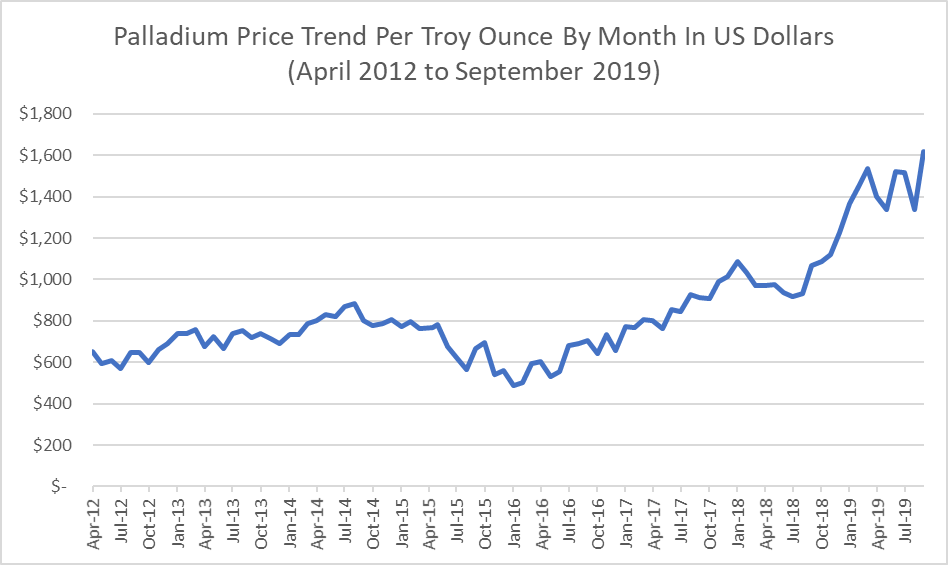

Change in Palladium Feedstock Pricing

In precious metals, the palladium price increased sharply to $1,620 per Troy ounce (Toz.) up from $1,336 per Toz. one month prior. This represents an average price increase of 21 percent in 30 days. Palladium is also consumed in MLCC electrodes for specialty applications in high voltage, high frequency and high temperature electronics.

The price increase for palladium would have an impact on the costs for engineered powders and pastes designed for use as MLCC electrodes. Increases in palladium prices will have a direct impact on costs to produce MLCCs in the United States, Mexico, France and Japan. The palladium price has been further impacted in September by fresh fears of labor unrest in South African palladium mines, coupled with expected higher palladium loadings in autocatalysts for new stringent emission standards. Seventy-five percent of the world’s palladium is consumed in catalytic converters, so any positive movement in the China automotive market may create higher prices for palladium.

Figure 2: Nickel Price Trend Per Ton; Source: Paumanok Monthly Report On Passive Components – September 2019 Edition

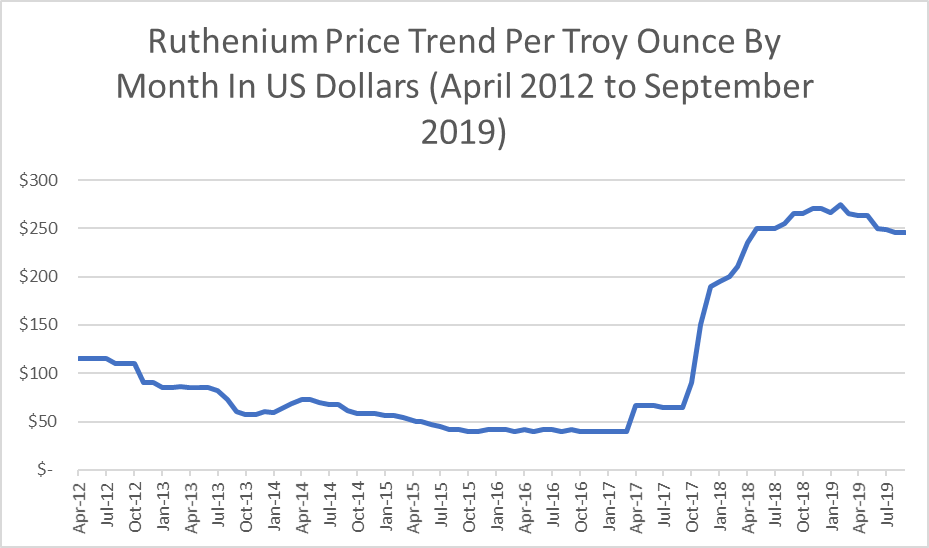

Change in Ruthenium Feedstock Pricing

Ruthenium prices remained firm at $246 per Toz., well above the norm. The price of ruthenium has increased by 380 percent between August 2017 (when the price per Toz. was $51) and September 2019 (when the price was $246 per Toz.).

As the chart below illustrates, the ruthenium price remains unusually high and is impacting production costs for thick film chip resistors. The ruthenium price increase is so significant that it has been impacting resistor production costs for two years.

Due to the rarity of this metal, the small amount consumed (90 percent of ruthenium is consumed in resistors) and the concentrated supply (ruthenium is a by-product of platinum and rhodium mining), prices are historically volatile. In 2019, the ruthenium price has remained high even though resistor markets have waned, due to the fact that the majority of the metal is mined in South Africa and is also therefore influenced by labor unrest impacting the South African Platinum belt in 2019.

Figure 4: Ruthenium Price Trend Per Ton; Source: Paumanok Monthly Report On Passive Components – September 2019 Edition

Summary of Changes

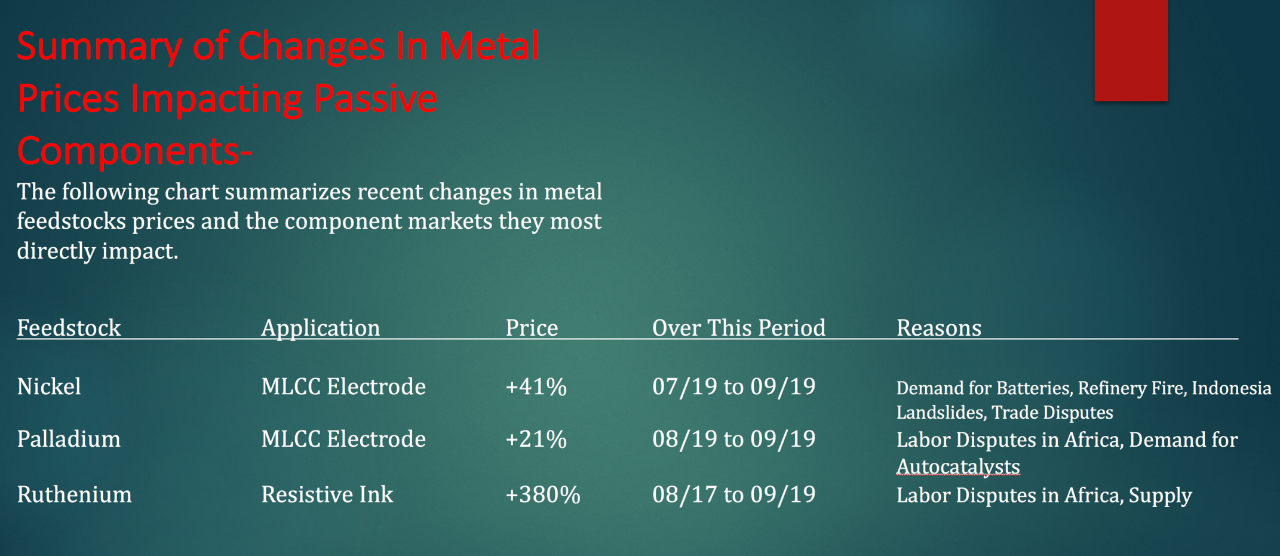

The following chart summarizes recent changes in metal feedstock prices and the component markets they most directly impact:

Figure 5 – Summary of Metals Price Changes Impacting Passive Components in 2019; Source: Dennis M. Zogbi for this article

Metal costs, as a percentage of total cost of goods sold, can be as much as 25 percent in large runners like MLCCs and thick film chip resistors. Therefore, price increases of 21 percent for palladium, 41 percent for nickel and 380 percent for ruthenium are impacting the overall cost of production for specific large-volume components.

Expect the costs to produce MLCCs and thick film chip resistors to be on the rise in accordance with increases in feedstock prices, most closely impacted by supply chain disruptions in South Africa and Indonesia; trade tensions between the U.S. and China; and both speculation and real demand for these key metals.