This article written by Dennis M. Zogbi, Paumanok Inc., published by TTI MarketEYE elaborates on impact of copper price increase to MLCC ceramic capacitors and its supply chain.

Copper is a metal that is consumed primarily in the electrical industry for multi-conductor cable, but which also is used in powder and paste form in the electronic component industry in a very limited but important capacity – as the termination material for the hundreds of billions of multilayered ceramic chip capacitors produced worldwide each year.

Its unique metallic structure of copper makes it an excellent conductor and lends itself to uses in conjunction with base metal electrodes to form the conductive links between capacitance and circuit functions of the printed circuit board.

Copper Terminations for MLCCs

Termination materials for base metal electrode multilayered ceramic chip capacitors (BME MLCCs) are generally produced from copper and matched with electrodes of nickel. They require additional plating materials to ensure solderability.

Copper is purchased as powder and mixed into a paste for dipping of the end-caps of the MLCC, usually using an advanced bulk dipping process that terminates baskets full of ultra-small case size electronic components. Terminations require a large volume of material per MLCC (about 17 percent by weight). Termination materials therefore account for a significant amount of the “variable metals costs” to produce MLCCs and are subject to raw material costs outside the MLCC ecosystem.

As was the case with electrode materials, there are different levels of demand in the supply chain with many of the large companies buying powder from the merchant market and mixing their own termination inks while other ceramic capacitor manufacturers (usually the smaller ones) are buying ready-made copper termination inks that are matched with both the electrode and the ceramic dielectric material.

The Global Copper Ecosystem in 2022

The copper is mined as ore, processed into nano-technology powder or flake and then processed into paste for MLCC terminations. Copper is an important raw material consumed in the production of high capacitance MLCCs in all MLCC chemistries – X5R, Y5V and X7R as a termination material. Copper terminations are almost always used with nickel electrodes. We monitor the status of copper as part of the 8532 2.4 Industrial Blockchain Project at Paumanok IMR.

Copper must be the base metal of choice to pair with nickel electrodes. The copper termination markets are lucrative but not as demanding as the nickel electrode markets. The best part of the copper market is the steady supply of material and the long-term stability of price.

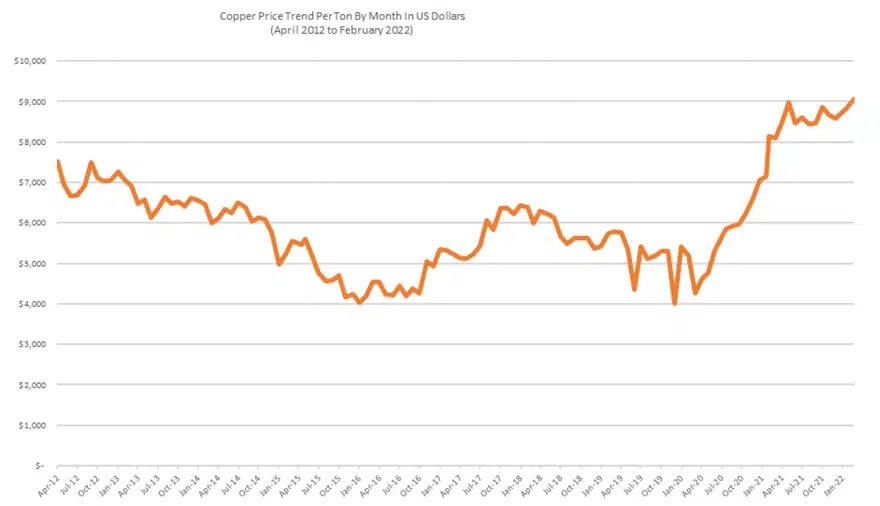

Still however, the price of copper increased steadily in 2021, skyrocketed in the December 2021 quarter and kept rising as Eastern European tensions erupted into armed conflict causing copper pricing to jump up again through the March 2022 quarter.

Copper Ore Market and Trends: 2022-2027

The copper ore market increased by 5.6 percent in global shipment volumes to 21.2 million metric tons worth $176 billion USD worldwide for calendar year 2021. The price per ton for copper rose sharply from $6,174 per ton in 2020 to $8,313 per ton in 2021 and can be considered a key building block for inflation. Revenues for major copper mining operators such as BHP, Freeport and Glencore showed dramatic increases in revenues, much of which was profit-taking, directly causing worldwide inflation as the ripple effect of higher prices for keystone materials had on the worldwide economy.

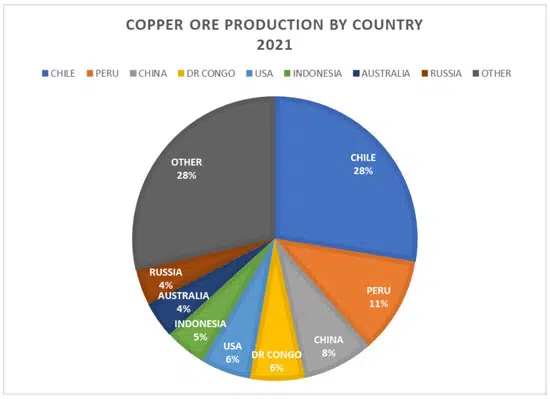

Copper Ore Output by Mine Location: 2021

The following chart illustrates the global mine production for copper by world location and mine owner. The reader will note that resources in Chile, Peru, China, DR Congo, the U.S. and Indonesia dominate global supply but Chile and Peru control a combined 39 percent of worldwide mine output. The world’s top mining companies in base metals control the copper assets and resources in both countries.

Copper Ore Output by Mine Location and Mine Owner – 2021

The following chart illustrates the copper ore supply to the global market for 2021 by mine owner and mine location. The reader will note that certain vendors stand out as controlling multiple mines.

Industry 4.0 requires corporate visibility from product to mine. Copper is a key conductor material, and as we transition to electrical solutions, demand for this low cost, highly conductive metal will grow substantially. These countries and the miners in them will become more important in the future.

Top Mining Companies in Copper: 2021-2022

The following chart illustrates the mine production value for copper for each major mining operation for copper for 2021. The reader will note that certain mining operations get more dollars per ton for their copper than others and this is based upon their compliance with ethics, sustainability and governance. This trend will also become more prevalent in the supply chain as green bond investing is tied to ESG compliance to encourage swift, revolutionary change.

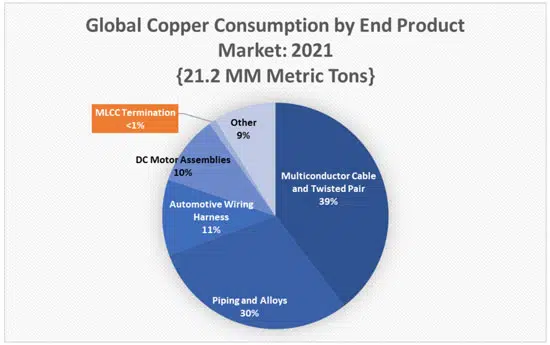

Copper Consumption in 2021

The following chart illustrates global consumption volume for copper based upon detailed analysis of the supply chain for copper into the electrical supply chain for 30 years. Copper is an excellent conductor, but is also extremely ductile, and therefore its use as a conductor for power cable is enormous.

All power cable is copper drawn, and it represents the largest segment, but twisted pair for communications, although diminished due to handsets, still accounts for copper consumption in large quantities. Copper is also used for its sanitary element; and therefore, is part of surface alloys, jewelry and piping for plumbing. Automotive wiring harnesses for ICE automobiles are also a significant consumer as are all DC motor assemblies that employ copper windings for basic continual motor function.

MLCC terminations, registering in the hundreds of billions of pieces, still only represent less than 1 percent of the 21.2 million metric tons of copper consumed in 2021.

Copper Mining Outlook: 2022-2027

The outlook is for copper to grow at 5.6 percent per year over the next five years—growing from 21.1 MM metric tons in 2021 to 27.7 MM metric tons by 2027. This is to support expected increases in worldwide demand from EVx cars and power infrastructure.

Copper Terminations for MLCCs: An Introduction

Copper powders and flakes, when combined with glass frit and organic binder materials, produce a termination paste that is used with multilayered ceramic chip capacitors produced with base metal internal electrodes (BME MLCCs). The dramatic trend in the MLCC industry, which has grown rapidly in Japan since 1993 and is now just taking a firm foothold in North America, Europe and the Asian countries outside of Japan is the transference of internal electrodes and external terminations employing precious metals (palladium and silver) to less expensive base metals of nickel (internal electrode) and copper (external termination).

Current Market Status in MLCCs

Capacity utilization rates are extraordinarily high, and lead times continue to get longer. Capacity expansion in the global MLCC industry will largely be base metal in nature (requiring copper powder in large quantities). Production of MLCCs is largely in Asia, with the largest copper contracts in Japan and Korea and minor contracts in China.

Historical Market Development

The high price of palladium, which went beyond $1,000 per troy ounce in January of 2001 created the historical volatility of palladium price that caused MLCC manufacturers to continue to expand their MLCC production capacity into BME MLCC. Thus, copper termination powers are guaranteed good growth prospects for the foreseeable future. Today the price of palladium is over $2,000 per troy ounce, so they made the right choice.

MLCC Product Markets

Ceramic, 0201 MLCCs (Chips (0201 BaTI02)

- This “multilayered ceramic chip capacitor” MLCC has the physical dimension of 0.02 x 0.01 inches and is extremely small, no bigger than a grain of salt. This product is manufactured from ceramic dielectric materials in a stacked dielectric and electrode configuration and terminated with solderable metal end-caps. This product enables portable technology and is largely consumed in wireless handsets and enables module circuitry. It is used for bypass, decoupling and filtering and is a ubiquitous product line produced worldwide in the hundreds of billions of pieces.

Ceramic, 0402 MLCCs (Chips (0402 BaTI02)

- This “multilayered ceramic chip capacitor” MLCC has the physical dimension of 0.04 x 0.03 inches and is extremely small. This product is manufactured from ceramic dielectric materials in a stacked dielectric and electrode configuration and terminated with solderable metal endcaps. This product enables portable technology and is largely consumed in wireless handsets and enables module circuitry. It is used for bypass, decoupling and filtering and is a ubiquitous product line produced worldwide in the hundreds of billions of pieces. It is the largest mass produced part in the world.

Ceramic, 0603 MLCCs (Chips (0603 BaTI02)

- This “multilayered ceramic chip capacitor” MLCC has the physical dimension of 0.06 x 0.03 inches and is very small. This product is manufactured from ceramic dielectric materials in a stacked dielectric and electrode configuration and terminated with solderable metal endcaps. This product is used in many circuits but is generally too large for today’s modern handsets. It is used for bypass, decoupling and filtering and is a ubiquitous product line produced worldwide in the hundreds of billions of pieces. It would have end-markets in automotive, industrial and computer.

Ceramic, 0805 MLCCs (Chips (0805 BaTI02)

- This “multilayered ceramic chip capacitor” MLCC has the physical dimension of 0.08 x 0.05 inches and is very small. This product is manufactured from ceramic dielectric materials in a stacked dielectric and electrode configuration and terminated with solderable metal endcaps. It is used for bypass, decoupling and filtering and is a ubiquitous product line, produced worldwide in the hundreds of billions of pieces. It would have end-markets in automotive, industrial and computer.

Ceramic, 1206 MLCCs (Chips (1206 BaTI02)

- This “multilayered ceramic chip capacitor” MLCC has the physical dimension of 0.12 x 0.06 inches and is very small. This product is manufactured from ceramic dielectric materials in a stacked dielectric and electrode configuration and terminated with solderable metal endcaps. It is used for bypass, decoupling and filtering and is a ubiquitous product line produced worldwide in the tens of billions of pieces. It would have end-markets in automotive and industrial.

Ceramic, 1210-1225 MLCCs (Chips (1210-1225 BaTI02)

- This “multilayered ceramic chip capacitor” range of MLCC has the physical dimension of 0.12 x 0.10 to 0.12 to 1225 inches. This product range is manufactured from ceramic dielectric materials in a stacked dielectric and electrode configuration and terminated with solderable metal endcaps. It is used for bypass, decoupling and filtering and is a smaller product line used for value added and application specific end-markets produced worldwide in the hundreds of millions of pieces. It would have end-markets in defense and specialty markets.

Deep-Dive Analysis: Variable and Fixed Production Costs of MLCCs

For 2021 the cost to produce MLCCs was about 75 percent of revenues industry wide. MLCCs have the lowest cost structure for all capacitors and subsequently the highest operating and net profit margins. Therefore, the operating profit on ceramic capacitors averaged about 25 percent worldwide. Ceramic capacitors are reliant upon ceramic dielectric materials for their construction, which is basically variations on barium titanate, whose building blocks are barium compounds and titanium dioxide raw materials, which are stacked between varying layers of nickel electrode materials and terminated with copper materials (the subject of this MarketEYE report).

Breakdown of Cost of Goods Sold For MLCCs: 2021

Raw materials account for the largest percentage of the cost of goods sold. In comparison to other dielectrics, ceramic capacitors have lower raw materials costs and higher profit margins due to the high percentage of variable cost structure.

The cost structure associated with production of capacitors is very rigid and must be somewhat scientific and repeatable to ensure the maximum of profits. It can be said that the number of world class competitors is also great, and this has contributed to the traditional erosion in price on a year-over-year basis.

Raw Material Costs Associated With MLCCs: 2021

Raw materials consumed in the production of ceramic capacitors, which include ceramic dielectric materials, electrode materials, termination materials, assembly materials and packaging materials, accounted for the largest percentage of CGS in 2021. This represents billions of dollars in worldwide market opportunity. Raw materials will always be the highest cost factor in the production of capacitors because of the relationship between available surface area of the dielectric materials and subsequent capacitance in the finished component. The raw materials consumed in the production of ceramic capacitors include ceramic composition materials (which implies barium carbonate, titanium dioxide and the ceramic formulations that produce X5R, X7R, Y5V and NPO dielectrics, among others), nickel electrode powders and pastes and copper termination materials.

Outlook: 2022 to 2027

We forecast higher costs to produce BME MLCCs over the next five years as industries compete for the copper metal. Consumption forecasts for copper in EVx sub-assemblies and chargers are substantial as is the forecasted increase in copper cable consumption to support infrastructure. Higher raw material costs for copper powders and pastes are expected as a result, impacting the variable cost to produce MLCCs between 2022 and 2027.