source: Nikkei Asia news

Proliferating features, demand from Chinese makers creating boom for components. Murata Manufacturing Chairman and President Tsuneo Murata says smartphones are still developing, and there is large room for growth in smartphone parts.

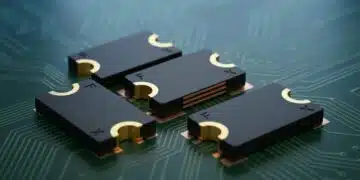

TOKYO — The global electronics parts market is thriving, driven by brisk growth in demand for smartphones. The Nikkei interviewed Tsuneo Murata, chairman and president of Murata Manufacturing, a global leading supplier of capacitors and electronic filters, about the prospects for the market.

Q: How is the capacity utilization situation for Murata’s plants?

A: Our plants typically operate 24 hours a day, with workers working in three shifts. All are operating at nearly full capacity. One issue is boosting production to meet demand for various components amid tightening supply. We are working to expand production lines, but at the rate it is progressing, some plants will have to shorten their summer holidays and increase operating days.

Q: What is driving the brisk performance?

A: If you look at just unit sales figures for smartphones, you may think the smartphone market is nearing a plateau. This year’s global demand is estimated at 1.59 billion units, up just 2% from last year. But if you look at the details, smartphones are undergoing a dramatic increase in quality, and we see a dramatic increase in the number of electronic parts used in a single device. Take capacitors, for example. Whereas ordinary phones use 100-200 of them, high-end smartphones have 800.

Another big factor is the increasing number of customers. Global brands like Apple and Samsung Electronics remain our important customers, but we have also expanded business with Chinese local manufacturers. In addition to serving the domestic market, they have started to export to Southeast Asia, and some are exporting to Japan. They have also increased the use of more sophisticated parts.

Sales are also growing for communications modules, such as ones that enable faster data downloads and that enable devices to use different frequency bands in different countries.

All in all, smartphones are still developing, and we see large room for growth in smartphone parts.

Q: What are other areas where you see opportunities?

A: Automobiles are increasingly being equipped with electronic devices, so they have become an important segment. Automakers are competing to introduce functions using onboard sensors, such as automatic braking and parking assistance, and this has increased demand for electronic parts. Our auto-related business has grown 10% annually, but the rate of growth is accelerating, so this segment is finally really taking off.

Q: The domestic labor shortage is a serious issue for Murata. Is it possible for the company to expand supply to high enough levels to meet the growing demand?

A: We have a concentration of plants in the Hokuriku region (north of Tokyo on the Japan Sea coast), which is suffering a serious labor shortage compared to other regions of Japan, and we have the impression that it is difficult to secure staff there. We are also seeing some of the workers we have taken the trouble to train move on to our rivals. But our strength lies in the strength of our development and manufacturing function in the domestic operations, so we are not planning to shift our production overseas just because we lack sufficient workers at home. We are aiming to overcome the staff shortage through rationalization — spending to introduce more robots and electric vehicles for automatically moving parts between different manufacturing processes.

Q: Murata’s product portfolio includes many parts that have high global market share, and the company enjoys a high operating margin of nearly 20%. That is in contrast to the Japanese semiconductor makers that once held strong global positions but fell from grace. What do you think created this difference?

A: Generally speaking, the components business is highly sensitive to supply-demand balance, so it is susceptible to ups and downs. However, if you stop investing just because your earnings have deteriorated, you will not be able to regain competitiveness. Even if you are experiencing a difficult phase, I think it is important to have a long-term perspective and continue to make investments for product development and plant investment.

Interviewed by Nikkei senior staff writer Kunio Saijo