Dennis Zogbi is mapping out the complex passive components electrodes and terminations ecosystem for precious and BME base metals. The article was publishes on TTI Market Eye.

This article focuses on four metals that are consumed as electrodes and terminations in passive electronic components and includes two precious metals and two base metals.

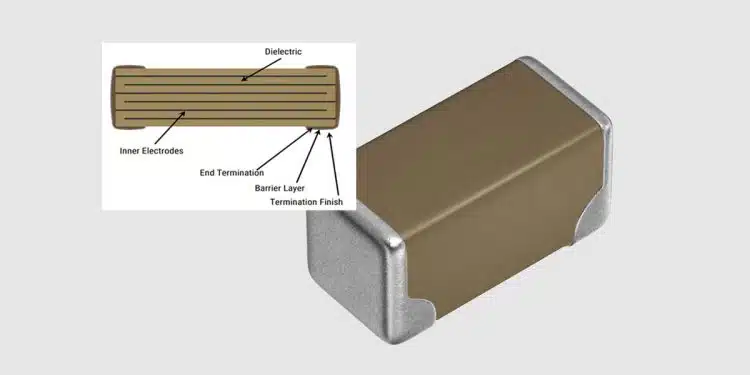

Electrodes and terminations are fundamental to the construction of passive electronic components, with emphasis upon stacked ceramic solutions for capacitance, resistance, inductance and sensing in electronic circuits.

THE STACKING METHOD FOR MASS PRODUCED ELECTRONIC COMPONENTS

To achieve higher operating functionality, electronic components adopted a stacking method for ceramic dielectric materials almost 70 years ago. This stacking capability has evolved over time to handle increasingly thinner layers, which in turn has fostered in an age of increased volumetric efficiency in portable electronics.

The specific product lines that benefited from increased functionality through stacking include multilayered ceramic chip capacitors (MLCC), multilayered chip varistors, ceramic chip coil inductors, PTC thermistors, NTC thermistors and various types of EMC, EMI and RFI filters. A cornerstone material supply chain for multilayered chip components is the precious and base metals used for electrodes and terminations and matched with the ceramic stacks. This article sheds light on the metals ecosystems that feed into mass produced electronic components.

The Stacking Method for electronic components creates opportunities for base and precious metals in the form of metal electrodes and metal terminations. These metals represent a significant cost for component manufacturers and involves ecosystems and expertise outside of the direct control of the component manufacturers.

TYPES OF ELECTRODES FOR STACKED ELECTRONIC COMPONENTS

In the ceramic capacitor supply chain, electrodes are required to connect each layer of capacitance to the circuit through a conductive pathway. An electrode would be required in any multilayered ceramic stack process and includes MLCC, chip varistor, chip thermistor and ceramic filter.

Electrodes are manufactured from either nickel or a mixture of palladium and silver.

Precious Metal Electrodes

In low layer count MLCC, the market still uses high-cost palladium and silver powders in different loadings depending upon sintering temperatures. All specialty ceramic components for mission critical applications in high voltage, high frequency and high temperature circuits still employ palladium bearing electrodes.

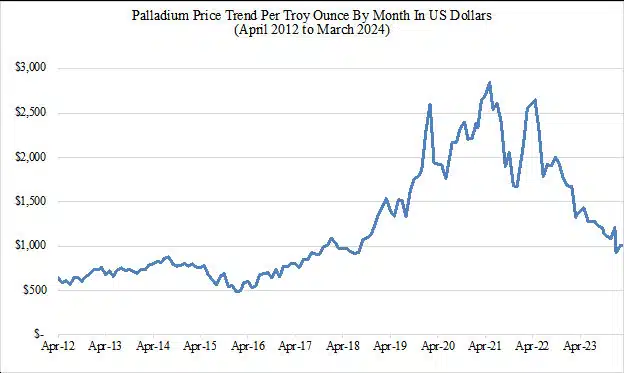

Palladium Electrodes: Palladium is a platinum group metal that is mined in South Africa and Russia, among other locations, and is consumed primarily for auto-catalysts. It is also used for jewelry and as the primary electrode material in precious-metal-based MLCC, which are in turn used in high reliability, high temperature and high voltage product markets globally. Historically, palladium has proven a difficult raw material partner for the MLCC supply chain because of its price volatility, which is compounded by it being a significant commodity metal subject to outside speculation on price.

Silver Electrodes: MLCC and other stacked ceramic components that employ precious metal electrodes bearing palladium, will cut the palladium with silver to lower costs. A low-fire sintering operation for ceramic capacitors can employ low-palladium loading while a high-fire sintering operation employs a high palladium loading content but is also balanced out with silver content. Thus, silver is a very important precious metal required for mass-produced electronic components.

Silver is consumed as a termination material for many electronic components but primarily for MLCC that employ precious metal electrodes. MLCC with precious metal electrodes and silver terminations are in turn consumed in high voltage, high temperature and high reliability MLCC for similar end-use market segments.

Exotic Precious Metal Electrodes: Recent trends in precious metal electrodes include the matching of relaxer ceramic technology to produce zero-palladium electrodes for ceramic stacking, a 100 percent silver electrode. Additionally, we have advised on exotic electrodes materials including platinum and gold.

Base Metal Electrodes

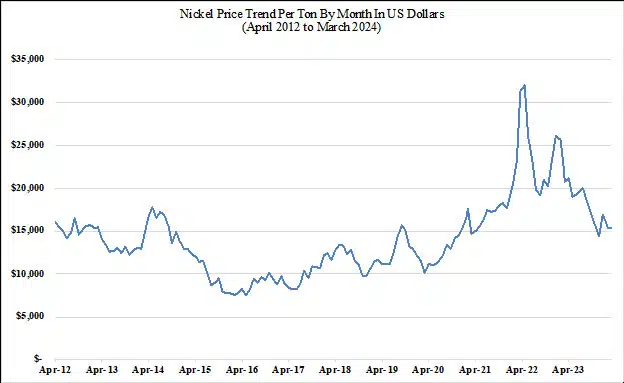

The base metals employed in mass produced and high-layer-count, ceramic, stacked components is nickel and copper. 100 percent nickel electrodes are employed in most of the MLCC produced in the world today, although there are also some specialty MLCC lines that employ copper electrodes because of the non-magnetic nature of the copper.

Nickel Electrodes: Nickel is the primary electrode material consumed in high capacitance MLCC. Nickel supply is, in turn, important for the production of X5R, Y5V and X7R MLCC, which are the capacitors of choice for the operation of smartphones, tablets and TV sets. The price of this metal, which is key for energy storage solutions, is expected to continue to rise in coming years. Breakthroughs in nickel electrode nanotechnology are among the most exciting tracked by us as we offer a glimpse into the future of high capacitance and high voltage MLCC yoked together.

Copper Electrodes: Copper is used in some MLCC electrode systems because, unlike its counterpart nickel, it is non-magnetic. The price of this metal, which is key for energy storage solutions, is expected to continue to rise in the coming years.

Electrode Matching Systems: Electrodes must be expertly and aptly matched with corresponding ceramic materials and termination metals.

Ceramic Matching Systems: In some instances, the ceramic dielectric material will also be doped with precious metal materials to aid in matching.

Termination Matching Systems: Precious metal electrodes must be matched accordingly with precious metal terminations, and base metal electrodes must be matched with base metal terminations.

TYPES OF TERMINATIONS FOR STACKED CERAMIC ELECTRONIC COMPONENTS

Termination materials are generally produced from copper or silver and require additional plating materials such as nickel and tin to ensure solderability. Terminations require a large volume of material per MLCC (about 17 percent by weight). As was the case with electrode materials, there are different levels of demand in the supply chain, with many of the large companies buying powder from the merchant market and mixing their own termination inks while other ceramic capacitor manufacturers (usually the smaller ones) buying ready-made termination inks.

Precious Metal Terminations

Generally speaking, MLCC with palladium and silver electrodes will require terminations of silver (to keep the precious metal theme consistent), and MLCC with base metal electrodes will require copper termination materials.

Silver Terminations

Silver is usually purchased in the form of flake to ensure proper termination and mixed into an ink or paste for application on the component end-cap through a dipping process.

Base Metal Terminations

Generally speaking, MLCC with palladium and silver electrodes will require terminations of silver (to keep the precious metal theme consistent), and MLCC with base metal electrodes will require copper termination materials.

Copper Terminations

Copper is purchased as powder and mixed into an ink or paste for dipping of the ceramic chip component end-caps.

Termination Matching Systems

Generally speaking, MLCC with silver terminations are matched with palladium and silver electrodes (to keep the precious metal theme consistent), and MLCC with base metal electrodes will require copper termination materials.

METALS AS A VARIABLE COST TO PRODUCE STACKED CERAMIC ELECTRONIC COMPONENTS

Raw materials impact the overall costs to produce passive electronic components, and electrode materials and termination materials represent among the largest “variable costs” associated with the production of electronic components. Any fluctuation in price or availability for these key feedstocks can have a negative impact on profit margins for electronic component producers, but seldom does a component manufacturer or their customers in OEM and EMS output have long term visibility on the various sub-levels of the supply chain.

Cost savings in electrode materials have been a key factor in ceramic capacitor production over the past 35 years. The movement away from palladium and silver to nickel was a significant cost savings initiative because any additional process steps associated with nickel electrodes in MLCC were never enough to outweigh the cost savings by moving away from precious metals to base metals.

Passive Component Raw Material Index Update

Passive electronic components are raw material intensive. Raw materials consumed in the production of mass-produced, surface mount passive components usually come in the form of engineered powders and pastes. These powders and pastes make up the largest “variable cost” associated with the production of capacitors and resistors. This is why we have tracked the price and availability of specific ceramics and metals consumed as dielectrics and resistive elements for the past 35 years.

HOW MATERIALS IMPACT PASSIVE ELECTRONIC COMPONENT COSTS TO PRODUCE

Raw materials are the most expensive “variable cost” associated with the production of passive components. Any fluctuation in price or availability for these key feedstocks can have a negative impact on profit margins.

Palladium Costs, Trends and Directions

Palladium is a platinum group metal that is mined in Russia and South Africa, among other locations, and is consumed as the primary metal of choice for the reduction of emissions in the internal combustion engine through catalytic conversion. Palladium is also used as the primary electrode material in precious metal based MLCC, which are in turn used in high reliability, high temperature and high voltage product markets globally.

Such high feedstock pricing impacts costs to produce for many small MLCC manufacturers, and this is the primary motivating factor behind the movement to alternative electrodes and alternative MLCC designs in many end-markets where it has not been used before such as fossil fuel engine electronics, defense, space and oil and gas tools and pumps.

Nickel: The Prime Alternative to Precious Metals in Passive Components

Nickel is the primary electrode material consumed in base metal electrode multilayered ceramic chip capacitors (BME MLCC). The fluctuations in nickel price are primarily the result of competition for the metal with the steel industry, where it is used as a metal hardener. Nickel supply is, in turn, important for the production of X5R, X6S, Y5V and X7R MLCC, which are the capacitors of choice for the operation of smartphones, computers and home theatre equipment. The overall price trend for nickel between April 2012 and March 2024 has been remarkably and comparably stable. (See Figure 1.3).

The historical stability of price for nickel is a great selling point for its use in MLCC electrodes to displace palladium/silver (Pd/Ag) designs. The reader should note that it is the rapid shift of materials pricing within existing contracts that has caused the most negative impact on profitability over time. The most successful passive component manufacturers have the tendency to purchase raw materials when the prices are lowest and consume them when the materials price is at its highest. This has the affect of “manufacturing profitability” by converting the added value of the materials when they offer the greatest opportunity for profit from the vendor.

Copper: A Base Termination Metal

Copper engineered powders are consumed in the production of MLCC as well, but as the termination material consumed in conjunction with the nickel type electrode (a base metal must be paired with another base metal in the MLCC design). Therefore, copper and nickel are an important type of base metal duo. Copper is used in some MLCC electrode systems because, unlike its counterpart nickel, it is non-magnetic. The overall price trend for copper between April 2012 and April 2020 was historically stable; however, from May 2020 to March 2024 the price of copper has skyrocketed to historical highs because of its use as a conductor, a next-generation enabling metal for infrastructure and electric drives.

Its price fluctuation in 2021and 2022 should be of keen interest to researchers of high capacitance MLCC operations as competition for copper between industries will drive up future MLCC termination costs. Due to the fact that base metal type MLCC are produced in the trillions of pieces and the termination pastes have high volumes of metal per MLCC body, the volume of copper consumption in MLCC is significant and growing at a consecutive rate over time in concert with MLCC demand.

Silver: A Precious Termination Metal

Silver engineered powders are consumed in the production of MLCC as well, but as the termination material consumed in conjunction with the palladium type electrode (a precious metal must be paired with another precious metal in the MLCC design).

SUMMARY AND CONCLUSIONS

Electrodes and terminations are fundamental to the construction of passive electronic components, with emphasis upon stacked ceramic solutions for capacitance, resistance, inductance and sensing in electronic circuits. Older legacy materials for electrodes and terminations include palladium and silver respectively. These electrodes and terminations are still consumed in low layer count ceramic components or in specialty chip thermistors and varistors, inductors and resistors.

The newer electrode and termination materials are of base metal and include nickel and copper. The trend was to displace palladium in electronic components with base metals in instances where it was cost-effective to do so. This paper illustrates how pricing for these metals has exhibited volatility in recent years, with precious metals rising and coming back down again, but base metals, especially copper and nickel, showing elevated price levels as many industries compete for these two metals in a quest for lower global carbon emissions.