Source: FBDi news

German component distribution (according to the FBDi e.V.) is experiencing solid growth. Orders remain significantly ahead of sales growth. Passives and power supplies are driving the market.

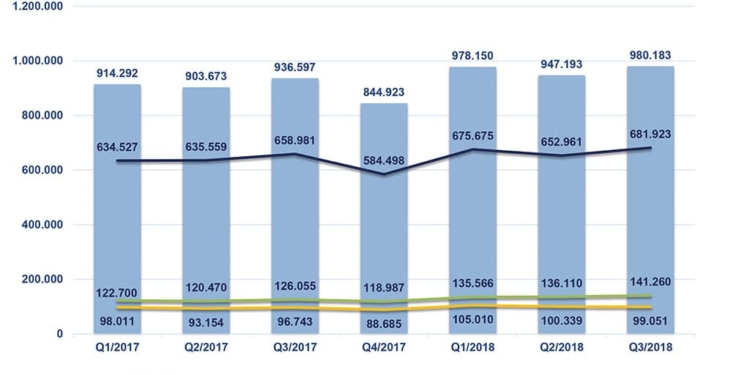

Berlin, 22. November 2018 – The German component distribution market reported solid but sluggish growth for the third quarter of 2018. According to the distribution companies registered with the Fachverband Bauelemente Distribution (FBDi e.V.), sales during the period July to September 2018 grew by 4.7% to reach 980 million euros.

The pattern of orders continued the trend of previous quarters, with orders growing significantly faster than sales – by 9.5% to 1.08 billion euros. The book-to-bill rate (the ratio of incoming orders to sales) rose to 1.1.

Broken down by technology, passive components recorded the highest increase of 12.1% (to 141 million euros), followed by semiconductors (up 3.5% to 682 million euros) and electromechanics (up 2.4% to 99 million euros). Power supplies climbed 8% to reach 27 million euros and displays 1.9% to reach 21 million euros. With regard to the distribution of sales, the parameters remain unchanged: semiconductors accounted for 69.6%, passives 14.4%, electromechanics 10.1%, power supplies 2.8%, and the rest 3.2%.

Consequently, the sales reported by the FBDi during the first nine months reveal an optimistic picture with an increase of 5.5% taking the overall figure to 2.9 billion euros and a healthy order backlog across all areas, but particularly for passive components – where order growth reached 21.6%.

FBDi Chairman of the Board of Directors Georg Steinberger remarked:

“For over two years, we have seen an increase in orders that is only partially reflected in sales. The year 2018 in particular has broken numerous order records, but there is still a risk that cancellations or postponements will significantly curtail the order backlog. The poor delivery situation and long delivery times are dampening any expectations of further significant progress in the

fourth quarter, which means that 2018 will draw to a close with sales growth of 5 to 6% and many unfulfilled expectations on the customer side.”

Turning to the general future outlook, Steinberger noted:

“Despite all the macroeconomic obstacles, high-tech remains a hot topic. Considering how little specific action is being taken by European governments in the areas of digitalisation, smart infrastructure and energy transition and how its urgency will grow in the next few years, I have no major concerns regarding the growth prospects for components. There is also the fact that industry is currently undergoing a new revolution: Robotics, machine learning and artificial intelligence are set to fundamentally change the way we live and work – all of which calls for the right

hardware.”