source: TTIMarketEye article

06.06.2016 // Dennis M. Zogbi // Passives

A look at the global market for capacitors, resistors, and inductors consumed in the most demanding of environments…

I’m sitting across from a team of engineers in Huntsville (Rocket City), Alabama and they have a problem. Apparently an external power supply on the International Space Station was failing repeatedly and it was because the output filtering capacitor could not withstand the unique nature of the harsh environment of outer space. After my brief diatribe about maximum temperature capabilities of passive components; the engineer politely describes the nature of the problem, “It’s not how hot it gets, it’s the rapid transition from ultra-low temperature to ultra-high temperature which the components cannot withstand.”

So this customer of passive components, has just become a manufacturer as well, and have invented a completely new component that would have done the job without requiring a spacewalk. After a brief discussion over the expense associated with having to replace external equipment on the ISS by “exiting the vehicle”- not to mention the enormous “safety issues” involved in a “sojourn” outside the vehicle. I explain to them that I consulted on a similar project where a capacitor had failed in an undersea repeater cable and had to be replaced. In that instance the cable had to be retrieved from the bottom of the ocean and the specific repeater repaired–very expensive, very risky business, but of course, it’s not an exact one-for-one comparison to the unique nature of the problems that face electronics in space.

I’m immediately impressed with their new capacitor prototype because it’s shiny. It’s covered in gold and platinum, “We’re not really designing this capacitor with costs in mind,” he says as I hold it up to the light. This I can see. “We can put these puppies in parallel series and achieve high-voltage and high-capacitance but what is most important is that they will survive the vibration frequencies of launch AND the rapid changes in temperature experienced at various stages of orbit they are ‘mission critical’ in its most focused sense.”

Then the conversation switches to a more generalized problem are space-based component requirements being met by the merchant market? Is technology moving at a uniform pace among disciplines? Or is more captive innovation required for the industry to grow at a rate that is equally as impressive as its 176% growth rate since 2005.

Passive Components For Space

I consider space-based passive components as a minor subset of the $1.6 billion global specialty passive components market. Back in 2005 when the first part of this study was accomplished, I considered space-based passive components as a sub-set of the defense end-use market segment. However, today, with the rapid commercialization of space upon us, space-based passive components are appearing as a minor emerging market of its own, with explosive growth in the commercial sector and continued rapid growth in the government sector. The primary reason is the smartphone which saw dramatic growth in worldwide unit sales volume between 2007 and 2015, and which required support satellites for time and location features which are standard features on all phones. The next phase, which is upon us, is the introduction of CubeSats (a brandname we love here at Paumanok), which enables trade companies, colleges, universities, and sports teams to design, build and launch their own satellites. This is a market opportunity for vendors of specialty passive components. Many of the mom and pop passive component owners who Ive had the great honor to know and dine with, or fish with, or shoot skeet with got into the high-tech economy for the same reason I did, because of the Apollo missions. Embracing the commercilization of space seems like a natural progression.

An opportunity that requires in-house technical expertise in the construction of high-voltage, high-frequency, high-temperature and extremely robust passive components. Here is a list of criteria required for component vendors to sell into space-based supply chains:

- High Voltage Passive Components

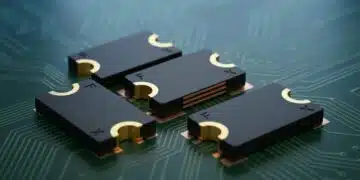

Passive components for space applications are usually rated in excess of 500 Vdc and in many instances to 5 kilovolt in both radial leaded and surface mount chip designs. Plastic film, ceramic, tantalum, carbon and diamond capacitors; tin-oxide resistors and specialty wirewound power discrete inductors are now consumed in space applications for high-voltage circuits. Packaging can be intense, with molded casing and gull wings for heat dissipation. For space applications, regardless of the intended circuit; additional unique criteria are required of the part-including resistance to mechanical shock from launch and the intense centrifugal potential in orbit. - High Frequency Passive Components

Space-based communications are at frequencies greater than 1 GHz which requires specialty ceramic components for data and voice transmit and receive. Not necessarily difficult to build given the right dielectric materials and electrode materials are employed, but this is a black art in many respects, especially when we are dealing with extremely high frequencies where satellites and spacecraft are required by international law to operate. Thus the technical limitation becomes one of reaching the 10 Ghz and above level and have the capacity to increase that frequency handling to DC lightwave. All high-frequency capacitors are ceramic in nature; and all resistors are either nichrome or tantalum nitride at these frequencies. Ceramic, metal, and glass would all be used as substrate materials. 100% palladium or ruthenium metallization is also required in most instances. Once again the parts would be subjected to high-vibration frequencies due to launch and the centrifugal affects of orbit, they may also be subjected to high temperatures. - High Temperature Passive Components

Space capacitors must be rated to negative 30 Kelvin to 1000 degrees C or any variation that NASA JPL can measure in terms of heat and cold variations in the vacuum of space. The ultra high temperature market which really begins at 200 degrees C historically has been the realm of du Pont Teflon® and Kapton® capacitors which really got their start in the United States Space Program; (but with the Kapton® capacitor really developed specifically because of the unique environment of space travel) is either ceramic or glass in nature, and once again in resistors, these are ceramic, metal or glass substrates with nickel, tin or tantalum based resistor elements. High-temperature inductors used for space craft are almost exclusively aircore molded wirewound coil inductors. - Radiation Hardened Passive Components

Certain types of passive components must be hardened to the intense radiation to which spacecraft might be exposed. Radiation has only a minor affect on solid ceramic and tantalum capacitors but has been known to wreak havoc on liquid electrolytes found in electrochemical capacitors. Tantalum nitride resistors are also consumed in specific applications requiring radiation hardening due to the mission critical nature of the circuitry. - Ruggedized Passive Components

Passive Components consumed in space-based systems must be robust and handle intense mechanical stress and vibration frequency required to escape Earth’s orbit. There is also the added resistance to moisture and corrosion and the inability for ignition, or no sparking or smoking, which favors ceramic capacitors, solid polymer tantalum capacitors; ceramic substrate resistors (alumina core) with tin-oxide metallization (Antimony-10); and air core molded wirewound inductors. - In the end though, packaging requirements may also involve unique casements and unusual lead styles; as well as the unique volumetric efficincy needs of spacecraft which may pave the way for future developments in assymetrical packaging.

Top Vendors of Passive Components for Space

The majority of passive component vendors who support global space initiatives are located in the United States, Israel, UK and France and include KEMET Corporation, AVX Corporation, Johanson Dielectrics, Knowles Capacitor, Vishay Intertechnology, Exellia, IRC Corporation, and Presidio; among others. There is also a general trend of new development of supply chains in China, Russia, India, Slovenia and Korea, but for the most part, the enture global space program relies on passive components from the United States, Israel, UK and France.

Global Space Program Collective Spending

Since we last reviewed the space sector some remarkable changes have been noted in the unique emerging market:

- The value of worldwide government spending on space-based electronics increased by 176% in ten years.

- The commercial market for space-based electronics, which did not exist in 2005, is now at least as large as the government market.

- The market remains about as custom as it gets, regardless of suggestions of standardization.

Government Spending on Space: A Hot Growth Business

The global government spending on space increased by 176% in value between 2005 and 2015, making it one of the fastest growing electronics segments in the world. Global government spending on space related electronics increased from $27.6 billion U.S. dollars in FY 2005 to $79.2 billion in FY 2015 (See Figure 1).

Source: Paumanok Publications, Inc. In Billions of USD. A 176% CAGR in ten years. Paumanok IMR Research Project 2005-2015

Government Spending on Space Based Electronics by World Region: 2015

The United States Government continues to dominate the global market for space-based electronics, followed by China, Russia, Europe, India, Japan, and the Rest of The World. China, Russia and India have seen explosive growth in their spending on space-based electronics (See Figure 2). What is also remarkable is the proliferation of space-based electronics production into Korea and Indonesia, and many other smaller nations in Eastern Europe and the Pacific, the proliferation of space-based technology over the past decade to countries with no prior connection to the market in 2005 is a unique aspect of the extreme specialty nature of this value-added and application specific market segment.

Outlook for Government Spending on Space Based Electronics by Region to 2025

The following chart (Figure 3) illustrates the growth by world region in spending on space-based electronics, as well as our forecasts to 2025. What is remarkable about the table is that it shows huge growth in India and China as would be expected; but also huge growth in Russia and the Rest of The World. In 2005 it was questionable whether or not the Russian Space Program would remain financially viable, but it rebounded remarkably. The other surprise was the proliferation of space spending throughout the Rest of The World, with substantial increases in government spending in Asian countries such as Indonesia.

The U.S. of course, continues to dominate space-based electronics, with only a minor adjustment in percentage dominance of the market in ten years. The United States is where the majority of vendors of space-based components reside (which also means that these same components are being sold through distribution overseas to other space programs and further sheds light on the fragile nature of the supply chain for specialty components and the equally unique parameters associated with risk assessment when compared to any other mainstream end-use market segment in the high-tech economy).

Outlook for Government Spending on Space-Based Electronics by Key Country:

We expect that government spending will increase to $154 Billion USD on space based electronics by 2025, an increase of 95% over ten years. Efforts in the commercial market will also grow accordingly.

- China – CNSA the Tiangong program aims to launch a fully operational space station similar to Mir by 2023, hence the expected increase in funding of the CNSA over the next decade.

- India – ISRO aspires to be a leader in the field of space technology and plans to establish a supply chain that will support this endeavor. ISRO plans 33 satellite launches coupled with unmanned vehicle launches to Mars.

- Italy – ASI will contribute to the European Launcher Development Program, and to the European Space Research Organization.

- Japan – JAXA has developed ambitious plans for manned and unmanned launches to explore both Mars and the Moon.

- Europe – ESA the newest Ariane rocket, Ariane-6 is set for active duty by the early 2020s.

- Russia – The Russian space program has grown on average nearly 30% over the last five years. A $50 Billion spending program was launched in 2013 and will last until 2020.

- USA – NASA continues to use its budget to further explore the outer reaches of space thorugh planetary missions. Commercial markets booming, but fed by NASA funding.

The Commercialization of Space

One interesting finding of this exercise is that between 2005 and 2015 the value of demand from the commercial sector for space-based electronics has grown substantially. From being almost non-existent in 2005 to an estimated $125 billion in global value in FY 2015.

The most visible contractors in the commercial space sector include Orbital Sciences, SpaceX, Virgin Galactic, Aerojet Rocketdyne and Boeing, each of whom have received contracts from NASA to ferry goods to and from the ISS.

- SpaceX

The company is profitable and cash-flow positive, and has over 70 launches on its manifest representing over $10 billion in contracts including commercial satellite launches and NASA missions. - Orbital Sciences Corporation:

Annual revenues of approximately $4.5 billion (2015 Pro forma) with total contract backlog of nearly $15 billion. - Aerojet Rocketdyne:

Aerojet Rocketdyne has powered more than 1,600 rocket launches since the inception of the U.S. space program, including the iconic Apollo mission that landed the first humans on the Moon. This company is a key developer of sub-assemblies for the emerging cubesat markets in the United States and abroad. - Boeing:

NASA has completed the critical design review phase for Boeing’s Space Launch System (CST-100 Starliner), including the Boeing built core rocket stage and the avionics system; and had 12 successful launches in 2015 by the United Launch Alliance joint venture. Boeing also delivered the world’s first all-electric satllites for ABS and Eutelstat in 2015. - Virgin Galactic:

The company is building rockets that will launch the small satellite revolution; the rise of cubesats and microsatellites has meant that at last, commercial satellite start-ups, universities, schools, and even crowdfunding campaigns can put their own satellites into space.

Outlook is Brighter than the White Hot Intensity of 1,000 Suns

But the real opportunity for growth lies in the unexpected. Two years after our initial research into space-based passive components, the smartphone took off. And since then one of the primary uses for the phone has been for GPS navigation using fleets of earth orbiting satellites for time and location (300 satellites were launched from earth in CY 2014, of which half were less than 22 pounds, including CubeSats, (which challenge some of the more conventional thinking about how to chose electronic components for spaceflight). GPS circuits are passive component intensive and therefore we see the economy developing whereby those satellites become more commoditized and easily replaced.

The space market has the ability to re-juvenate American, French, Israeli and UK manufacturers of specialty-based passive components, and with a 95% CAGR forecast for government spending, it’s a market we should all start paying attention to.