Taiyo Yuden Co., a Japanese maker of ceramic capacitors used in smartphones, sees increasing demand for its components next year as China pushes ahead with the fifth generation of cellular technology.

“We’re already getting orders for 5G base stations,” Chief Executive Officer Shoichi Tosaka said in an interview. “Early next year we should start seeing 5G-related orders for smartphones.”

Huawei Technologies Co. and ZTE Corp. have led the orders for capacitors used in base stations, Tosaka said. The demand is coming mostly from Chinese carriers, after the Trump administration pushed U.S. allies to exclude Chinese suppliers from their networks. Huawei may sell 100 million 5G-enabled smartphones in China alone next year, Tosaka said.

This should have been a bad year for Taiyo Yuden, as smartphone shipments have sputtered and the U.S. government blacklisted one of its biggest customers in Huawei. Instead, the company has stuck to its May forecast for record revenue and profit. Demand for its capacitors has proven resilient to geopolitical shocks largely because they’re components used in large numbers across all kinds of electronic devices — from smartphones to electric cars. Taiyo Yuden’s shares have more than doubled this year.

The first batch of 5G-enabled iPhones, whenever they come, will “open up the floodgates” on device upgrades, Wedbush Securities Inc. predicted this month. About 350 million iPhones among the Cupertino, California company’s 900 million installed user base are now in the window of an upgrade opportunity, analyst Dan Ives wrote in a note to clients.

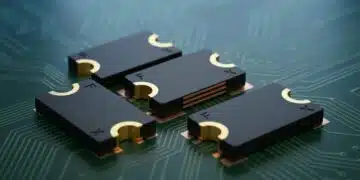

The multi-layer ceramic capacitors, or MLCCs, Taiyo Yuden makes are building blocks of the modern world. Tosaka said the demand for MLCCs is likely to keep growing for the next five years to a decade.

While many investors still see Taiyo Yuden as a mobile play, the company has succeeded over the past three years in reducing its reliance on smartphone components. The company’s orders used to spike around July and August, driven by preparations for a fall smartphone model refresh, followed by a trough. Now automotive and industrial applications account for close to 40% of Taiyo Yuden’s revenue and Tosaka is looking to raise that proportion to 50% within five years.

“The risk used to be that we sold a lot to a few customers,” Tosaka said, but now “it’s become a long-tail business.”