Source: Paumanok blog

The global capacitor industry, which for the purposes of this article includes ceramic, aluminum, tantalum , plastic film and carbon capacitors of all types and configurations, accounted for approximately $30 billion US dollars in global revenues for FY 2019 (Fiscal Year ending March) with almost 4 trillion pieces shipped, and 2 trillion consumed.

Fixed and Variable Costs To Produce Capacitors:

In the worldwide capacitor industry, fixed costs represent about 20% of the costs of goods sold, while variable costs- those that fluctuate, represent a full 80% of CGS; with vendors focusing primarily on variable costs as the area to improve profitability. Variable costs include raw material costs, labor costs, variable overhead costs and variable manufacturing costs.

Raw Materials: The Largest Single Variable Associated With Cost of Goods Sold:

Raw material costs represent the largest single cost factor in the production of capacitors regardless of dielectric, so the reader will notice that many historical methods for cost savings and increased profitability are related to management and manipulation of the costs associated with buying and processing raw materials, which include feedstocks, engineered dielectrics, cathode materials, additives, electrodes, terminations and leads.

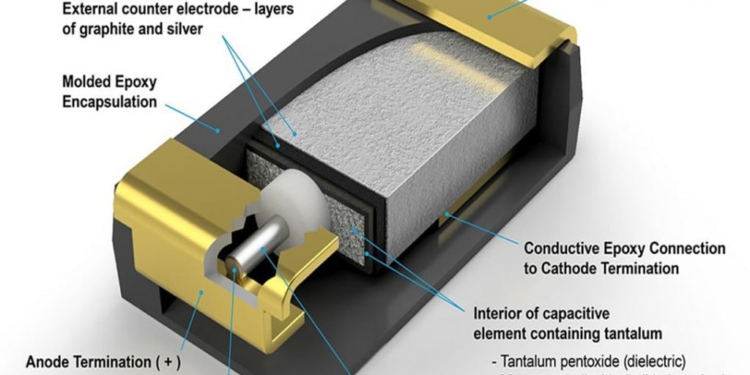

Tantalum Capacitors: Documented Methods for Increasing Profitability-

Vertical Integration of Powder and Wire Production:

It is difficult to find cost savings for the production of tantalum capacitors, because unlike the other capacitor dielectrics, it is extremely difficult to produce capacitor grade tantalum metal powder, requiring a level of expertise that is considered advanced among metallurgists.

The chemistry and processing capabilities to create tantalum pentoxide, the active ingredient in tantalum capacitor anodes- are significantly advanced and require a level of expertise that is beyond the capabilities of many governments, much less trade vendors. Therefore the number of active production facilities that can produce capacitor grade powder and wire is limited worldwide to Japan, Germany, China and the USA.

However, the vertical integration of a smaller tantalum powder producer into the largest tantalum capacitor manufacturer has shown, through presentations and reports to the financial community, that such actions can produce significant cost savings over time by eliminating the premiums associated with the merchant market.

Tantalum wire production has become more prevalent in the supply chain with more and more capacitor manufacturers bringing wire drawing capabilities in-house. This is prevalent in the tantalum supply chain because of the dwindling number of merchant vendors of tantalum wire.

Cathode Application- Gas Versus Dipping:

A gas infusion process for the application of conductive polymers into the porous structure of tantalum anodes generates a higher margin than the alternative monomer and polymer “dipping” process due to the excessive waste stream associated with impregnating anodes by chemical bath. Manufacturing facilities that employ dipping processes to impregnate anode porous structure with conductive polymers have also taken steps to limit the number of dip cycles as a method of cost savings as well.

featured image source: AVX Corporation