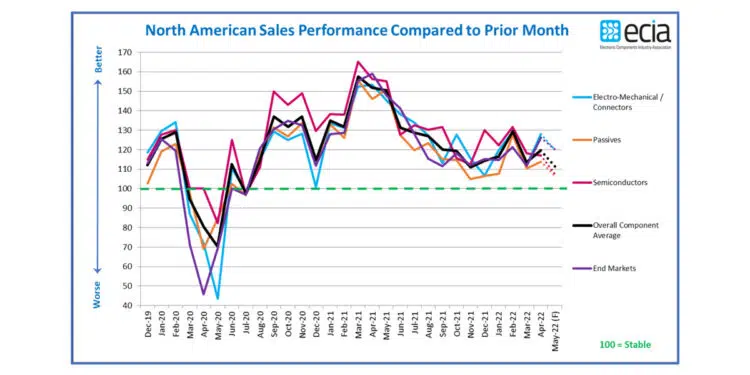

ECIA’s Electronic Component Sales Trend Survey (ECST) exceeded expectations in April 2022. However, survey participants are clearly cautious in their forecasts for May.

Overall sales sentiment for April beat expectations by over 13 points as the index measurement grew from 113.6 to 119.6. Survey participants still expect growth in May but soften their expectations in the index to 111.5, a drop of 8.1 points and the lowest level since the November 2021 results.

After a period of dramatic swings in the index it has settled into a relatively stable range between 111 and 130 for overall sentiment over the past ten months with an average of 120.0. As an added positive observation, the last time the index measured below 100 was July 2020. The market has seen nearly two years of positive momentum. Looking forward, the electronic component markets continue to face strong headwinds. Hopefully, the market will demonstrate continued resilience and relative stability in an increasingly unstable environment.

Electro-Mechanical components saw a significant swing in sentiment once again in April. Following its drop of 16.8 points in March it rebounded by 15.8 points in April. By contrast, Passive components sentiment recovered just slightly, up 3.4 points, and Semiconductors saw a slight 1.1 point dip in April following its steep March decline. Expectations for May show a similar weakening trend across all three major categories with index measurements dropping between 7.0 and 9.4.

The strongest improvement in the index in April was seen in Electro-Mechanical, Connectors and Capacitors. By contrast every semiconductor subcategory saw a decline in April with the exception of MCU/MPU. Looking forward to May, with the exception of Memory, the sentiment in every subcategory falls between 4 and 11 points.

The overall end-market index continues its general alignment with the direction of the component index for April and May. The strongest sentiment measurements for April and May are found in the Avionics/Military/Space and Industrial markets. By contrast, the index measurements for Computers and Telecom Mobile Phones continued to anguish below 100 in April. Mobile Phones have registered sentiment below 100 for 7 of the past 10 months. Consumer Electronics recovered just above 100 in April.

Looking forward to May, only Computers register sentiment below 100 as Mobile Phones improve above 100. Automotive Electronics joins Avionics/Military/Space and Industrial markets with the strongest expectations for May. While the overall index measures for components and end-markets continue their alignment in April and May, the end-market index scores have moved to a notably higher level than the component index for both months.

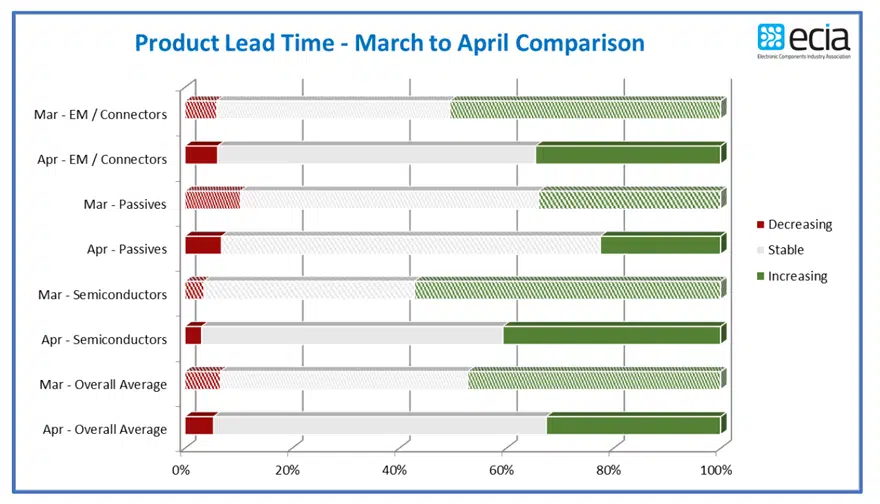

The latest ECST survey results point to possible lead time relief after actual reported lead times jumped back up again in March. The April ECST survey reports a substantial decline in expectations for increasing lead times between March and April. Passive components show the greatest optimism for less pressure on lead times while Semiconductors report the greatest pressure. However, all three component categories show major improvement in expectations. This is a return to the more hopeful lead time sentiment seen in recent surveys.