April 2024 collection of news summaries, survey results and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

Industrial/Distribution Seen Bottoming in 1Q on Early Signs of Restocking; AI Forecast Moving Higher

What’s Changed/What’s New?

1. Order rebound in Industrial/disti seen picking up pace/broadening into 1Q-end, boosting confidence demand has bottomed. Some Industrial customers seen raising CY24 forecasts, projecting 2H restocking, though still refraining from placing backlog orders.

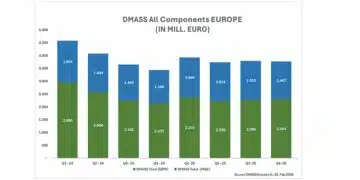

2. Aggregate global B2B seen improving to 1 in 1Q with N.A. above and Europe and China still slightly below parity.

3. CY24 AI connector outlook revised higher to 3x growth on 2H upside from hyperscale, pushing Datacom projections to +30%.

Top 4 Channel Comments:

• We see a ton of quoting activity, but customers are waiting for the last moment to place orders. They are shopping around and looking for creative ways to find deals. Most orders outside of Mil/Aero are quick turn orders in distribution, with not a lot of backlog buildup.

• Rockwell recently raised its forecast to us by 35% compared to Feb but when we asked for orders Rockwell said not yet. Rockwell has worked its excess channel inventory, but factory inventory remains at a few months. Expect a return to a normal Rockwell demand pattern by June.

• Amphenol/TE/Others are seeing an uptick in orders from distis but they are hammering for more. Arrow/Avnet have started to re-order, after cutting orders a lot previously, and specialty IP&E distis are finally feeling good about their inventory and starting to plan strategic buys.

Other Key Takeaways:

4. Overall 1Q shipments seen finishing slightly ahead with 2Q outlook still projected at up low to mid-single digits. Though visibility remains limited, increased expectations for 2H restocking in Industrial/Disti/Comm Transport are seen driving incremental optimism.

5. Auto demand seen tracking in-line with original CY24 forecasts of +MSD-HSD growth with uptick in ICE demand in the West and continued APH/TEL share gains in China, offsetting near flattening in Western EV demand.

6. Western Auto OEMs seen recently pausing next-gen architecture development, along with BEV, raising MT content growth concerns. Chinese OEMs’ recent push to add Chinese connector suppliers to distis line cards globally also flagged as a MT/LT risk.

7. Commercial Transportation orders from ag, rail, truck in N.A. seen improving in 1Q, driving optimism for a 2H rebound in shipment. Orders in Europe seen as stable on muted demand from China.

8. 1Q Mil/Aero demand seen exceeding forecasts with an increase expedite requests due to low inventory causing lead times to tick up.

9. Connector pricing seen as remaining stable with suppliers likely to push prices increases in distis on 7/1 due to higher metals costs.

Conclusion

Feedback in our work continues to show M/M improvements in March and into early April, fostering optimism in the supply chain that 1Q will mark the bottom of IP&E fundamentals as B2B ratios have broadly returned at 1x for the first time in several quarters.

The rate and magnitude of improvement varies but our research continues to point to signs of green shoots in bookings and most recently signs of Industrial/distribution accounts beginning to turn the corner in terms of reordering with suppliers.

The cyclical nature of fundamentals along with the continued upside in AI orders leaves us optimistic expecting improving M/M sales throughout 2024, barring any macroeconomic or geopolitical shocks. Furthermore, we also remain optimistic about the LT growth prospects for the industry.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research