German magazine Markt & Technik, in its Issue 17/2025, published an interview with Tomas Zednicek Ph.D. conducted in mid-March 2025 by Engelbert Hopf. The interview focused on the European passive electronic market outlook and expectations for 2025. This article published on passive-components.eu blog in May 25 provides updated comments based on the tariff-induced dynamic market development.

Dr. Tomas Zednicek, Founder and President of the European Passive Components Institute (EPCI), remains optimistic about the sector’s development in 2025, driven not only by the demand surge from the AI boom. Technically, he focuses on further miniaturization through passive components compatible with semiconductor manufacturing processes.

Update 5/25: At the current stage, the tariff-induced uncertainty in the global market presents both headwinds and tailwinds in specific applications and geolocations, making any forecasting in this turbulent environment difficult. However, the AI boom will undoubtedly expand the driving requirements for electronic components, and the inventory has ceased to serve as a strong foundation for maintaining cautious optimism.

Markt&Technik: Last year, the industry expected an upswing in the fall – which did not materialize. Where do you see the reasons for the disappointing year 2024?

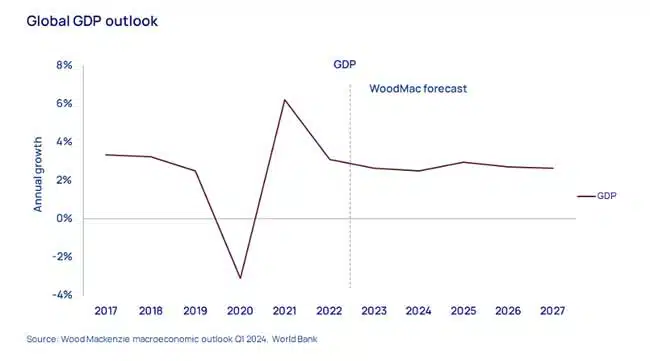

Dr. Tomas Zednicek: In general, an upswing in the electronics industry is directly linked to the development of the global gross domestic product (GDP) and its forecasts by reputable institutions such as the International Monetary Fund. In the spring of last year, we observed positive sentiment and optimistic forecasts, especially in the USA and Asia, which typically also impact Europe, where sentiment was not as optimistic at that time. Therefore, several forecasts, including mine in our last interview, hoped for a better seasonal pre-Christmas effect in the fall.

However, the effects of high inflation, high interest rates, restrained consumer spending, and low productivity growth caused the economy to stagnate more than expected. At least eight countries in the European Union, including Germany, experienced a technical recession in 2023 and had not fully recovered by the end of 2024. Other regions, like the USA and Asia, also faced similar or locally confined issues.

How do you currently assess the chances for an upswing in Germany and Europe? Why should 2025 succeed where 2024 did not?

Of course, I don’t have a crystal ball to make predictions; nevertheless, the probability is higher that 2025 will be better than 2024. Inflation has been curbed, inventories of a broader range of electronic components have been reduced, and the forecast for global GDP growth is slightly better than in 2024. This could positively influence consumer spending and, consequently, the consumption of electronic products. The International Monetary Fund forecasts GDP growth of 3.3 percent for 2025 and 2026, compared to 3.2 percent in 2024. I would like to point out that even small changes in GDP on a decimal level can have a significant effects on the growth of semiconductors and passive electronic components.

update 5/25: Following the chart below from Wood Mackenzie and WorldBank suggests positive GDP growth dynamic in 2025. In analysis by Wood Mackenzie it’s still believed that despite the current tariffs the “Economic momentum is set to continue – but all eyes are on the US.”

One of the big unknowns of 2025 is Donald Trump – how strongly do you think the tariff discussions will affect the economic development of the passive components sector in Europe?

Since the rules and conditions are constantly changing, it is difficult to say. Politics should strive to create a transparent and predictable business environment that entrepreneurs can use for their business strategies. Analogous to electronic circuits, the greatest losses are caused by transients – they are needed for a necessary switch to a higher level, and the system must be robust enough. Nevertheless, constant switching can lead to more serious problems and uneven failures.

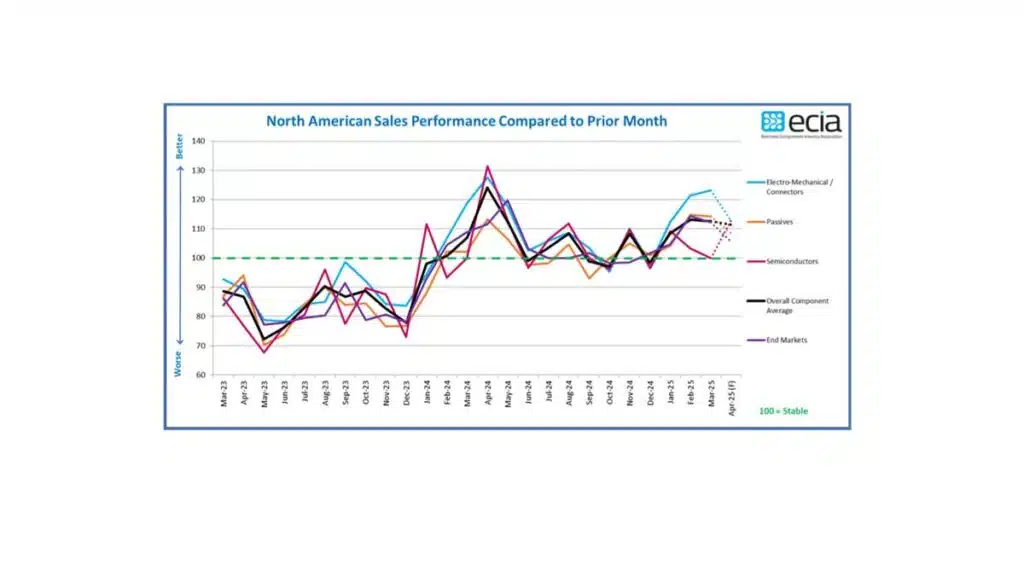

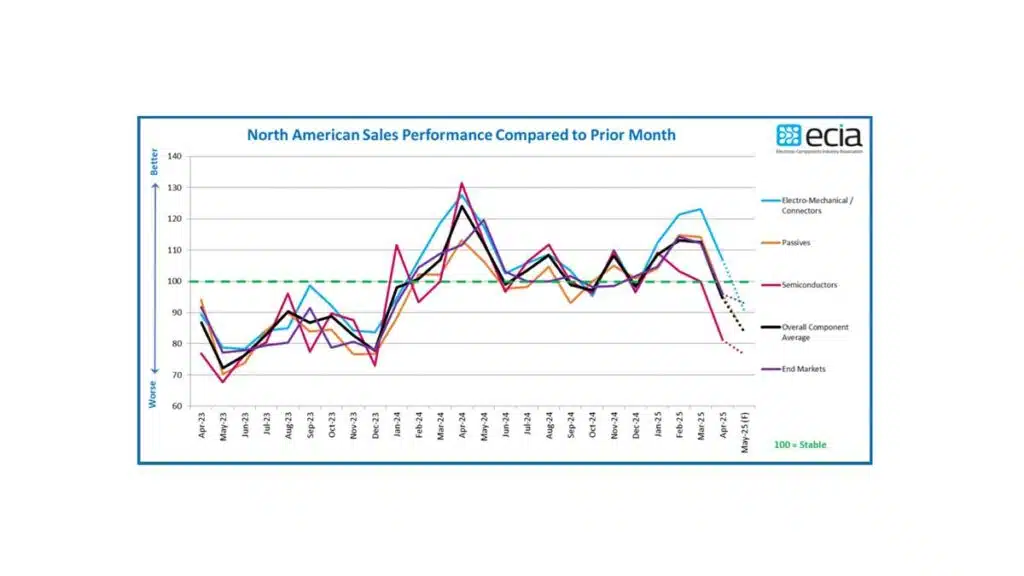

05/25 update: The extent of the tariffs’ impact on the electronic components market remains uncertain and will be evident in the longer term. However, we can already observe some measurable immediate impact on sales sentiment in the USA. The ECIA North American sales sentiment survey revealed that the tariffs have significantly crushed the original positive outlook for sales in April 2025.

Many industry players in Germany assume that a change in government will have no impact on the economic and revenue development in the field of passive components, at least not in 2025.

I believe that the global GDP and the state of the world economy in an export-oriented country can have a greater influence on the entire electronic components sector than a change in government. Therefore, the effects could be minor in the short term and below the visibility resolution in 2025. It will then depend on whether the government introduces real changes in the local business environment.

While the development in the automotive sector in 2024 left much to be desired, the demand situation in the field of industrial electronics was really poor. Do you expect a recovery here?

At least the challenge is there: We are living in a decade of rapid AI development, which brings new challenges in automation and robotics that can affect a wide range of industrial applications. The number of jobs will be redefined in total, some will be lost, and others will be newly created. It is up to us how flexible and innovative we will be to ride this wave. Traditional industrial countries in Europe have built their growth on their analytical, systematic, and logical approach, which, I hope, still represents a competitive advantage for Europe. Now is the time for Europe to demonstrate its ability to overcome bureaucratic obstacles.

Germany’s new federal government plans to establish a special fund of 500 billion euros, which is mainly supposed to flow into infrastructure measures. What impact could this have—besides the additional billions for the defense industry—on the demand development for passive components?

The key will be how effectively this incentive is designed and utilized. As already mentioned, politics should focus on structural changes that genuinely support the local business environment in the medium to long term. One-off actions with “bells and whistles” are loud and visible and bring immediate benefits to their initiators, but without structural changes, their impact may be limited.

“The core know-how and value of majority of passive components do not lie in their production, but in the high-tech materials used, the development, the materials science and the control of the supply chain. This is what we should focus on if we want to support the passive component industry in Europe.” Dr. Tomas Zednicek

Many production capacities for passive components have been relocated from Europe to regions with cheaper labor, and it could be difficult to bring them back as economically viable solutions. On the other hand, the core know-how and value of these components do not lie in their manufacturing but in the high-tech materials, for example, dielectrics, and the underlying materials science. For this reason, I believe that our main focus should be on knowledge, development, and supply chain control when we want to support the passive components industry in Europe.

Based on experience, after an improvement in demand for semiconductors, passive components follow six months later. When do you expect this, and how will it affect the supply situation in Germany and Europe?

A recovery in passive components can indeed be industry-specific. In consumer-oriented segments, the delay can shorten over time as design and prototyping become faster. In more conservative industries, the ratio may remain roughly the same. However, considering the general trend of a six-month delay after the semiconductor market recovers, you get a good basis for predictions.

There are industry representatives who see AI as a significant driver for the future increasing demand for electronic components. Do you share this view, and if so, are there passive components that are particularly important for AI servers and would quickly push production capacities in this area to their limits?

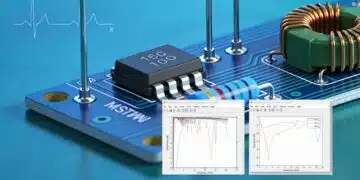

AI is currently the buzzword that is present everywhere, and indeed, it is the main driver for the volume demand for components, including processor coupling, board power supplies, memory, energy generation, or transport. Therefore, it genuinely affects demand and drives the development of PC architecture for a wide range of applications.

Driving the advancement of electronic systems. I would like to provide some examples of how AI can impact a wide range of passive capacitors and their combinations:

- Processor Coupling: Required are ceramic capacitors with high CV and low voltage, capacitors with low self-inductance, as well as integrated passive capacitors.

- Energy Management: Transitioning from a 12V line to a 48V line to suppress losses, necessitating inductors with high saturation.

- Memory: The shift from DDR4 to DDR5, where low-voltage VRs are integrated into the memory, makes capacitors redundant; consequently, demand shifts to 25V types for 12-busbar systems.

- Power Supply: The high energy consumption poses an additional strain on the existing power grid infrastructure. Furthermore, AI power supplies can cause high dynamic power peaks that need to be filtered by supercapacitor energy storage, as batteries cannot withstand as many cycles.

Expectations are particularly high for ceramic capacitors. Murata predicts that MLCC consumption for AI servers will double. Other leading ceramic capacitor manufacturers, such as Samsung Electro-Mechanics and Yageo, are reporting a significant increase in demand and are expanding or commissioning new facilities. This indicates strong signs of confidence.

What do you think about the CNF-MIM capacitor that Yageo plans to launch this year? Do you see developmental efforts in the industry moving in a similar direction?

Integrated passive components and wafer-based semiconductor process capacitors, like these CNF-MIM capacitors, are indeed a step in the promising direction. With the increasing speed and capabilities of processors, we need components that are closer to ICs to reduce parasitics, enhance ripple current, and decrease losses. Another potential application is energy harvesting devices on a chip, which require local energy storage in close proximity.

The CNF-MIM principle involves combining carbon nano-fibers with materials that have a higher dielectric constant using additive technology. Compared to subtractive deep-trench silicon technology, this offers good potential for future developments (Smoltek announced to achieve 230% higher capacitance density compared to their Gen0 capacitors). However, to my knowledge, the capacitance density was so far around 650nF/mm2, so it has not yet achieved a higher capacitance density in real products than silicon capacitors, where Murata claimed to reach capacitance density over 1.3 uF/mm² already in 2021.

Recently, MLCCs and chip inductors in the 006003 size were introduced. Do you see a need for such products beyond smartphones and IoT devices? Do you expect further miniaturization steps?

I was already skeptical about the practical application of 008004 chips, as their assembly costs are higher than the component costs themselves. Therefore, for applications beyond the key enabling basic technologies in smartphones and IoT devices, they are not economically viable. We might see more discrete components in these sizes before the end of the decade, but the focus will shift to integrated passive components, preferably those compatible with semiconductor manufacturing processes.

Besides the possibility of manufacturing passive components using thin-film semiconductor technology, do you see other options for creating the physical functions of passive components with materials other than ceramic powders or other traditional raw materials?

There are additional possibilities for manufacturing passive components that are currently being researched, successfully demonstrated, or even produced as prototypes. Examples include 3D printing of an entire PCB circuit board, including a spiral antenna, applying or spraying dielectric and conductive inks, or knitting components for smart textiles. Working with nano-materials also offers a range of entirely new approaches and handling methods. The real challenge, however, lies in transferring these technologies into economically viable mass products with the necessary stability, reliability, and repeatability while achieving an appropriate yield.

Interview conducted by Engelbert Hopf.

⸻

Published under permission by www.markt-technik.de