Source: Quartz article

by Daniel Wolfe. At a recent conference, GoPro CFO Brian McGee made an admission: His company couldn’t manufacture enough of its flagship action camera. McGee said GoPro expected it could sell 5 million cameras, but was only able to make about 4.2 million in 2018.

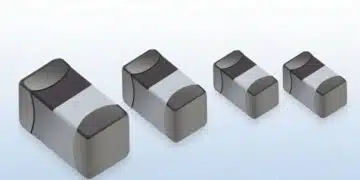

The culprit is a shortage of a tiny electronic component called an MLCC, or multi-layer ceramic capacitor. It costs less than a penny, but is indispensable to today’s products, from consumer electronics to automobiles.

A single GoPro camera contains about 320 MLCCs. Other products have thousands.

TTI Inc., a distributor of electronic components, including MLCCs, called the capacitor situation a “worldwide shortage” in a July 2018 letter to its customers. The message from manufacturers is the same: There is a shortage, has been a shortage, and will continue to be one through 2020.

Already, orders for MLCCs are backed up for nearly a year. That means supply-chain managers need to forecast demand for their products well in advance, and cannot quickly manufacture new devices if those forecasts prove low.

Demand for MLCCs has outstripped supply since 2017, mainly due to the sophistication of electronics in vehicles, the complexity of our mobile phones, and the growing market for internet-of-things devices. For instance, the latest iPhone X requires upwards of 1,000 MLCCs. That’s a 10% increase over previous models, according to the Nikkei Asian Review, and twice as many as the iPhone 6S.

A high-tech automobile like a Tesla requires 10 times more MLCCs than a phone, roughly 10,000 per vehicle. A growing need for these components by car manufacturers is boosting niche suppliers. Half of the sales at America capacitor manufacturer Kemet come from its line of ceramic capacitors, CEO William Lowe told investors during its earnings call in January. On the same call, Kemet announced 14.2% year-over-year revenue growth.

Meanwhile, suppliers have been reticent to make more MLCCs because the profit margins on the components are so slim. Even with price increases over the past year, MLCCs still cost less than half a cent. The largest manufacturer of MLCCs by market share, Murata announced a plan for a 10% increase in production. The Japanese company also increased its prices by as much as 30% in the past year.

It’s a tricky situation for manufacturers in an industry that is typically conservative with its investments. New plants are expensive. The dot-com bust left suppliers sitting on billions of dollars of inventory, causing prices to crash, according to Electronics Purchasing and the Supply Chain News.

Even companies willing to take on the risk of increased production are hampered by equipment availability. Wait times for the tooling equipment needed to set up MLCC-making machines keep growing. John Sarvis, president and CEO of component supplier AVX, told investors during its earnings call in July 2018, that the company had intended to increase production by 20% in 2018. Sarvis said AVX missed that target because of long lead times from equipment manufacturers.