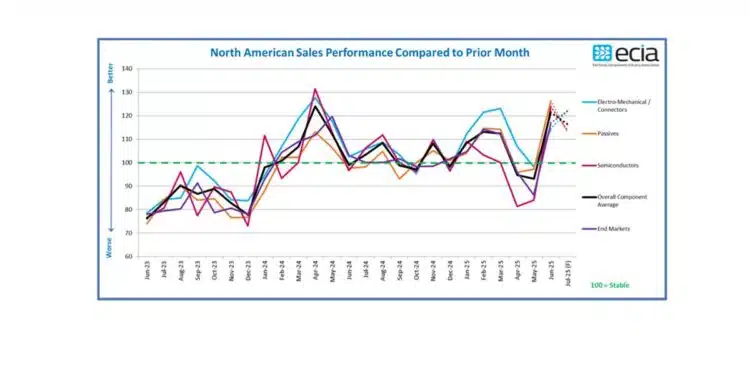

The ECIA North American sales sentiment survey in June 2025 delivered unexpected surge in electronic components industry sentiment.

An unexpected surge of 28.4 points in the overall average component industry sentiment between May and June comes as a surprise compared to the expectations set by the May Industry Pulse survey.

The average component index score of 121.5 surpasses the anticipated score of 98.4 in June by 27.5 points. As expected, the volatile nature of tariffs remains the primary factor influencing sales projections. However, there were some promising indications of potential agreements between the US and China and the US and EU during June, which may have contributed to this surge in optimism.

Additionally, the effort to make purchases before the imposition of tariffs, which is still a moving target, is likely reshaping the typical annual sales pattern, skewing it more towards the first half of the year.

Given that tariffs are not expected to be imposed until after July, the index outlook for July dips only slightly to 116.5. Semiconductors experienced the most significant upward movement, with the index soaring almost 40 points from May to June, reaching a peak of 123.8.

Passive Components achieved the highest June index score at 126.3, a remarkable 29.2 jump. Electro-Mechanical/Connector Components also saw a substantial boost, reaching 114.4 in June, securing an unusual third place in the component scores. The June Industry Pulse results reveal that the persistent erratic and unpredictable nature of tariff activity and communication has created a highly unstable sales environment. While these elevated numbers for June and the July outlook may be cause for celebration, it would be prudent to continue in crisis management mode for the foreseeable future. Manufacturer Representatives delivered the most enthusiastic sales sentiment scores in every component category, followed by Manufacturers with robust reports exceeding 100 in every category except Electro-Mechanical. Distributors also experienced a significant jump in their June scores, albeit with a more cautious outlook compared to the other groups. The overall end-market jump in the index

The score actually surpassed the overall component index score increase, which came in at 116.9 in June, marking a significant 30.8 leap.

In addition, the end-market score is projected to improve further in July, nearly matching the Electro-Mechanical\Connector score of 122.3. Notably, every individual end-market score registers solidly above the 100-point threshold, with the exception of Mobile Phones. The broad-based positive results for June and July further reinforce the promising near-term outlook these results portray. However, it’s essential to exercise caution regarding the long term.

The lead time scores indicate a highly stable environment. Participants reporting negative lead times decreased significantly from very few in May to zero in June, which is a notable achievement for the Industry Pulse survey. Reports of increasing lead times also declined in June. The average score for stable lead times reached 91% of reports in June. A healthy supply chain inventory and lead time situation will be a valuable asset amidst the current geopolitical instability.