Taiwan’s passive components vendors are optimistic their shipments for second-quarter 2021 will continue to be bolstered by strong demand for automotive, stay-at-home and 5G applications, according to industry sources.

This year, the passive components supply chain will still follow traditional seasonal patterns with shipments continuing rising through the third quarter before declining slightly in the fourth, the sources said.

Shipments of passive components could expand faster if IC shortages ease, the sources noted, adding that both vendors and clients are facing low inventory levels due to strong demand for terminal applications.

Top passive component vendor Yageo has seen its capacity utilization for MLCCs ramping up to over 90% in the second quarter from over 80% in first-quarter, and its chip resistor capacity utilization is also advancing to over 80% from 70-80%.

Walsin Technology expects its shipments of passive components to surge steadily in the months ahead on stable expansion in demand for datacenter, server, EV and networking applications.

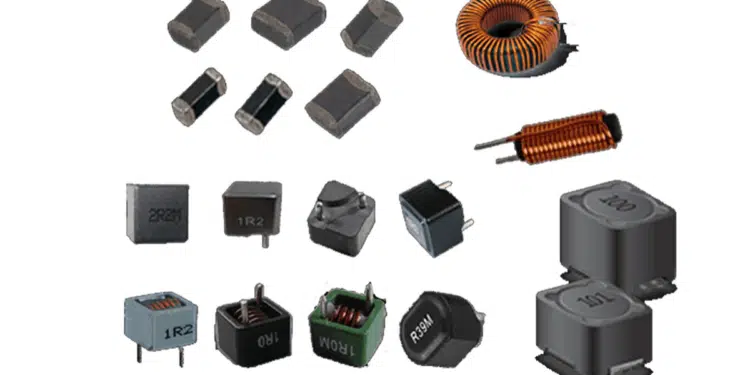

Inductor makers Chilisin Electronics, Tai-Tech Advanced Electronics and ABC Taiwan Electronics are all optimistic that strong demand for networking and automotive applications will further power their shipment and revenue increases in 2021, with order visibility extending to six months for popular-specs offerings.

Upstream materials and equipment vendors Ample Electronic Technology, LaserTek Taiwan and Tian Zheng International Precision Machinery have also seen clear order visibility extend to the third quarter, particularly orders for conductive pastes and SMT packaging materials.