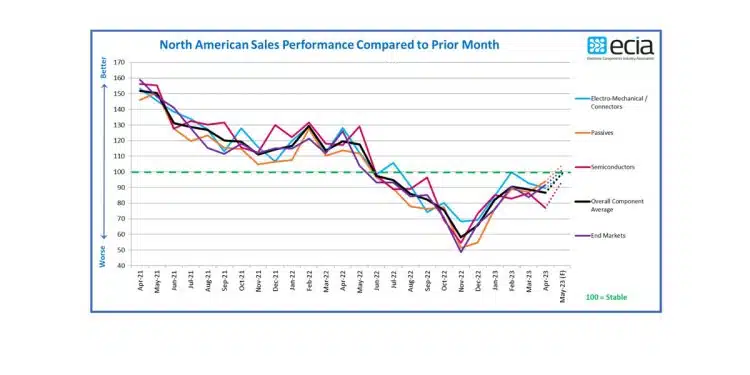

North American April 2023 electronic component sales sentiment sees slight dip in March and April but promising outlook for May according to ECIA Electronics Components Industry Association Survey.

The most recent results of ECIA’s ECST survey show sales sentiment slipping slightly with show overall sales sentiment declined by 1.9 points compared to the March survey results. The second month in a row of slightly lower results.

However, the outlook for May is considerably brighter as expectations jump above 99, almost up to the break-even level between declining and improving sales. This encouraging outlook may provide an early indicator that the market decline is easing and could see a turnaround in year-over-year performance before the end of 2023.

The overall component sales sentiment index dropped below 100 in June 2022. If the May 2023 expectations are realized, it would mark the strongest measurement since May 2022 when a robust result of 117.6 was reported prior to the 20-point drop below the 100 threshold in June.

The Passive Components sentiment index delivered the strongest results in April with a score of 94. The exciting news is the May prediction for month-to-month Passive sales sentiment moving into positive territory with expectations of 104.5, solidly above the 100 threshold. Electro-Mechanical components saw sales sentiment decline slightly in April. However, a strong rebound is anticipated in May with an improvement of 9 points pushing index expectations up to 98.5.

The April sales sentiment results for Semiconductors were a stark contrast compared to the other major categories as the index collapsed below 77. Three of the four Semiconductor segments reported a sharp decline in April. Only “Discrete” semiconductors delivered improved results. However, hope springs eternal and the May outlook for Semiconductors jumps by over 17 points to top 94. The May expectations show three of the four Semiconductor subsegments with strong improvement. Only the MCU/MPU subcategory shows declining expectations for May. The trends reported by the ECST index for Semiconductors are fairly consistent with the results reported by WSTS for the Americas. While the worldwide semiconductor market is suffering a “hard landing”, it is fair to say the Americas are achieving a “soft landing” so far. End-market results are very encouraging with strong improvement in April and a May index outlook above 100. Healthy results for the end markets are broad based. Most encouraging is the May outlook that predicts sentiment above 100 for Automotive, Industrial, Military/Aerospace, and Medical.

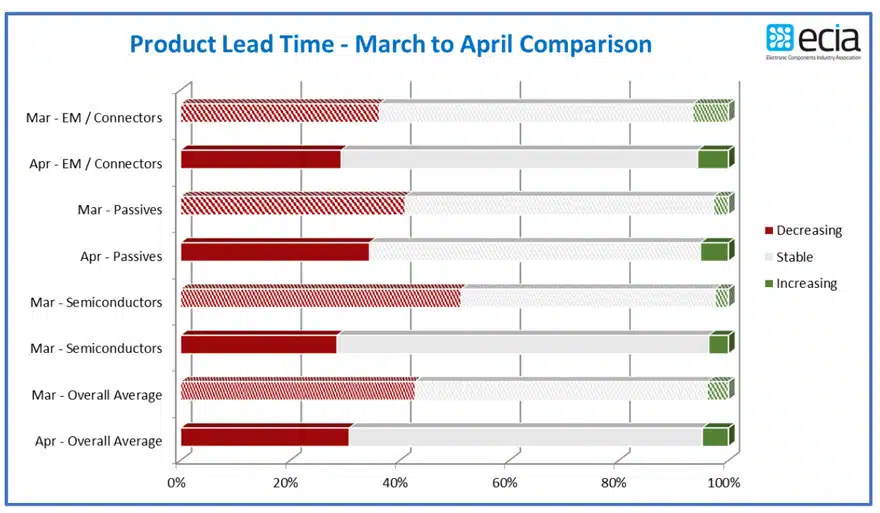

Product lead time trends in the latest ECST survey show a strong level of “stability.” 68% of survey respondents saw Semiconductor lead times as stable. Electro-Mechanical/Connector and Passive lead times were reported as stable by 65% and 60% of respondents respectively. Overall, declining lead times were seen by 31% of survey participants.

Increasing lead time reports remained very low at only 5% for the overall average. Credit does need to be given to increased production. Given the overall assessment that inventory overhang is the greatest challenge facing the supply chain currently, product mix issues would appear to be the main contributor to any reports of increasing lead times as inventories balance out in the declining market.