source: TTI Market Eye article

03.15.2016 // Dennis M. Zogbi //

Capacitors, Resistors and Inductors: Global Market Update

The global passive electronic component industry, which for the purposes of this article includes capacitors, linear and non-linear resistors and discrete inductors of all types and configurations, will account for approximately $25 billion US dollars in global revenues for FY 2016 (Fiscal Year ending March) with almost 3.45 trillion pieces shipped. This article takes a current view of the market for January 2016 and forecasts future industry related events.

Global Market Developments in Passive Components

RAW MATERIAL PRICING UPDATE

The Passive Component Raw Material Index (which covers feedstock pricing for many of the primary raw materials consumed in the production of passive electronic components) showed a significant decline of 13.33% in November 2015 on a month to month basis then STABILIZED and increased slightly by 0.23% for the month of December 2015; but has lost an additional 2.72% in January 2016.

Base metals such as nickel, copper, aluminum and zinc prices all declined, as precious and rare metals such as palladium, tantalite, silver and crude oil. From the high point of September 2014 to January 2016 the passive component raw material index has lost 43% of its price value. This bodes well for profitability in the electronic materials supply chain, but it also signifies weakness in other economic sectors that also consume these raw materials and that suggests a weak overall economy worldwide.

Figure 1.1

Source: Paumanok Publications, Inc.

Impact of Raw Materials by Product Line in Passive Components:

While many individual ingredients go into the production of individual passive component lines, the products shown in the materials index are part of the supply chain and are trackable by third party data sources, which we pool here collectively to form the Paumanok Passive Component Market Index.

Figure 1.2:

Correlation of Raw Materials with Individual Passive Component Product Lines:

Source: Paumanok Publications, Inc.

Correlation of Raw Materials with Individual Passive Component Product Lines:

Base metals such as nickel and copper are used as the electrode and termination materials in ceramic chip capacitors; while aluminum is used as the anode and cathode materials in aluminum electrolytic capacitors; and zinc is the active ingredient in non-linear resistor products- metal oxide varistors used for circuit protection in almost all AC line electronics.

In the more exotic materials, which include precious metals, rare metals and crude oil; we note that palladium is used in MLCC electrodes; ruthenium is used as the resistive ingredient in ruthenium oxide and ruythenate pyrochlore thick film metallizations for resistors. This also includes tantalite, or tantalum ores. Which are consumed in tantalum capacitors; as well as silver, which is also consumed in MLCC terminations and SLC electrodes. Crude oil is the feedstock for plastics, which are consumed in AC film and DC film capacitors.

Ultimately the index covers materials consumed in more than 90% of the total passive component units produced in any given year.

Changes in the Index on Recent News From China:

Primary sources say the price reductions for all materials tracked in the Passive Component Index between November 2015 and January 2016 is based upon the slowdown in forecasted metals consumption in China for CY 2016. For January 2016, nickel, copper, aluminum and zinc prices all declined, as did palladium, tantalite, silver and crude oil. From the high point of September 2014 to January 2016 the passive component raw material index has lost 43% of its price value. This bodes well for profitability in the electronic materials supply chain, but it also signifies weakness in other economic sectors that also consume these raw materials and that suggests a weak overall economy worldwide.

Base metal raw material prices showed a decrease in December of 2.3% on a month-to-month basis, after a plunge of 13.5% in November, when all product lines dropped substantially in price. This was of great concern to us and largely blamed on a reassessment of Chinese metals consumption in the coming year. All base metals continued their price decline as is shown in the chart above.

Precious and rare metal prices DECREASED again by a large 12.2% in January on a month to month basis following A WHOPPING 20.9% in NOVEMBER 2015.Palladium prices dropped to a new low of $488 USD per Troy ounce for January 2016, considering it was $883 in August of 2014. Ruthenium, tantalite, silver and especially crude oil are all very low in price now.

COMPONENT MARKET UPDATE: MARCH 2016 QUARTERLY FORECAST

In January 2016 we have maintained our forecast for a global quarter-to-quarter rate of decline for December 2015 quarter at 0.1% in US dollar value worldwide (only a small percentage change); followed by a new forecast of a decline of 2.1% in passive component demand in US dollars for the March 2016 quarter. The primary impact on the global passive component industry in 2015 and 2016 is the weakened yen to dollar ratio and the rapidity which the rates change. Growth in yen was subsequently remarkable, but sales in US dollars was weak and showed no or anemic growth as a result. An unusual global economy. In 2016 we see the beginning of the impact of higher US interest rates impacting the global market, which yen values expected to appreciate slightly in response, and creating a market decline in value, while increasing demand in volume.

Therefore, the March 2016 forecast should show improvement in revenues for American, German, Chinese and Korean passive component vendors, at the expense of Japanese vendors and as a direct result of the rise in interest rates in the United States. The model is that for March 2016 that higher interest rates in the United States will cause yen appreciation, resulting in higher prices for passive components and lower unit volumes. This we believe caused the increase in distributor purchases of resistors in the previous December 2015 quarter.

Summary Figure 1.3

Source: Paumanok Publications, Inc.

CAPACITOR LEAD TIMES

In this the January 2016 MarketEYE report demand for capacitors remained steady state and unchanged in the month following weakness in the market in December; however two products, the molded chip tantalum capacitors and the DC Film chip capacitors showed tightening lead times and increased unit demand; most certainly coming from the IOT market to support high capacitance in a small footprint and power filtering for the screen backlighting. We still perceive the capacitor unit markets to remain tightened and that currency valuations remain the largest continued threat to return on investment in the component industry in FY 2016 and FY 2017.

Summary Figure 1.4

Source: Paumanok Publications, Inc.

RESISTOR LEAD TIMES

In January 2016, we note a slowdown in demand for resistor networks and thin film chips. The unusual disruption in the sensitive supply chain for resistors noted in the November 2015 market, repeated itself in December 2015, especially for the 0805 and 1206 thick film chip resistors and have maintained their higher level of demand in January 2016. The only explanation anyone can give is a replenishment of resistors by major distributors which happened in the December 2015 quarter and is now petering out in the March 2016 quarter. The market is recoiling from the purchases made in the fourth quarter of 2015.

Summary Figure 1.5

Source: Paumanok Publications, Inc.

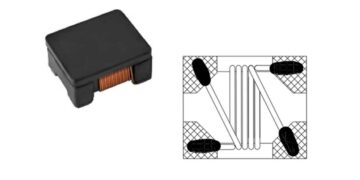

INDUCTOR LEAD TIMES

Lead times for discrete inductors remained at their elevated levels for the month of January 2016; December and November 2015 and October 2015, after showing increases in lead times for August and September 2015 on a month-to-month basis. Inductor demand remains solid and under new scrutiny for use in automobile cockpit electronics at new designated frequencies.

Summary Figure 1.6

Source: Paumanok Publications, Inc.

CURRENCY TRANSLATIONS AND HIGHER INTEREST RATES IN THE USA: 2016

As we have noted, the exchange rates of foreign currencies that define the passive component market index, have been having a major impact on vendors that report in US dollars. We expect the March 2016 quarter to mark a turning point brought about by higher interest rates in the USA changing the growth rate of the yen; which will in turn cause an appreciation of the yen which will begin to impact global pricing for passive components. We also expect depreciation in the NT$ and the Won as the yen strengthens. Even a slight appreciation in the yen value will result in a shift in global valuations for passive components for 2016. The reader must remember that during FY 2016 Japanese vendors reported the best quarters in their existence due to the rapid and variable change in yen value; while vendors from all other nations saw anemic rates of growth as a result. Once again the industry was impacted by events that was outside the control of their trade. The swing of the pendulum back in the other direction may have equally unbalanced results in FY 2017.

Figure 1.7

Exchange Rate Trends and Forecasts: Yen, NT$ and Won Currencies to the United States Dollar Quarterly Exchange Rates

Source: Paumanok Estimates Based upon Won Table Data in USD per currency.

Summary and Conclusions:

The Passive Component Raw Material Index has demonstrated some of the lowest pricing in the history of the collection of data for the index with all base and precious materials consumed in the production of passive components at all time pricing lows. This reflects a weakness in the overall global economy even though it also means lower overall costs to produce components.

Lead times for capacitors, resistors and inductors all remain at elevated levels in January 2016 on a month-to-month basis. However, the primary concern for all of 2015 has been the depreciation of the yen to the US dollar. In 2016 the model appears to have been influenced by the announcement that interest rates will rise in the United States, and this is causing the yen to appreciate against the dollar. The results in revenues for the passive component industry may be down slightly in the March 2016 quarter as Western vendors benefit from better pricing in overseas markets, but Japanese vendors feel the backlash of having to lower prices amidst an appreciating yen.