This article written by Dennis Zogbi, Paumanok Inc. published by TTI Market Eye provides an overview of vertical material technology integration in the field of capacitor industry.

The global capacitor industry – which for the purposes of this article includes ceramic capacitors, aluminum capacitors, tantalum capacitors, plastic film capacitors and supercapacitors of all types and configurations – accounted for approximately $31 billion in global revenues for fiscal year 2024.

This article offers a comprehensive overview of the strategies capacitor manufacturers have employed over the past 35 years to enhance profitability across different dielectric ecosystems, including electrostatic capacitors, which include ceramics and plastics and electrolytic capacitors, which includes aluminum, tantalum and supercapacitors.

The insights presented are drawn from Paumanok Publications, Inc. extensive archives of annual market research studies, technology presentations, monthly reports and resources from Paumanok’s Passive Component Industry Magazine LLC.

Fixed and Variable Costs in Capacitor Production (Electrostatic and Electrolytic)

In the global capacitor industry, fixed costs account for approximately 20% of the costs of goods sold (CGS) while variable costs make up the remaining 80%. To improve profitability, vendors focus primarily on controlling variable costs, including raw materials, labor, variable overhead and variable production related expenses.

Among these, raw materials represent the largest single cost factor in capacitor production, regardless of dielectric type. Consequently, many of the historical strategies for cost reduction and profitability enhancement are centered on optimizing the procurement and processing of raw materials. This includes managing costs related to feedstocks, engineered dielectrics, cathode materials, additives, electrodes, terminations, and lead wires.

This article explores a combination of best practices for improving profitability in both electrostatic capacitor markets (multilayered ceramic chip (MLCC) ceramic and plastic film) and electrostatic capacitor markets (aluminum, tantalum and carbon-supercapacitors).

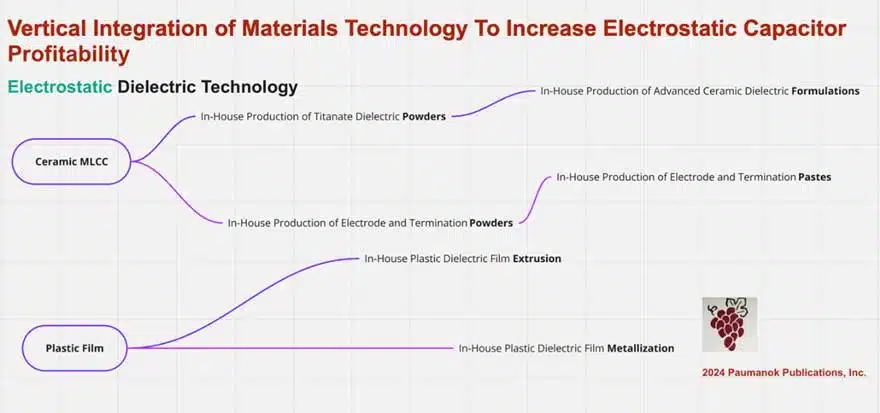

Vertical Integration of Materials Technology In Electrostatic Capacitor Manufacturing by Dielectric

The electrostatic capacitor market accounts for 65% of all capacitors sold worldwide and includes the ubiquitous MLCC ceramic capacitor market and all the plastic dielectric film capacitors. What electrostatic dielectric ceramics and plastics have in common is their ability to operate at extremely high voltages. The following illustrates best practices in capacitor production that have proven over time through provenance and utility to enhance product performance and increase overall electrostatic ecosystem profitability.

Vertical Integration of Materials Technology in Ceramic MLCC Manufacturing

Ceramic capacitors are electrostatic components, produced in multiple configurations including surface mount MLCC as well as axial and radial leaded designs. Ceramic capacitors, especially the ubiquitous MLCC, represent the most commonly consumed capacitor by type worldwide in terms of both value and volume. All other capacitor markets are considered niche when compared to ceramic capacitors.

Here is a summary of methods by which ceramic capacitor manufacturers have reduced their respective cost structures and increased profitability over the years:

In-House Production of Advanced Barium Titanate

Captive in-house production of advanced forms of barium titanate – such as those synthesized via the chemical oxalate or hydrothermal process – is a key strategy for ceramic capacitor manufacturers to reduce costs and improve component performance.

In-House Production of Ceramic Formulations

A proven strategy for achieving cost savings in ceramic capacitor manufacturing is for companies to produce their own composition formulations in-house instead of sourcing them from external suppliers. Ceramic formulations include X7R, X5R, Y5V and COG, as well as a range of specialty materials tailored for specific applications such as high-temperature, high-voltage and high frequency circuits. By controlling the formulation process internally, manufacturers can optimize material properties, reduce dependency on the merchant market and better meet the lead time demands of specialized applications while lowering overall production costs.

Electrode and Termination Powder and Paste Development

Another traditional cost-saving strategy in ceramic capacitor manufacturing involves using lower-cost nickel electrodes and copper termination powders instead of more expensive palladium electrodes and silver termination powders, particularly in the multi-layered ceramic chip capacitor (i.e. in X5R, Y5V and high-layer-count X7R type ceramic capacitors). Additionally, the in-house capability to process nano-metal particles into powders and pastes for use in MLCC electrodes and terminations has proven critical in enhancing the performance capabilities of high capacitance MLCC at higher voltages, an important and profitable breakthrough in advanced materials development at the component level.

Vertical Integration of Materials Technology in Plastic Film Capacitor Manufacturing

Plastic film capacitors are critical components used in power transmission and distribution grids; motors and drives; renewable energy systems, lighting ballasts, power supplies, microwave ovens, transportation, furnaces, welding machines, aircraft, medical defibrillators, logging tools, rail guns and high-reliability electronics.

Plastic film capacitors are produced in a variety of configurations including radial leaded, axial leaded, SMD film chip, small can and large can configurations. Plastic film capacitors are also the oldest dielectric used in capacitor construction, as plastic film capacitors were the primary power factor correction design for the original electrical grids and were in mass production as far back as 1901. Today, plastic film capacitors are largely defined as being either metallized polypropylene (PP) or metallized polyethylene terephthalate (PET).

In the fragmented, fast-growing AC film capacitor segment, the markets, technologies and opportunities of polypropylene dielectric plastic film capacitors have been well documented in studies by Paumanok IMR over the past 35 years, including both dry and liquid-filled designs for use in a variety of electrical systems.

Additionally, Paumanok market and technology research also focuses on DC film capacitors for printed circuit board applications in power supply, lighting ballast, consumer AV and specialty/defense applications and includes value and volume of demand for 5mm pitch PET film capacitors, AC and pulse film capacitors, interference suppression film capacitors and PPS, PEN and PET film chip capacitors, as well as specialty PTFE and polyimide film capacitors for consumption in high-temperature electronics.

Because of extensive competition in the space due to ease of market entry, plastic film capacitor vendors are constantly attempting to decrease costs.

Here is a summary of how some plastic film capacitor vendors cut costs and increase profitability:

In-House Plastic Film Extrusion

Captive film extrusion has been noted in both AC and DC type plastic film capacitors, but our primary research notes that the volume of captive extrusion of polypropylene exceeds that of all other plastic film dielectrics. Some of the major producers of large can power transmission and distribution capacitors can extrude thin dielectric polypropylene film as well as metalize it. This decreases plastic film capacitor costs substantially. For decades, one of the major producers of large can plastic film capacitors has employed the “Tenter-Film” process to extrude dielectric films. Again, this process removes the premium that the capacitor manufacturer would pay if buying extruded dielectric film directly from the merchant market.

In-House Plastic Film Metallization

Captive metallization of capacitor-grade dielectric plastic film is an excellent way to increase profit margins and lower costs for capacitor manufacturers over time. An increasing number of AC and DC film capacitor manufacturers metallize their own thin films in-house. In fact, the vertical integration of plastic film dielectric from the merchant market into the capacitor market occurred first in the capacitor industry, with other dielectrics justifying their own vertical integration of materials from the merchant market into the captive market by the fact that it was common practice in plastic dielectric films. This process saves the capacitor manufacturer the premiums associated with buying metallized dielectric film directly from the merchant market.

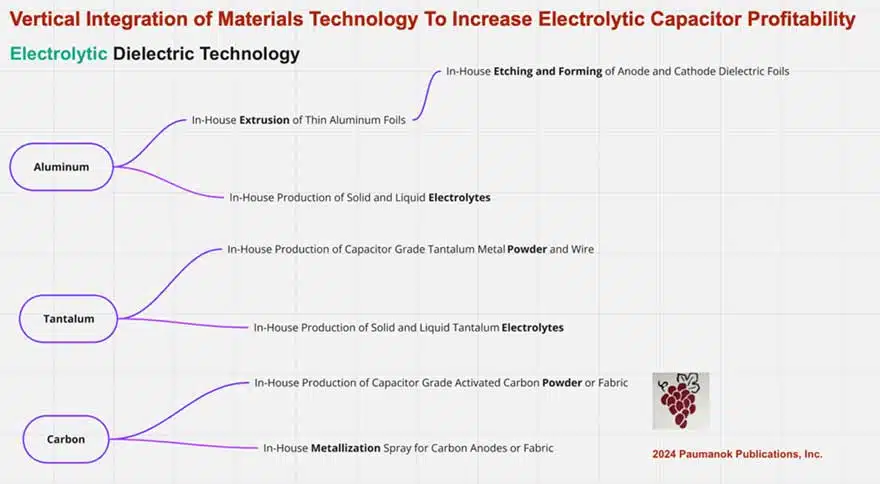

Vertical Integration of Materials Technology in Electrolytic Capacitor Manufacturing by Dielectric

The electrolytic capacitor market accounts for 35% of all capacitors sold worldwide and includes the aluminum, tantalum and carbon dielectric capacitors. What electrolytic dielectric materials have in common is their ability to offer extremely high capacitance at reasonable voltages. The following illustrates best practices in capacitor production that have proven over time through provenance and utility to enhance product performance and increase overall electrolytic ecosystem profitability.

Vertical Integration of Materials Technology in Aluminum and Carbon Electrolytic Capacitor Manufacturing

Aluminum and carbon electrolytic capacitors are among the most complex of all passive electronic components, requiring multiple technological capabilities under one roof to produce. This includes the knowledge of chemically etching and forming anode and cathode foils (a very specialized process); the application of electrolytes, including water, alcohol and polymer-based materials and additional exotic materials requirements, such as knowledge of separator papers, rubber stoppers, aluminum cans, tabs and lead wires.

Here is a summary of how some aluminum electrolytic capacitor vendors cut costs and increase profitability:

Highest Variable Cost is in Aluminum Foils and Activated Carbons

In multiple studies by Paumanok Publications between 1988 and 2024 on the subject of aluminum capacitors and the costs associated with their production, the following cost savings measures have proven to be most effective in increasing the profitability of aluminum electrolytic capacitor manufacturers. The largest cost factor associated with the production of aluminum electrolytic capacitors is the variable raw material cost, and the largest variable raw material cost is etched aluminum foils. In carbon-based supercapacitors, which are also based on electrolytic capacitor technology, the cost savings comes in the vertical integration of activated carbon fabric cloth or powdered anode in house at the capacitor manufacturer.

In-House Foil Forming and Etching

Many of the top vendors of aluminum capacitors etch their own anode and cathode foils to cut costs. In-house etching of anode and cathode foils requires chemical expertise and low-cost energy as etching and formation are technically demanding, electricity-intensive practices. There is movement in the industry toward etched and formed foil in nations with extremely low energy costs. This process is also designed to decrease costs because electricity consumption is a key cost factor in forming capacitor foil.

Vertical Integration of Materials Technology in Tantalum Electrolytic Capacitor Manufacturing

The other electrolytic capacitor design is the tantalum electrolytic capacitor. This capacitor is unlike other designs because it employs a porous anode of tantalum to achieve the maximum surface area needed for high capacitance in a small case size. Unlike its aluminum electrolytic capacitor counterpart, tantalum employs a dry type electrolyte in the form of either manganese (MN02) or a conductive polymer material (PeDOT, pyrole).

Vertical Integration of Tantalum Powder and Wire Production

It is difficult to find cost savings for the production of tantalum capacitors, because, unlike the other capacitor dielectrics, it is extremely difficult to produce capacitor grade tantalum metal powder, requiring a level of expertise that is considered advanced among metallurgists. The chemistry and processing capabilities to create tantalum pentoxide – the active ingredient in tantalum capacitor anodes – are significantly advanced and require a level of expertise that is beyond the capabilities of many governments, much less trade vendors.

Therefore, the number of active production facilities that can produce capacitor grade powder and wire is limited worldwide to Japan, Germany, China and the U.S. However, the vertical integration of a smaller tantalum powder producer into the largest tantalum capacitor manufacturer has shown, through presentations and reports to the financial community, that such actions can produce significant cost savings over time by eliminating the premiums associated with the merchant market.

Tantalum wire production also has become more prevalent in the supply chain with more capacitor manufacturers bringing wire drawing capabilities in-house. This is prevalent in the tantalum supply chain because of the dwindling number of merchant vendors of tantalum wire. Tantalum wire is necessary in the production of both molded and coated chip capacitors because it acts as the lead wire from the anode to the lead frame.

Cathode Application – Gas versus Dipping

A gas infusion process for the application of conductive polymers into the porous structure of tantalum anodes generates a higher margin than the alternative monomer and polymer “dipping” process due to the excessive waste stream associated with impregnating anodes by chemical bath. Manufacturing facilities that employ dipping processes to impregnate porous-structure anodes with conductive polymers have also taken steps to limit the number of dip cycles as a cost-savings method.

Summary and Conclusions

This article illustrates the best practices for reducing costs in capacitor manufacturing in each dielectric as documented by market research reports produced by Paumanok Publications, Inc. over the past 35 years.

The similarities among best practices by dielectric involve similar vertical integration of raw material engineering processes involving ceramic and metal powder and paste production, materials extrusion and materials metallization.