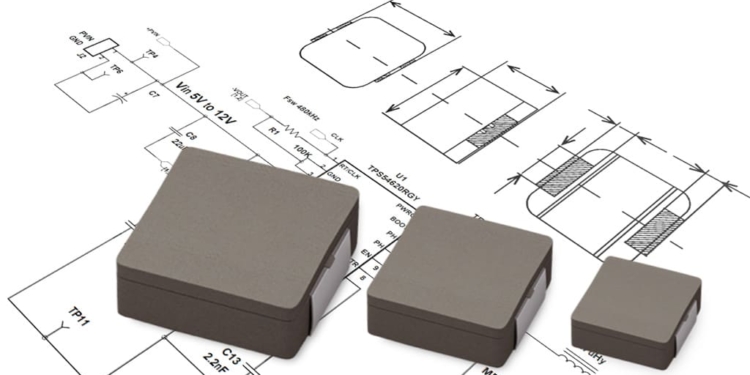

Metal composite power inductors are fast emerging as an ideal choice for modern mobile electronic designs. The trend of downsizing of ECU power circuits used in plethora of electronics applications in consumer electronics and automotive industries is one of the several trends likely to spur commercialization of products in the metal composite power inductors market.

Power supply interfaces in electronic circuits need continual advancement.

Electrical performance, notably acoustics and operating temperature, as well as mechanical considerations, notably size/density, offer interesting trade-offs for designers, pushing them to test new engineering marvels in the electronics industry.

Power inductor manufacturers are implementing new film technologies and wounding designs to navigate the trade-offs.

Prominently, metal composite types have elicited enormous attention in high-performance DC-DC converters to fulfil new standards in automotive and consumer electronics industries.

Inductor Technology Continually Advancing

End-use industries in metal composite power inductors market are striving to overcome the limitations of traditional ferrite inductors in next-gen power circuits. The scales have seemingly tilted toward metal composite power inductors: these are being rapidly incorporated in range of electronic devices such as smartphones, data storage devices, and automotive electronics. Applications that need high saturation current, stable magnetic permeability, and excellent EMI shielding have opened up abundant opportunities for companies in the metal composite power inductor industry.

Considerations of energy efficiency especially when power circuits need to operate at high temperature and a large current range are critical parameters that have given rise to new inductor technologies. Additionally, downsizing of electronic component units (ECU) has opened up significant attractive opportunities in the market. According to a study by market intelligence firm, the value is projected to reach US$ 1.1 Bn by 2031.

Trends Determining Product Adoption Rate in Automotive Industry

Usage of metal composite inductors has proliferated in automotive applications wherein these are being adopted for both switch-mode power supplies and DC-DC converter solutions. Electronic component suppliers are reaping significant revenue gains owing to rapidly expanding applications of these type of inductors.

Companies have captured steady revenue streams due to expanding target applications of metal composite power inductors. Automotive ECUs are undergoing rapid shifts, with electrification of vehicles being a key driver of these changes in recent years. Rapid policy push to adopt electric vehicles has upped the ante for inductor manufacturers to offer components that make automotive power supply reliable and safer for electric vehicles. The rapidly expanding electric vehicle (EV) industry is thus poised to greatly influence the course of the metal composite power industry market in near future.

Evolving Standards for Automotive ECU Components Raise the Ante

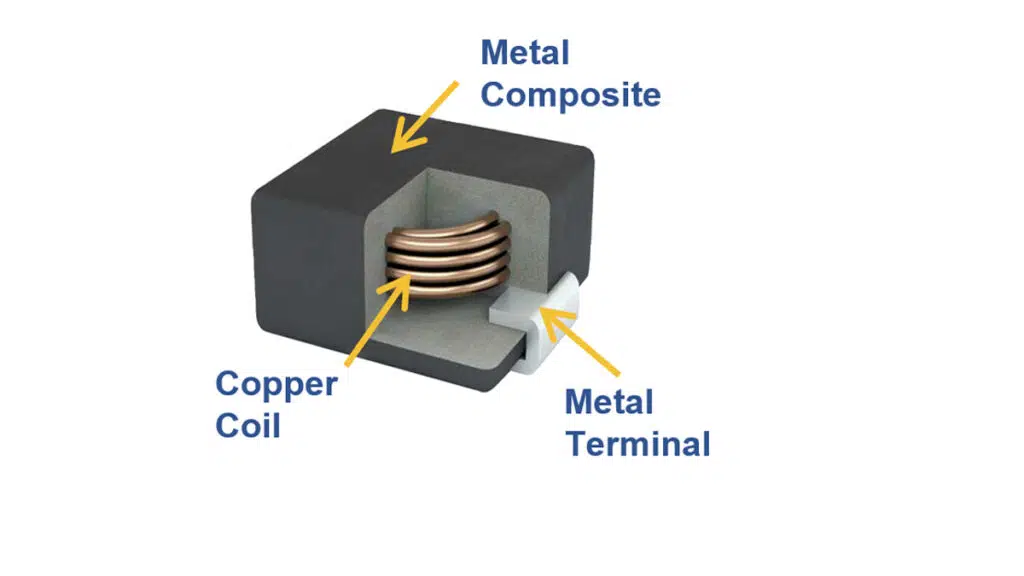

A clutch of companies is keenly extending their product line in order to fulfil the current and emerging industry standards in automotive markets. KEMET, a YAGEO Group Corporation is one the pioneers in capacitor and inductor technology whose product portfolio is slated to shape the competition landscape. The company recently unveiled a family of metal composite power inductors for the automotive market. These are targeted toward all automotive electronics that need high-temperature capability, low acoustic noise, and stable inductance over wide temperature and current ranges. The supplier claims that the new family of inductors can operator anywhere between −55 °C and +155 °C and stated that its inductance range is 0.10–100 μH at 100 kHz. The company has expanded its METCOM inductor product line to target under-the-hood automotive components in an automobile.

The company reveals that it has leveraged its core competencies in inductor material development and advanced production technology for magnetic permeability and flux density. Its Senior VP and CTO stated that its expertise has enabled them to develop and launch devices with high-permeability and high-saturation flux density in order to meet high performance in emerging standards. Specifically, the company claims that its offering fulfils AEC-Q200 qualification standard.

Downsizing of ECUs in automotives is making the demands more stringent, which has bolstered the revenue potential of electronics component manufacturers in the metal composite core inductor market. Several other companies in Asia Pacific have jumped into the fray to grab the opportunity. Panasonic’s ETQ-PM Series of metal power inductor is a case in point. Murata Manufacturing Co., Ltd. is another player whose product lineup is making metal composite power inductors more attractive than the ferrite type. Few other notable players are Pulse Electronics Corporation and Vishay Intertechnology.

Exponential rise in consumer interest in connected car functionality such as vehicle infotainment is likely to drive R&D spending on automotive electronic components. This inevitably will nudge end-use industries to recalibrate their considerations for the type of power inductors they plan to adopt, which is likely to broaden the market outlook.