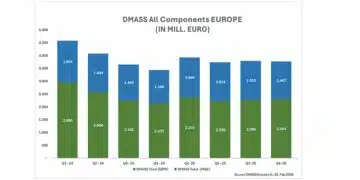

According to DMASS Europe e.V., European components distribution market declined by -23.3% in Q1 2024, nevertheless sees huge potential for recovery across all industry segments and technologies.

The first quarter of a business year normally sets the mark for speculation how the full year may turn out. According to DMASS Europe e.V., the European components distribution market, which enjoyed three years of significant growth, reported a decline of over 23% across all components and thus will face a few challenging quarters.

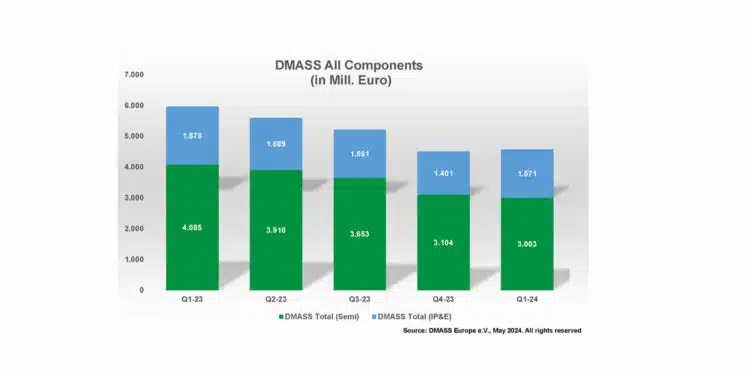

Consolidated distribution revenue of reporting members declined by 23,3% to 4.58 billion Euro. While semiconductors dropped by 26.5% to 3 billion Euro, IP&E (Interconnect, Passive and Electromechanical) components declined “only” by 16.3% to 1.57 billion Euro.

Hermann Reiter, chairman of DMASS: “As well all know, this market consolidation was overdue for a while, so Q1/2024 turned out to be the least surprising quarter I have seen in a while. Even if we may face a few challenges over the next few quarters, recovery will start sooner or later, and I am confident that 2025 will be back on track. It wouldn’t make sense to overreact now with cost-cutting exercises. The multiple crises the world is facing right now should hide the simple truth that the electronics revolution is ongoing: from the all-electric society to artificial intelligence, the world needs more and more innovative components. We will find more opportunities than resources to realise them.”

Semiconductors (Q1):

Semiconductor distribution sales in Europe shrank by 26.5% to 3 billion Euro. This is the first time ever that a first quarter was lower than the preceding Q4. Regionally, no country remained positive, with major differences between regions. The UK proved surprising resilient with a decline of only 15%.

Product-wise, only high-power LEDs and Microprocessors showed growth, all other product groups and categories declined between 4 and 37%.

Interconnect, Passive and Electromechanical Components (Q4):

In IP&E, the slowdown continued in Q1, 2024, but showed a very positive sequential upturn against Q4/2024. The IP&E distribution market declined by 16.3% to 1.57 billion Euro. The slowdown between the three major product groups differed significantly, with Passives under higher pressure than Emech and Power Supplies. in all 3 product groups remained in the lower double digits. At the country-level, Central Europe (Germany, Austria and Switzerland) suffered most, UK, France, Italy and Iberia did surprisingly ok. (see tables below).

| Product Group IP&E | Total k€ | Change Q1/Q1 |

| PASSIVES | 584.363 | -21,18% |

| ELECTROMECHANIC | 872.872 | -13,10% |

| POWER SUPPLIES | 114.111 | -13,36% |

| DMASS IP&E Total | 1.571.346 | -16,31% |

| Country/Region IP&E | Total k€ | Change Q1/Q1 |

| UK | 167.504 | -12,49% |

| IRELAND | 11.936 | -11,86% |

| GERMANY | 364.798 | -23,34% |

| FRANCE | 159.658 | -12,82% |

| ITALY | 177.711 | -11,23% |

| SWITZERLAND | 48.670 | -20,57% |

| NORDIC | 132.232 | -19,71% |

| BENELUX | 74.581 | -17,03% |

| IBERIA | 91.365 | -10,15% |

| AUSTRIA | 40.317 | -27,89% |

| RUSSIA | 170 | -55,60% |

| EASTERN EUROPE | 205.877 | -14,01% |

| ISRAEL | 32.952 | -19,63% |

| TURKEY | 39.485 | 8,98% |

| OTHER | 24.090 | 4,74% |

| DMASS IP&E Total | 1.571.346 | -16,31% |

Chairman Hermann Reiter concludes: “It is becoming increasingly clear that the components market is much more complex than what you may see in global market predictions. For example, the AI hype is not happening everywhere and only involves a few component types. Our market, a.k.a. the mass market needs to full portfolio of leading-edge and mature technologies, involving many sources and manufacturers. For this complexity, distribution is the only reasonable and resilient answer.”