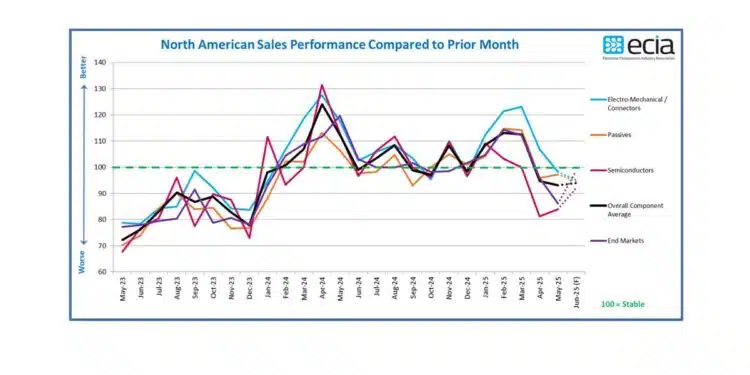

The ECIA North American sales sentiment survey in May 2025 results did not continue the collapse in sales sentiment that had been projected in the April survey.

In a positive development for the electronic components industry, the May 2025 ECST results did not align with the projected sales sentiment decline observed in the April survey.

The overall product index was projected to drop to 83.7 in May due to the challenging tariffs faced by supply chain participants at the time. However, the moderating tariff environment likely contributed to the sentiment index stabilizing at 93.1 in May, 9.4 points higher than the projected value last month.

Electro-Mechanical and Passive Components narrowly missed the 100-point threshold, recording scores of 98.3 and 97.2, respectively. While the Semiconductor score of 84.0 remains concerning, it is 7.3 points better than the projected value for May.

Relative stability may be the best that can be expected at this juncture, as the overall product index score remains relatively consistent at 94.0 in the June outlook. The sales sentiment index for Electro-Mechanical and Passive Components is projected to decline slightly in June, while Semiconductors are expected to improve back to 92.0.

The erratic and unpredictable tariff environment creates an unstable foundation for the sales environment in the future. Given these factors, cautious sales expectations for the electronics component industry are prudent at this point. In a surprising turn of events, Manufacturers reported surprisingly positive scores for both May and the June outlook.

All but one product category achieved scores above 100 in May, and all categories surpassed 100 in the June outlook. In contrast, Distributors expressed a decidedly negative outlook on the sales environment. While Manufacturer Representatives maintained a generally positive view in May, they joined Distributors in their pessimistic assessment for June. The overall end-market index score continued its decline in May sentiment but rebounded to nearly 100 in the June forecast. The inconsistent market sentiment behavior compared to components is puzzling.

The lead time scores have exhibited stability in recent months, with almost non-existent reports of delays.

The share of survey participants reporting increasing lead times surged from 9% in April to 23% overall in May, indicating a shift in the market dynamics. This change suggests that government policy will continue to play a pivotal role in determining the market’s future trajectory for the foreseeable future.