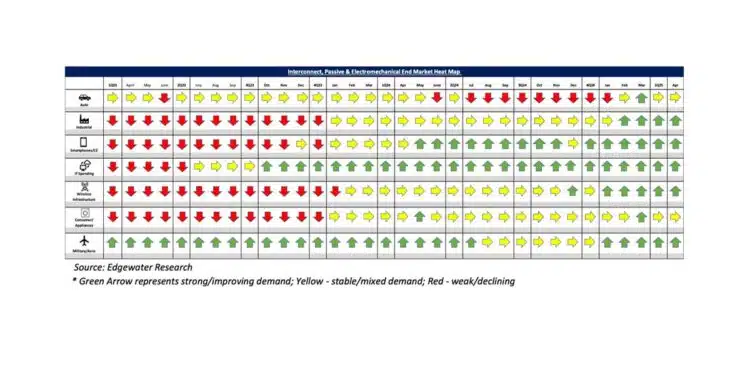

Edgewater researchers report Stable Core Demand and Strengthening AI Outlook Driving Near-term Fundamentals. May 2025 collection of news summaries, survey results, and channel market insights on Interconnect, Passives components & Electromechanical Components from Edgewater Research.

What’s Changed/What’s New?

1. Broader demand trends remain intact, with stable to improving order trends, despite some trade-related volatility in April.

2. Recovery viewed as fundamentally driven, with limited signs of meaningful pull-forward amid broad-based order improvement and modestly positive B2B. 2H visibility still limited, but sentiment cautiously optimistic for continued recovery.

3. 2H AI connector/cable forecast seen strengthening, in part driven by supply assurance efforts. End demand remains solid, however, elevated procurement ahead of consumption is seen prompting questions around inventory buildup and system deployment.

4. 2H Trn2 connector/cable forecast seen doubling since April, driven by Amazon efforts to secure supply and a recent decision to retain Trn2’s rack architecture in Trn3; implications for Trn2/3 rack projections unclear.

Top 3 Channel Comments:

• Demand is improving across distis and direct customers, signaling the end of the inventory cycle. We’ve raised our 2H forecast to high-single-digit Y/Y growth (from MSD) as channel and customer inventories remain low. April B2B was just >1 across all markets, with no major order distortions. In 2Q, Industrial demand in the Americas is expected to grow 3–5% Q/Q, while Auto remains flat.

• We estimate we were under shipping demand in the U.S. by 30-40% from the end of March through mid-May because of the pause on China shipments several U.S. distis enacted. Since the U.S. and China tariff reprieve was announced we have captured all of that over the last few weeks. We are now tracking to original plans for 2Q and our outlook for recovery remains unchanged.

• B2B remains slightly above 1 and we haven’t seen abnormal cancellations or pushouts because of the tariffs. The Military market remains the main growth driver for interconnect, but we also see growth in Industrial and other markets in N.A. Haven’t seen signs of pull forward in the data through April – the trend remains consistent with recent months.

Other Key Takeaways:

5. Passive demand noted as improving both in direct & channel business, B2B ratios across passive suppliers >1x and recovery noted as broad-based.

6. Nvidia NVL deployment seen improving with progress noted in addressing Amphenol connector issues; challenges appear yet to be fully resolved and NVL deployment continuing to lag with <8K projected in 1H and CY25 still at ~20-25K.

7. Copper remains preferred for current AI scale-ups applications; long-term 448G challenges and limited DAC reach drive expectations toward optical solutions (LPO/CPO).

8. Amphenol seen securing backplane and flyover cable design wins on AMD’s MI450 rack. Rack design noted as similar to Nvidia NVL72 implying comparable copper backplane content. Rack ramp-up projected for 1H26.

9. Amphenol seen as likely winning the backplane design on META’s MTIA rack, with a limited 2H25 launch and MP in 2H26.

10. TE seen securing interconnect socket design wins for SP7/SP8 AMD Venice CPUs, as well as for liquid busbar with leading CSP.

11. Auto demand trends seen stable through early May, potentially outperforming low expectations. 2H visibility still limited with ongoing concerns around 2H BEV programs from Ford and GM and potential de-spec’ing by OEMs tied to tariff/costs management.

12. Industrial demand reads stable to improving, with better trends in distribution, building automation, energy storage, and green shoots in factory automation. Some US tariff-related shipment delays noted in April; seen largely normalized post US-China tariff reprieve.

Conclusion:

IP&E fundamentals continue to recover across the broader market, with B2B ratios exceeding 1x across nearly all segments and channels. Encouragingly, outside of AI, the near-term rebound appears driven by a return to end-demand consumption rather than pull-forward behavior tied to geopolitical or tariff disruptions. Our research indicates the recovery is cyclical, supported by sustained AI strength, reinforcing our optimistic outlook through 2025 and into 2026—barring any meaningful deterioration in end demand due to geopolitical or tariff-related uncertainty.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research