MLCC capacitor market development indicates that the end is near for the inventory correction period in the Chinese spot market. Despite persistence of weak demand, decline in prices of consumer-spec MLCCs has eased during 4Q22 according to Trendforce report.

The latest research from global market intelligence firm TrendForce finds that the usual demand surge related to the year-end holiday season is not materializing during this second half of the year due to several factors.

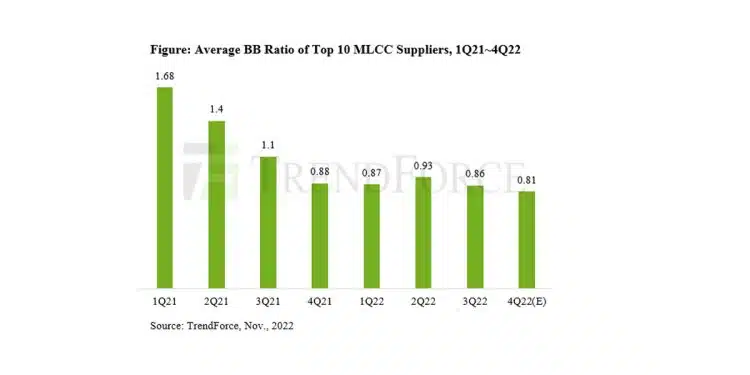

First, the data about the global economy continue to show a negative outlook, and the consumer electronics market is unable to shake off the constraining influence of high inflation and rising interest rates. Furthermore, at the 20th National Congress of the Chinese Communist Party that was held this October, the leadership of the Chinese government made it clear that the strict zero-COVID policy will remain in force. Lastly, ODMs are having problems lowering their inventories, and the whole supply chain from the upstream to the downstream is still experiencing inventory-related issues as well. Hence, in view of the underwhelming peak season and ODMs’ cautious approach to stocking up, TrendForce estimates that the average BB (book-to-bill) ratio of MLCC suppliers will have slipped slightly to 0.81 in 4Q22.

Starting this November, MLCC suppliers including Murata, SEMCO (Samsung), and Yageo have been receiving rush orders involving small quantities. These orders are from China’s Tier-2 smartphone brands and suppliers for networking devices, motherboards, and graphics cards. Among the various applications segments of the MLCC market, graphics cards was the first to experience falling demand in 1Q22. Therefore, through early and continuing adjustments, inventories of graphics cards OEMs have recently returned to relatively healthy level. It is also worth mentioning that traders in the Chinese spot market were aggressively cutting prices so as to capture more orders during 3Q22. However, they have halted quote offering and held back their supply lately, thereby forcing some Tier-2 smartphone brands to place rush orders with MLCC suppliers. This development indicates that the end is near for the inventory correction period in the Chinese spot market.

Although Decline in Prices of Consumer-Spec MLCCs Has Eased, Downward Price Pressure Will Mostly Remain During 1Q23

There is a chance that the price competition among MLCC traders will moderate after 4Q22. Nevertheless, TrendForce’s latest market survey shows that MLCC suppliers’ average inventory level is staying around 90 days. As for distributors in the channel market, their average inventory level presently comes to 90~100 days as well. Turning to the major ODMs, their average inventory level still resides around 30 days (3~4 weeks). Taking all market participants (i.e., distributors, suppliers, and ODMs) into consideration, the inventory situation of the entire MLCC market remains far from optimal (i.e., at the average level of 120 days).

Previously, ODMs kept almost no inventory for MLCCs. However, with the recent resurgence of COVID-19 outbreaks in China, ODMs are compelled to have some stock on hand so as to avoid a potential supply disruption. Furthermore, economic activities are expected to be very subdued in 1Q23. This will impact demand and exacerbate the off-season slump. With no tangible growth in orders and too much stock on hand, inventory-related costs will become much harder to bear. Consequently, ODMs will inevitably be very proactive in seeking price concessions for MLCCs.

On the other hand, TrendForce’s latest investigation finds that MLCC suppliers have realized that even after two consecutive quarters of substantial price reductions, there has been no turnaround in ODMs’ demand. Currently, quotes for most midrange and low-end consumer-spec MLCCs show no tangible profit margin. At the same time, suppliers are under pressure to present satisfactory year-end financial results. Therefore, suppliers are less willing to cut prices than before. Right now, their top priority is to survive through the latest market downturn. Keeping prices stable will allow them to retain some profitability and thereby persevere through this challenging period for the industry.

To Mitigate Effect of Demand Slump for Consumer Electronics, MLCC Suppliers Expand Production Capacity for Automotive Offerings

Looking ahead to 2023, the state of global economy is still expected to be anemic. This, together with geopolitical tensions and China’s commitment to its zero-COVID policy, will likely delay the demand turnaround in the consumer electronics market. However, the demand for electronic components from the automotive industry is expected to pick up steadily as the global semiconductor chip shortage gradually dissipates. Hence, MLCC suppliers will be focusing on automotive offerings next year. SEMCO will be aligned with Samsung Group’s grand strategy for 2023: all divisions including semiconductors, display panels, passive components, camera modules, etc. will launch a full-scale effort to develop businesses in the global automotive market. Regarding SEMCO’s capacity expansion plan for 2023, the supplier will add a total of 2 billion pieces per month of production capacity for automotive-spec MLCCs at South Korea’s Pusan and China’s Tianjin.

Turning to Murata, the supplier has kept its production capacity for automotive MLCCs growing at an annual rate of 10%. Starting in 2Q23, Murata will be adding a total of 3 billion pieces per month of production capacity at its three production plants. Two of them are located in Japan’s Fukui Prefecture and Izumo, whereas the third one is located in the Philippines. With this addition, Murata will reach 25 billion pieces per month for its entire production capacity, thus further cementing its position as the industry leader.

Lastly, regarding Yageo, it has fully incorporated KEMET’s technologies for automotive MLCCs and will begin expanding its production plant in Taiwan’s Kaohsiung in 2Q23. This plant is expected to gain another 1.5 billion pieces per month of production capacity.