This article written by Dennis Zogbi, Paumanok Inc. published by TTI Market Eye provides a price trend overview of key raw materials used for passive electronic components such as nickel, copper, aluminium, zinc, palladium, ruthenium, tantalum and silver.

The manufacturing of mass-produced surface mount capacitors, resistors and inductors relies heavily on specialized engineered powders and pastes, primarily composed of advanced ceramics and refined metals. In passive electronic components, raw materials represent the largest variable cost in the production process, directly influencing pricing and profitability.

As of March 2025, the market continued to experience volatility in the pricing of multiple metal-based materials. These fluctuations are driven by ongoing persistent inflationary pressures, supply chain disruptions at critical choke points and intensifying competition across industries for essential metals, compounded by global trade tariffs.

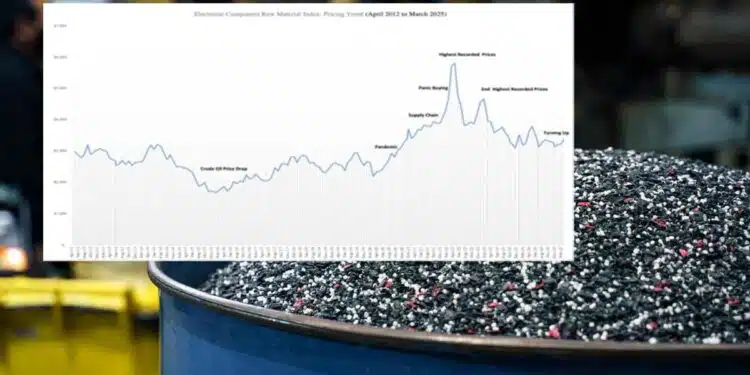

We have been tracking price increases in ruthenium, copper, silver, aluminum, zinc and tantalum and stability in the palladium and nickel price in the March 2025 quarter. The chart below shows the long-term cost trends associated with producing passive electronic components.

The above chart illustrates aggregate pricing for key feedstocks consumed as the primary dielectric material, resistive element, electrode or termination material for the production of trillions of passive electronic components.

How Materials Impact Passive Electronic Component Costs to Produce

Raw materials are the most expensive variable cost associated with the production of passive components. Any fluctuation in price or availability for these key feedstocks can have a negative or positive impact on profit margins. We have demonstrated through deep dive, single client studies that dielectric nano-materials are the single most expensive variable cost to produce for the passive component industry. This is followed by electrodes, then terminations, then “other” which is comprised of a variety of smaller pieces of technology such as cathode polymers and salt chemistry; alcohol and water chemistry; and cans, stoppers, lead wires, insulation, jacketing, molding, adhesives and tapes.

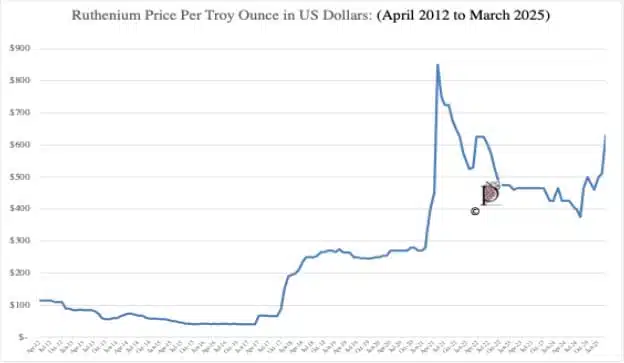

Ruthenium

Ruthenium is a precious metal that is similar to palladium, but its primary purpose is to be consumed in all thick film chip resistors and resistor networks produced worldwide. The price of ruthenium has shown extreme volatility because of its association with palladium mining activities in South Africa. The reader should remember that reliance on ruthenium for all mass-produced thick film resistor chips is a weakness that threatens the entire high-tech economy. The ruthenium price skyrocketed in March, signaling increased demand from the resistor chip and network supply chain amidst slowdowns in overall PGM mining due to electric vehicles impacting ICE production.

This price volatility has caused customers to seek alternative resistor designs also based upon thin film nickel. Unfortunately, the economies of scale of manufacturing for thin film resistors are a small fraction of that of thick film chips, one of the largest volume products produced in the world (measured in the trillions of pieces). Resistors represent a significant volume of worldwide consumption for ruthenium metal (with additional uses as a cracking catalyst, a hard disc drive coating and as an esoteric chemical compound). Therefore, the metal is very sensitive to any changes in resistor supply and demand the global high-tech economy and its signpost on the current market conditions should not be overlooked by the precious metal market analyst.

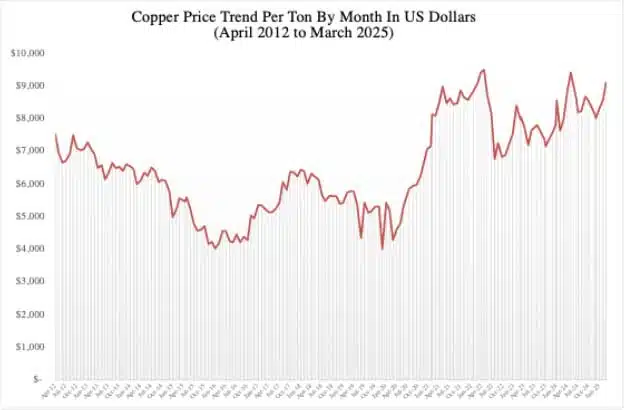

Copper

Copper engineered powders are consumed in the production of multilayered ceramic chip capacitors (MLCCs) as the termination material consumed in conjunction with the nickel type electrode. Therefore, copper and nickel are an important type of base metal duo. Copper is used in some MLCC electrode systems because, unlike its counterpart nickel, it is non-magnetic. The price of this metal, which is key for energy storage solutions, has showed extreme volatility from 2021 through 2025 due to supply chain disruptions.

The chart above illustrates the price trend for copper ore, which is a keystone material consumed in the multilayered ceramic chip capacitor termination matched with nickel electrode and a key specialty electrode material for non-magnetic MLCCs.

Silver

Silver is consumed as a termination material for many electronic components but primarily for MLCCs that employ precious metal electrodes. MLCCs with precious metal electrodes and silver terminations are, in turn, consumed in high voltage, high temperature and high reliability MLCCs for similar end-use market segments. The reader should note that the two primary termination metals for MLCC—copper and silver—are under price pressure.

Aluminum

Etched anode and cathode foils are consumed as the dielectric layers of aluminum electrolytic capacitors. Aluminum comes from bauxite, which is a mined material. Aluminum is abundant in the Earth’s crust and its price has been historically stable. Aluminum electrolytic capacitors are important components consumed in power supplies, television sets, computers and power electronics, including renewable energy systems. The market has shown extreme volatility between 2021 and 2025 due to supply chain problems and speculation due to its substantial sourcing of processing in Eastern Europe and because of global tariffs placed upon aluminum in the March 2025 quarter.

The chart above shows the price for aluminum ore feedstock, which is a keystone material for aluminum electrolytic capacitor anode and cathode foils as well as a key raw material for resistor substrates.

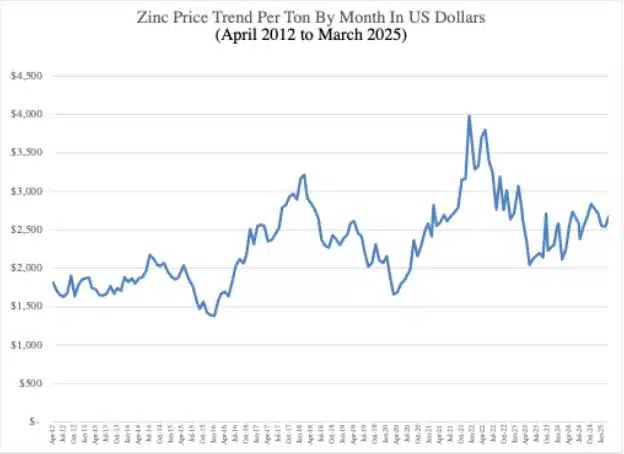

Zinc

Zinc is used as an additive in ceramic chip capacitors and as the primary ingredient in the production of metal oxide varistors, which are consumed for circuit protection components in all known AC-line voltage equipment and used to protect digital electronics from the effects of electrostatic discharge. The zinc price has been more recently unstable as is shown in the chart below.

Zinc is a primary material consumed in non-linear resistor as the active ingredient in zinc-oxide varistors.

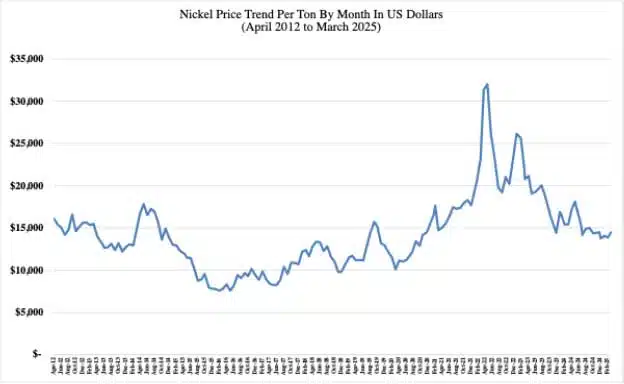

Nickel

Nickel is the primary electrode material consumed in high capacitance MLCCs. The fluctuations in nickel price are primarily the result of competition for the metal with the steel industry, where it is used as a hardener. Nickel supply is in turn important for the production of X5R, Y5V and X7R MLCCs, which are the capacitors of choice for the operation of smartphones, tablets and TV sets.

The market has shown extreme volatility from 2021 through 2025 due to supply chain choke points, hyper-inflation and competition for keystone metals consumed in multiple industries seeking to reduce carbon emissions. The price of these dielectric, electrode and termination metals, which are key for all energy storage solutions, is expected to continue to react in 2025 and 2025 in direct response to changes in global inflation rates. Expect the price of MLCCs to follow to absorb any small increases or decreases experienced in their nickel electrode paste supply chains.

The chart above illustrates the price trend for nickel ore, which is a keystone material consumed in the MLCC electrode and a key material for thin film and precision resistive layers.

Palladium

Palladium is a platinum group metal that is mined in South Africa and Siberia, among other locations. It is consumed primarily for auto-catalysts but also for jewelry and as the primary electrode material is precious metal based MLCCs, which are in turn used in high reliability, high temperature and high voltage printed circuit boards globally. Historically, palladium has proven a difficult raw material partner for the MLCC supply chain because of its price volatility, a by-product of it being a “speculative” metal subject to trading as a financial instrument.

Palladium is a metal that is used in MLCC electrodes for mission critical applications in high voltage, high temperature and high frequency. Such high feedstock pricing impacts costs to produce for many small MLCC manufacturers and this is the primary motivating factor behind the movement to alternative electrodes and alternative MLCC designs in many end-markets where it has not been used before such as fossil fuel engine electronics, defense, space and oil and gas electronics.

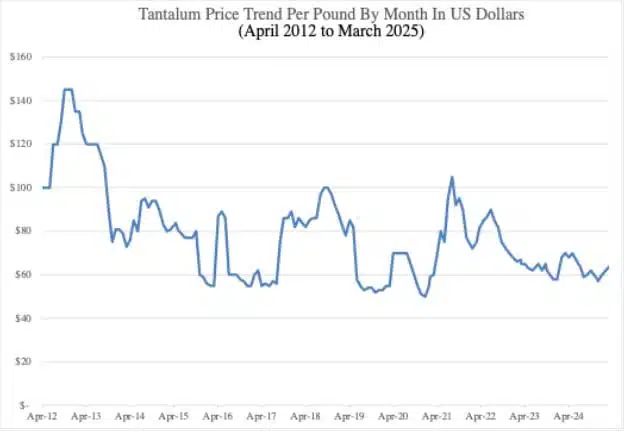

Tantalum

The majority of tantalite metal used in the production of tantalum capacitors comes from Central Africa. Other known tantalite resources are located in Australia, Brazil and Canada. Tantalite’s primary use is as capacitor grade tantalum metal powder for consumption in capacitor anodes. Tantalum capacitors are consumed in communications networking equipment, smartphones, automotive, medical and defense electronics. Tantalite and tantalum ores have demonstrated volatile pricing in the past but has remained relatively stable in price during the current market shortages. The reader should know that the lessons learned from the tantalum supply chain have been and will continue to be valuable as OEM brands insist on transparency on all material supply chains. Tantalum pricing has been stable in comparison to other dielectric materials for an extended period of time.

Paumanok Publications estimates that the primary raw materials consumed in the production of tantalum capacitors are capacitor grade tantalum metal powder and wire, which is engineered from high purity tantalum ores and concentrates. Tantalum, a rare metal, represents a significant portion of the variable costs to produce for tantalum type capacitors.

Summary

Raw materials impact the overall costs to produce passive electronic components. In fact, dielectric materials, electrode materials and termination materials represent the largest variable cost associated with the production of electronic components. Any fluctuation in price or availability for these key feedstocks can have a negative impact on profit margins for electronic component producers. For the March quarter, we are noting price increases in ruthenium, copper, silver, aluminum, zinc and tantalum and stability in the nickel and palladium prices, all key feedstock materials to produce mass-produced electronic components.

Pricing for raw material feedstocks consumed in the production of passive components has experienced new highs over the past four years in direct response to global inflation and significant strength of the U.S. dollar to other key currencies in the metric, primarily the yen, the won and the NT$.