Deutsche Bauelemente-Distribution (according to FBDi e.V.) posted a sales increase of 17.5% and an increase of 132% in order intake in the second quarter of 2021. The shortage of components prevents a better result.

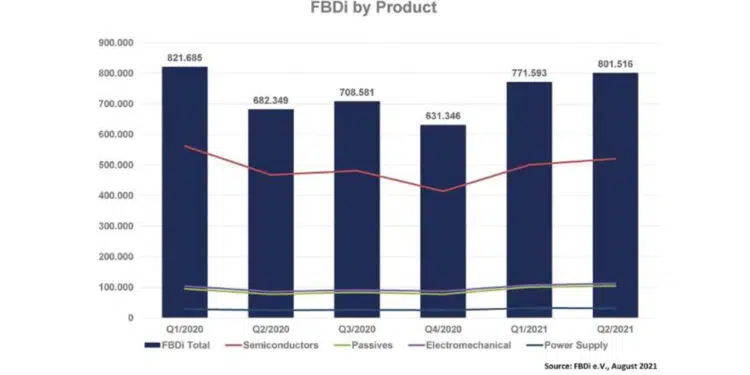

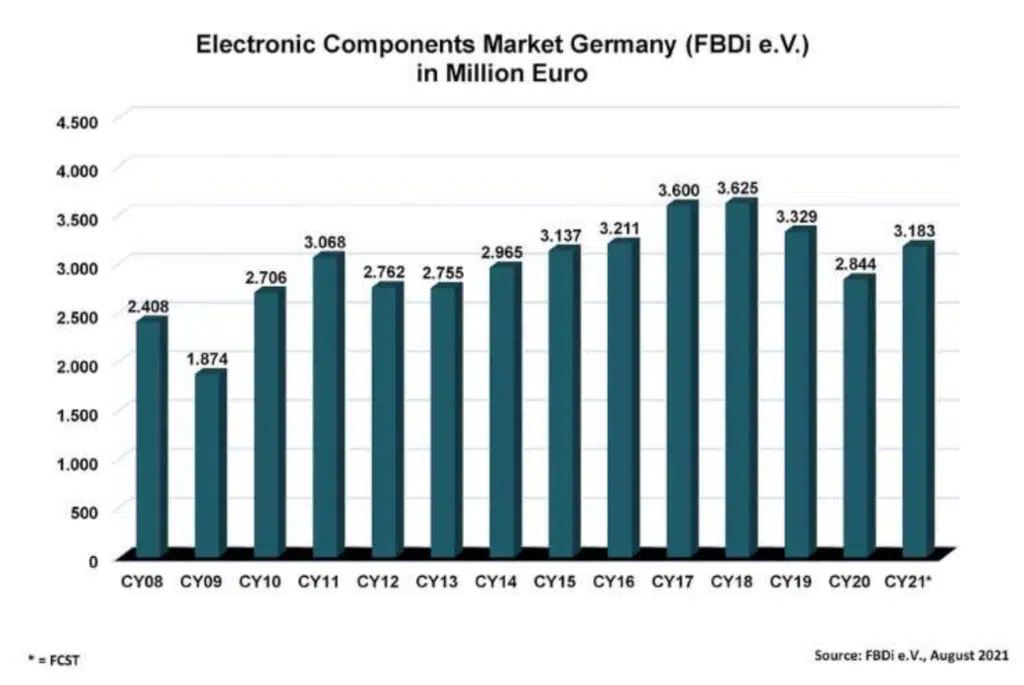

The first consequences of the component shortage became visible in the second quarter of the year. The distributors registered in the FBDi association recorded a 17.5% increase in sales to 802 million Euros from April to June 2021. In the same period, bookings virtually exploded, reaching two new records with 132% growth and a total volume of 1.43 billion Euros. As in Q1, the lack of availability slowed down sales growth

considerably. The book-to-bill rate rose again, to an incredible 1.79.

At product level, Passive Components grew significantly by 35% to 104 million Euros, as did Electromechanics by 31% to 112 million Euros. Semiconductors, the strongest product group, “only” grew by 11.2% to 520 million Euros, but had a massive increase in bookings to

over 1 billion Euros. Electromechanical sensors grew by 54%, displays by 3.9%, power supplies by 28.2% and assemblies and devices by 43.3%. The distribution of sales shows slight shifts: Semiconductors take 65% of sales, passives 13%, electromechanics 14%, power supplies 4%, and the remaining 4% are distributed among the other products.

FBDi Chairman of the Board Georg Steinberger: “In view of the absurdly high order situation, it can be assumed that the increase in sales was characterized more by a lack of availability and price increases than by real growth, which will hopefully materialize in the coming quarters. How much of the almost 1.5 billion euros in new orders is real will become clear next year at the latest, because a large proportion of these are long-term advance bookings by many customers who want to avoid a situation like now.”

Interestingly, the discussion about billions in subsidies for 5-nm chip factories has calmed down again somewhat, according to Steinberger: “We assume that work is continuing in secret on the politicians to distribute billions in tax gifts, but the differentiation of the discussion has already begun. After all, the European problem cannot be measured in nanometers, but in the lack of interesting chip designs suitable for mass production in the style of smartphone or tablet processors. And this is due to the fact that, compared to the USA, China and Japan, there are hardly any significant research and educational structures for microelectronics in this country, and just as little investment and support landscape for

chip start-ups. As long as subsidies always trickle down to large companies to finance things they do anyway, this will not change.”