source: EPCIA Newsletter

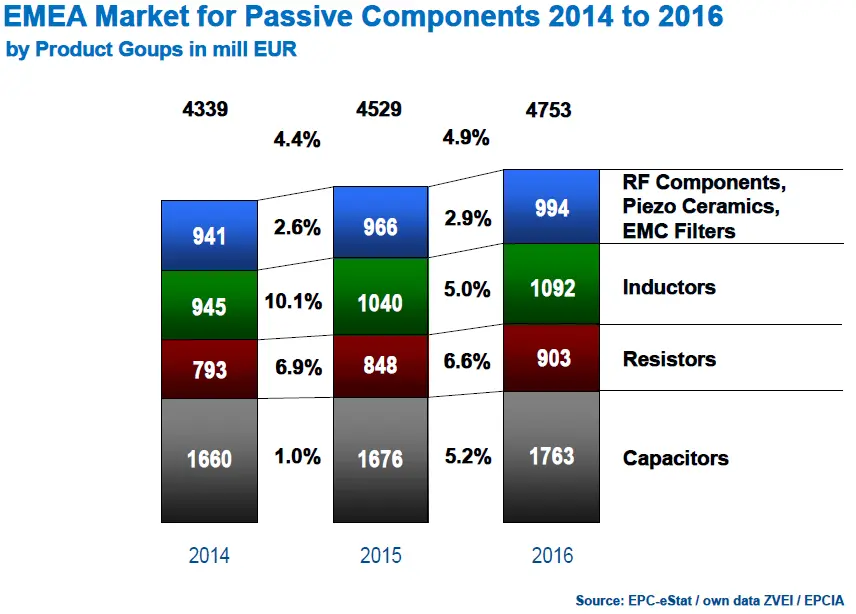

European passive component market development until 2016 has been just released by EPCI newsletter. In 2014 the European Passives Components market increased to a volume of EUR 4.3 bn and could continue the healthy development in the following years 2015 and 2016 with a steady growth of 4.4% and 4.9% to a total of EUR 4.8 bn in 2016.

The European Passive Components Industry Association (EPCIA) represents and promotes the common interests of the Passive Components Manufacturers active in Europe to ensure an open and transparent market for Passive Components as part of the global market place. Based on the aggregated results of the common European Passive Components Statistics (EPC-eStat), the markets developed as follows:

In 2014 the European Passives Components market increased to a volume of EUR 4.3 bn and could continue the healthy development in the following years 2015 and 2016 with a steady growth of 4.4% and 4.9% to a total of EUR 4.8 bn in 2016.

Product Groups

With a share of almost 40% and a volume of EUR 1.7 bn in 2014 Capacitors are the biggest product group of the Passive Components Market in Europe. Compared to 2014 the market was pretty flat in 2015. We recorded only a modest increase of 1.0%. In 2016 Capacitors grew 5.2% and reached a level of EUR 1.8 bn.

In 2014 the Resistors market reached a volume of EUR 0.8 bn. With a growth rate of 6.9% in 2015 and 6.6% in 2016 the Resistor market was able to exceed the EUR 0.9 bn level this year.

Inductors represent the second biggest product segment among Passive Components in the EMEA market with a share of more than 20%. In the last two years the Inductors market has grown the most with a CAGR of 7.5% and reached a size of EUR 1.1 bn in 2016.

The combined market of RF Components, Piezo Ceramics and EMC Filters totaled EUR 1.0 bn in 2016. It showed a moderate but steady annual growth of 2.8% on average from 2014 to 2016.

Main European Market Segments

The Automotive sector represents half of the total Passives EMEA market. Hence, strong growth – as in the last two years – is of highest importance for Passive Components in Europe.

The Industrial segment as the second largest in the EMEA market and with a share of one third is of major importance, too. Here, the market development was also positive from 2014 to 2016 with moderate growth rates.