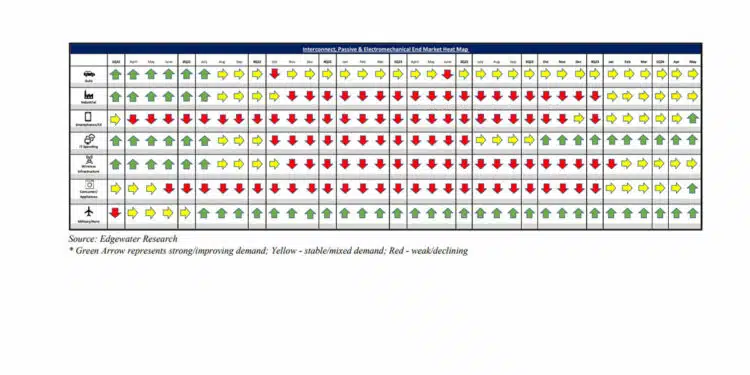

June 2024 collection of news summaries, survey results and channel market insights on Interconnect, Passives & Electromechanical Components from Edgewater Research.

Feedback Still Mixed but Improving, Orders Up Modestly on Improvement in Consumer

What’s Changed/What’s New?

1. Order trends seen as remaining mixed by geo, end market, and supplier but maintaining a modest upward trajectory in aggregate.

2. B2B seen as hovering around 1, flat to up Q/Q, and mixed by end market. 2Q sales seen tracking flat to up low single digit Q/Q, in-line with targets with disti POS flattish, and direct shipments better. 3Q outlook slightly better at flat to up MSD Q/Q.

3. Consumer demand seen inflecting positive. Apple interconnect demand noted stronger across Apple’s product line with significantly higher than normal connector pull-in for iPhone in June/July/Aug. Appliance demand also seeing an improvement driven by China.

Top 4 Channel Comments:

• 2Q shipments globally are tracking up 2-3% Q/Q, ahead of expectations of flat to +2%. The real story however is the recovery in bookings, which are tracking up 5-6% Q/Q driven by China Auto and areas in Americas. EMEA still lags in shipments and orders.

• We have started to place replenishment orders for A and B running connector SKUs. We are receiving input from Amphenol on the expected big sellers and are placing orders for those parts. We also have a new initiative on relays with TE. We’re beginning to replenish inventory but are being much more strategic than a few years ago when we were buying everything.

• We see strong orders and ramp-up for the iPhone 16. The production target is 80 million units which is not unusual, but Apple aims to secure 50% of the necessary components by August. This is a very tight window.

• TE says it needs to ramp up capacity for Medical and Datacom for AI products. Apparently, TE has several Medical programs ramping up in the coming quarters that could strain manufacturing soon.

Other Key Takeaways:

4. CY24 AI outlook consistent M/M, projecting >3x increase in sales. Nvidia NLV connector content assumptions unchanged M//M, but feedback suggests an upward bias in external I/O content on NVL36 on potentially higher rack-to-rack connectivity requirements.

5. Auto demand seen tracking inline for 2Q and CY24. Feedback modestly better M/M on China Auto, offsetting softness in EV demand.

6. Industrial is more mixed for 2nd straight month, with green shoots seen as uneven and overall demand trending flattish, lacking upward momentum. Expectations for recovery in Industrial seen pushing out to 4Q from 3Q prior.

7. Distributor feedback is mixed, with stable demand and near-healthy inventory levels. Distis seen starting to place replenishment orders for high-running SKUs while still digesting slower-moving parts; implying modest 2H improvement for suppliers.

8. Early signs of improvement were noted in traditional IT Datacom for both high speed and power delivery interconnect.

9. Connector suppliers expected to push a low single-digit price increase in distribution on 7/1, driven by the recent rise in metals costs.

Conclusion

Overall demand signals are mixed through May and into June, with fundamentals continuing to show signs of bottoming. While the performance by geography and end markets are mixed, we remain comfortable that the IP&E industry is much closer to reaching a balanced inventory position setting the industry up for better growth in 2H24 than in semis. While the outlook remains more favorable than semis, muted end demand across multiple end markets continues to leave the pace of the recovery muted/seasonal at best for 2H24. We remain confident in our low-single digit growth outlook for the IP&E industry in 2024 and continue to expect growth to resume historical patterns in 2025 and beyond.

Full report available from: Dennis Reed, Sr. Research Analyst, Edgewater Research