This article written by Dennis Zogbi, Paumanok Inc. published by TTI Market Eye provides an overview and mapping of 2024 progress in key passive electronic components technologies.

Capacitor Research 2024

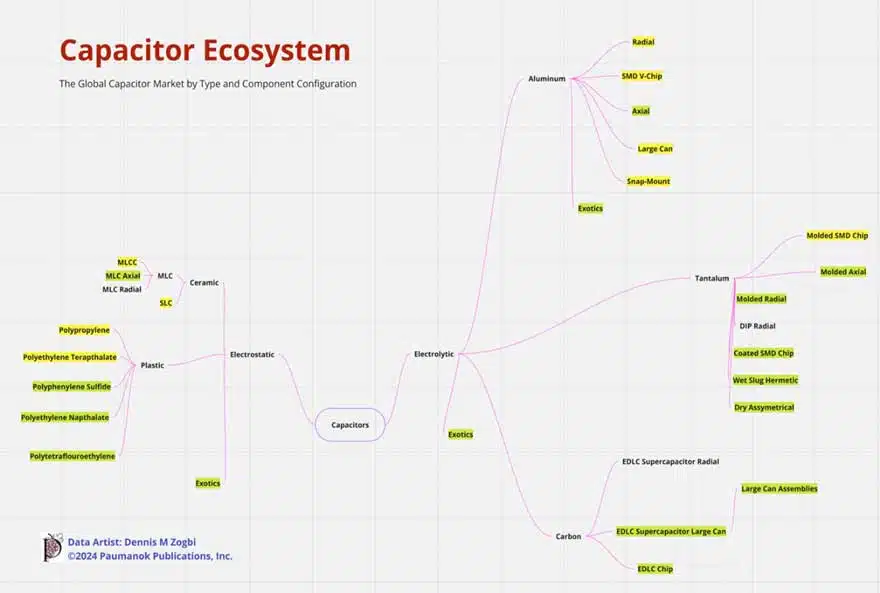

In 2024, key areas of technical and economic focus were on conductive polymer capacitors, high capacitance MLCC (Multilayer Ceramic Capacitors), power factor correction capacitors, and interference suppression capacitors.

A key insight is that each of these key growth product lines was focused on achieving higher operational capacitance for mass-produced components that can operate at temperatures of 105°C or 125°C.

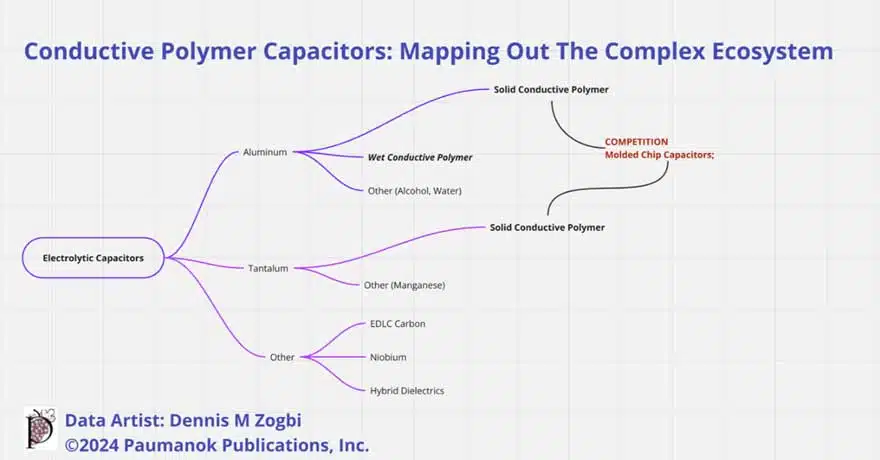

Conductive Polymer Capacitor Research

A significant portion of customer interest lies in understanding the current dynamics of the conductive polymer capacitor market and its potential for increasing standardization in general-purpose applications.

These devices are particularly well-suited for circuits that require high capacitance, high voltage, and high temperature in compact footprints. Their applications in decoupling artificial intelligence chipsets and electric vehicle propulsion make them a cornerstone solution for design engineers who prioritize the added safety of solid-state designs.

In parallel, the polymer electrolytic markets are experiencing global expansion, aiming to provide more capacity for producing liquid polymer solutions in compact vertical chip designs. This liquid polymer solution offers alternative ecosystems for supplying cornerstone technologies, particularly in the automotive industry. Additionally, advancements in nanotechnology are enabling the development of new ceramic-based capacitors that can compete with electrolytics at higher temperatures. This ongoing research and development in electrolytic capacitor technology continues to drive innovation.

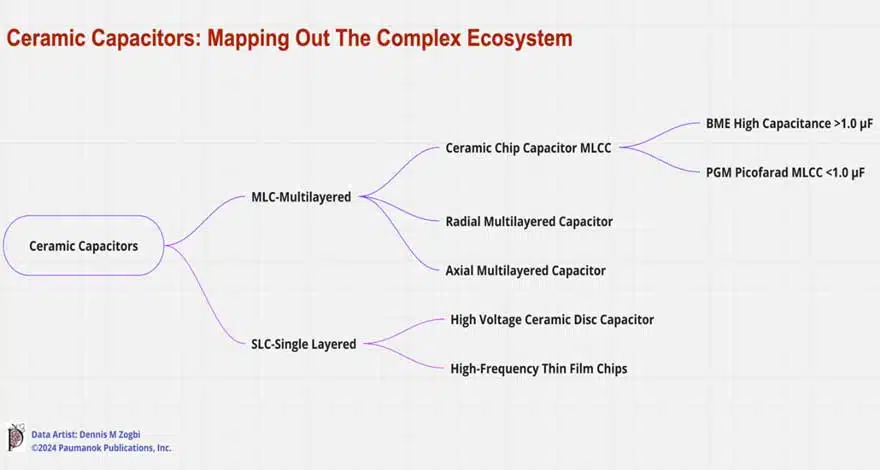

Ceramic Capacitor Research: Focusing on High-Capacitance Applications

Our technical-economic research in ceramic capacitors centers around high capacitance base metal electrode multilayered ceramic chip capacitors and specialty ceramics for high-voltage, high-frequency, and high-temperature applications.

Given the substantial size of the global ceramic capacitor industry ($19 billion) and its substantial combined research and development spending of $320 million, the level of activity in this space is diverse.

High Capacitance Base Metal Electrode MLCCs

We’ve focused our technical-economic research on enhancing the development of electrodes manufactured from nickel powders and pastes. Nanotechnology has consistently delivered granular improvements in component performance since 1993. This research aligns with electronic materials research in nickel, copper, palladium, and silver, as well as additional ceramic dielectric material research based on titanates and carbonates.

Specialty Ceramic Capacitor Research

High-temperature, high-frequency, and high-voltage ceramic capacitors are the focus of our research. High-voltage ceramic capacitors are widely used in automobile propulsion systems for inverter and converter circuits. High-frequency ceramics have gained popularity in satellite communications and related infrastructure backbone applications. High-temperature ceramics are employed in chipset decoupling to temperatures up to 105°C, while voltage and capacitance solutions up to 125°C are developed for automotive applications in battery management systems.

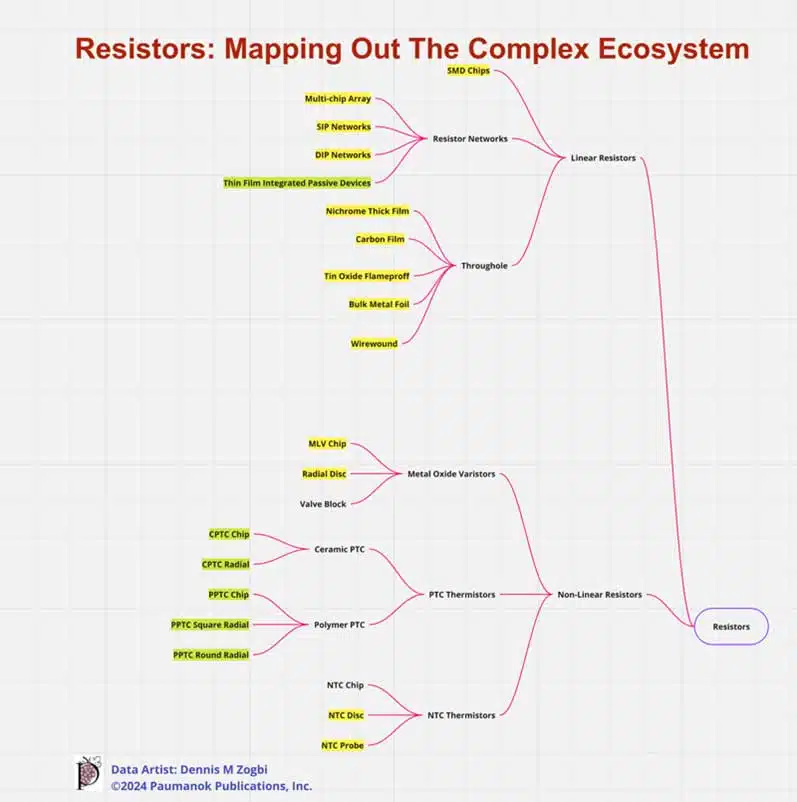

Resistor Research 2024

Our research quantifies and qualifies linear resistors, another significant economic indicator in high-tech electronics beyond capacitors. We’ve created a comprehensive dataset spanning from 1988 to 2024, categorized into the following sub-categories: thick film chip resistors, resistor networks in single-in-line and dual-in-line packages, arrays, and integrated passive devices; nichrome power film resistors; high-voltage flameproof tin-oxide resistors; wirewound resistors; tantalum nitride thin film resistors; and carbon cement type resistors.

Thick Film-to-Thin Film Trend

Thick film chip resistors, mass-produced with global capacity in trillions of pieces, primarily require the rare metal ruthenium as their fundamental resistive element, coupled with alumina substrates. This combination attracts vertical customers, prompting alternative solutions using alternative elements and substrates, particularly nickel chromium and tantalum nitride film solutions.

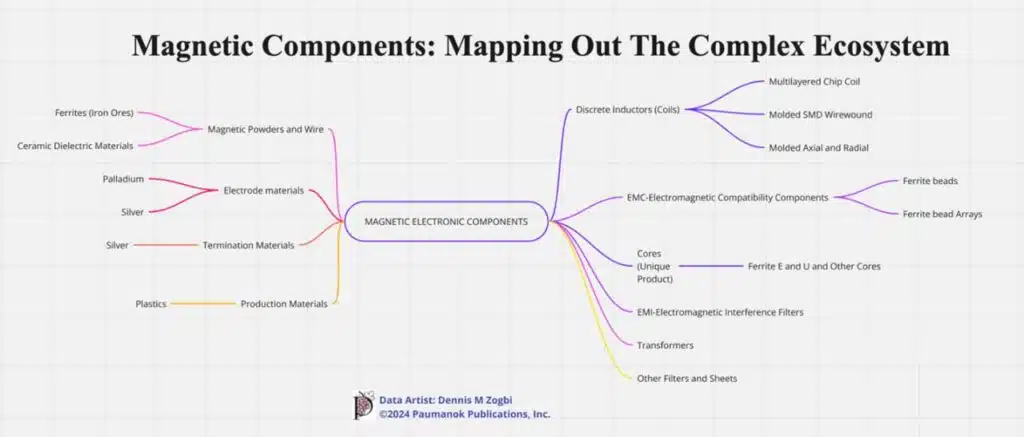

Magnetic Components: Mapping Out The Complex Ecosystem

In a recent technology analysis, we delved into the materials consumed in the production of discrete inductors, including choke point metals and ceramics. Additionally, we explored the technology direction of thin film SMD inductors as they enter the market, offering volumetric efficiency and operation at new frequency allocations.

Materials Research Update

Our research was focused on electronic materials for applications as dielectrics, electrodes and terminations. The successful application of these powders, pastes and slurries continues to be at the forefront of research and development.

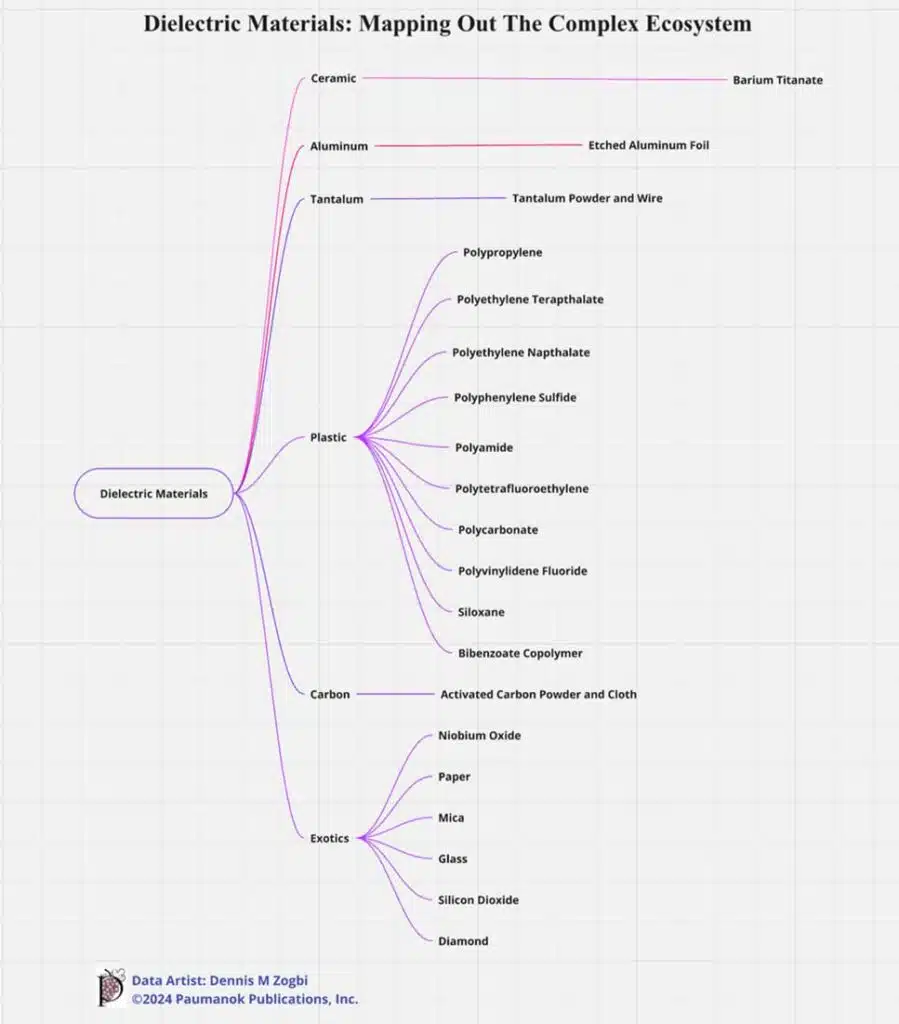

Dielectric Materials

We conducted technical-economic studies and analyses on ceramic dielectric material formulation markets, including barium titanate, barium carbonate, and titanium oxide building blocks specifically tailored for use as capacitor dielectrics in paste and slurries.

We also analyzed the global market for etched and formed anode and cathode foils for aluminum materials.

Finally, our research on plastic film capacitor materials focused on polypropylene and polyester terephthalate supply chains, while also exploring valuable niche markets in PTFE, PI, PPS, PEN, PC, and other exotic plastic film dielectrics.

The tantalum supply chain materials under technical-economic study and analysis encompass the intricate ecosystems for capacitor-grade tantalum metal powder and wire, including amorphous and hexagonal powders.

The carbon materials under technical-economic study and analysis include the complex ecosystems for activated carbon powder and cloth materials.

Exotic high EBITDA supply chains materials under technical-economic study and analysis include glass, mica, paper, niobium, silicon, and diamond.

Electrodes and Terminations: Keystone Materials for Ceramic Components Industry

We have identified electrodes and termination metals as pivotal materials for the continued success of the ceramic components industry globally. Since capacitance and resistance are fundamental to modern electronic circuitry, the materials consumed in their production, particularly dielectrics, electrodes, and terminations, are under constant scrutiny by our research.

The following chart reveals two key insights:

Precious metal supply chains for electronic components are driven by demand from automotive (under-the-hood) applications, military specifications (mil-spec), medical technology, oil and gas, and civil aviation. Spacecraft rely on electronic components with precious metal content due to the proven reliability of these electrode and termination matching systems in ceramics in high-temperature and harsh environments.

The development of base metal electrode systems was tailored for large-scale customers purchasing multilayered ceramic solutions for handsets, computers, and home theater electronics. The ongoing advancement of electrodes based on nickel, particularly the powder extrusion and paste dispersion on ceramic substrates, has consistently provided a technological edge in high capacitance MLCCs, both in terms of capacitance and voltage.

Summary and Conclusions

In 2024, the primary research at Paumanok was customer-driven and focused on a contested area of technical innovation in the electrostatic capacitors and electrolytic technology sectors.

The research concentrated on tantalum and aluminum electrolytic capacitor technology and the application of polymer cathode technology to reduce equivalent series resistance at higher voltages per cell. Additionally, advancements in nickel electrode dispersion technology, combined with precipitated ceramic dielectric powders and pastes, have led to increased capacitance in Multi-Layer Ceramic Capacitors (MLCCs) at higher voltages per chip, enabling further penetration into the electrolytic supply chain at higher profit margins.

Other research areas included capacitor, resistor, inductor, and circuit protection, as well as related dielectric, electrode, and termination system research. This research focused on developing high-reliability passive components for applications in high-temperature, high-voltage, and high-frequency electronic systems.

Two key end-markets emerged from this research: AI chip set decoupling and electric vehicle propulsion. Both applications require components that can operate at higher temperatures (105°C and 125°C, respectively) and higher voltages (10, 16, 25, and 35 volts per chip).

In the fixed resistor market, there was a continued interest in thin film nichrome and tantalum nitride chip resistors as alternative technologies to thick film (ruthenium and alumina), particularly in mission-critical electronics applications.

Magnetics technology remained focused on pairing high-frequency ceramic capacitor ecosystems with communications backbones, with more of this expected in 2025.