Dennis Zogbi, Paumanok Inc. publishes on TTI Market Eye outlook on thin film integrated passive devices and its market assessment.

The demand for thin film integrated passive devices is on the rise due to the precision and volumetric efficiency that these components offer when compared to traditional individual parts such as capacitors, resistors, inductors and overvoltage protection devices, making them a desirable option for design engineers who require unique solutions for the next generation of ultra-small modules and devices.

Bright Outlook Forecasted for Integrated Passive Devices

Leading industry analysts anticipate that the high-reliability segment of the market will continue to experience growth for thin film integrated passive devices, particularly in aerospace, medical and oil and gas electronics, but with emerging opportunities in propulsion and wearables where volumetric efficiency of all parts, pieces and materials are addressed for the next generation of mobility.

Historical Development, Technology, Types and Configurations

In the 1960s, resistor manufacturers started to package individual resistors into single-in-line packages (SIP), reducing the cost of assembling resistors on printed circuit boards. As the manufacturers realized they could make value-added configurations with alumina bridges, they developed thick-film networks with up to 32 resistive elements in dual-in-line packages with gull-wing leads for surface mounting. The dual-in-line package (DIP) also enabled manufacturers to integrate different types of passive components such as ceramic chip capacitors and chip resistors.

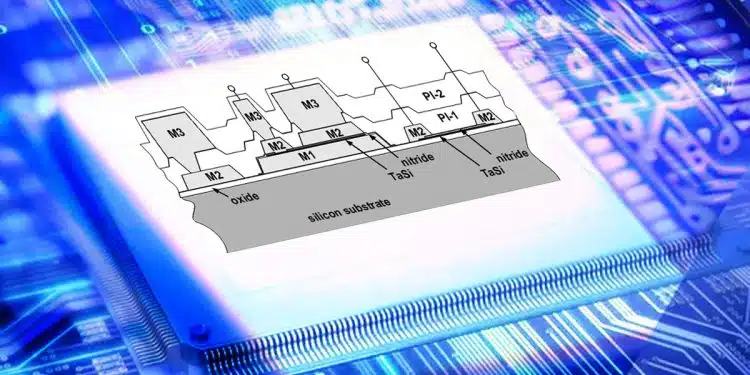

In the 1990s, semiconductor manufacturers used semiconductor manufacturing techniques to create layers of resistance using materials like tantalum nitride, chrome silicide, hafnium diboride and nickel-chromium. They also used ion-implantation devices to engineer silicon-oxide- and silicon-nitride capacitors, resulting in complex integrated passive devices (IPDs). The manufacturers then added transistor functions and circuit protection functions to IPDs using thin-film-on-silicon designs, which competed against traditional thick film DIPs and SIPs for termination and filtering functions, particularly in high-reliability applications where advanced mobility was a competitive advantage in the ecosystem.

Thin Film Metals and Deposition

Thin film technology is often used in network designs when more precise resistance values are required. Nickel-chromium and tantalum-nitride, as well as other materials such as chrome-cobalt, hafnium diboride, and chrome-silicide are deposited or “sputtered” onto ceramic substrates using physical vapor deposition of metal “targets.”

Thin film networks are available unpackaged for hybrid networks for digital-to-analog converters and as external feedback networks in hybrid operational amplifiers. They are also used as substrates for resistive-capacitive (RC) networks. RC networks are usually packaged in metal and ceramic flatpacks because they are regarded as precision resistive components.

Thin film network manufacturers are employing semiconductor technology to integrate passives beyond capacitance and resistance, including inductor coils, silicon rectifiers, Schottky diodes and transistors. As a result, thin film networks and thin film integrated passive devices are increasingly used in high-frequency applications, particularly in the computer, computer networking, defense and medical markets, and are competing with traditional thick film DIP networks.

Thin Film Resistors: Market Assessment

Since our last analysis of the thin film resistor market, it has experienced significant growth. There has been a notable increase in the number of vendors manufacturing thin film nichrome chip resistors, while the number of vendors in tantalum nitride thin film resistors has remained stable, with TaN type thin film resistors continuing to be the market leaders. However, we believe that a technology offering that includes both TaN and nichrome film resistors would be the most comprehensive.

The driving trend behind the demand for thin film resistors continues to be the need for advanced miniaturization processes that enhance volumetric efficiency while maintaining the functionality of the end product. Pricing has traditionally been secondary to achieving volumetric efficiency in high-reliability markets, but as demand grows in wearables, lower cost solutions are being sampled, primarily in base metal on alumina solutions. However, the “known reliability” of integrated passive devices based upon rare and precious metals and unique ceramic substrates have them cross-pollinating ecosystems at this keystone point of electronic technology.

An Assessment of Thin Film Materials Used in IPDs

It is important to note that both tantalum nitride and nickel chromium thin film resistors have their unique advantages and disadvantages. While tantalum nitride thin film resistors are known for their superior moisture resistance, they tend to be more expensive and are often used in specialty electronics where reliability is critical. On the other hand, nickel-chromium thin film resistors are more cost-effective and are commonly used in mainstream end-markets. However, they may not perform as well as tantalum nitride resistors in harsh environments.

As the demand for advanced digital circuits continues to grow, the precision and reliability offered by thin film resistors will become increasingly important. Therefore, it is likely that both tantalum nitride and nickel chromium thin film resistors will continue to have their place in the market, with their use depending on the specific application and end-market requirements.

Base materials such as nickel + chromium and chrome + silicide are also growth markets because they are already being consumed as thin film chips and networks in industrial electronic applications and are the likely solution for integrated passive devices for high volume consumer applications.

Thin Film Integrated Passive Devices: Regional Markets

It is interesting to note the regional differences in the demand for thin integrated passive devices. In the Western market, there is a greater demand for tantalum nitride-based solutions, which are preferred for their superior performance in moisture resistance, making them well-suited for specialty electronics such as defense, oil and gas and medical devices. On the other hand, the larger movement of demand in thin film resistor chips is in telecommunications and networking infrastructure equipment and wireless base stations where the added precision of thin film lends itself toward a more professional network.

In Asia, particularly in China and Japan, there is a genuine interest in thin film resistor chips and network solutions to enhance the continuing fascination with component miniaturization. The investments in infrastructure to build thin film chips in Asia have been well established in Japan and China for many years now, and there is a growing demand for the benefits of thin film technology in a circuit. Companies manufacturing electronic watches and wireless handset modules, such as power amplifier and antenna modules, have been successful at miniaturization to a degree that was beyond imagination just 30 years ago.

Europe remains a small market, but there is a significant amount of homegrown technology. France has rapidly increased its presence in the segment and they have vertically integrated IPDs in medical and transportation-related applications. As the demand for thin film integrated passive devices continues to grow across the globe, we can expect to see more investment in infrastructure and greater design engineer interest in the benefits of thin film technology in a circuit.

Thin Film Resistors: Markets by End-Use Segment

In 2023, the demand for precision thin film resistors is being driven primarily by the communications infrastructure market, specifically in the areas of wireless base stations and data-communication network switching. Additionally, there is increasing demand in other markets, such as ultra-small power supplies, including DC/DC converter bricks and specialty micro-power supplies for propulsion. Thin film resistors are also being utilized in the computer server markets, automotive infotainment and GPS tracking market as well as in consumer audio and video imaging markets such as smartwatches and ultra-small cameras. There is also significant demand in defense electronics, medical electronics and oil and gas electronics.

Competition in Integrated Passive Devices

In 2023, the global market for precision thin film resistors is served by a total of 30 manufacturers, each offering a variety of chips, networks and integrated passive devices. Of these manufacturers, 12 are based in the United States, 10 in Asia, and eight in Europe. While all 30 companies offer precision thin film chips, only 18 of them manufacture thin film networks and just eight are capable of producing sophisticated integrated passive devices.

Notably, the top three vendors of thin film resistors also specialize in integrated passive devices, highlighting the importance of the correlation between the type of thin film resistor used and the ability to produce advanced, three-dimensional circuit board applications.

Integrated Passive Devices: Global Market Outlook for 2023-2028

Based on our analysis, we predict that the demand for integrated passive devices will outpace many other passive component products in the next five years to solve the continued need to increase functionality while reducing size. This trend will be aided by the increasing economies of scale in manufacturing bases in Japan and Taiwan to produce integrated passive solutions for next generation ultra-small parts and systems.

Technology developments will continue to emerge from applications where volumetric efficiency is critical, such as implantable defibrillators, downhole logging tools, smart metering and space avionics. However, larger demand is expected to emerge in wearables, such as Class III medical electronics (consumer over-the-counter medical electronics) and smart watches and portable gaming.

The use of semiconductor manufacturing techniques to achieve next levels of volumetric efficiency is expected to growth in high-reliability end-markets where volumetric efficiency and portable functionality are key market drivers; however, higher-volume markets are also expected to grow in consumer end markets (watches and gaming) to support higher functionality in the future.