Passive Components Blog has released the 2025 Annual Capacitor Technology Dossier, a 33‑page deep dive into how capacitors moved from low-margin commodity parts to strategic enablers of AI, EV and 5G infrastructure in 2025.

The global capacitor market reached USD 41.23 billion in 2025, with strategic segments such as high‑voltage MLCCs, polymer/hybrid aluminum capacitors and DC‑link film capacitors growing at 12–17% CAGR, while general-purpose consumer MLCCs stagnated. The dossier explains why design-in decisions around capacitor technology, derating and qualification now drive system performance, reliability and total cost of ownership in mission‑critical applications.

What the dossier covers

- Seven structural trends shaping 2025

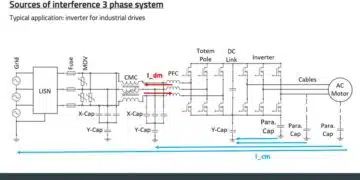

The report identifies seven forces that redefined the industry, including AI server power architectures, the 800 V EV tipping point, 5G‑Advanced RF front‑ends, regional supply chain reconfiguration, miniaturization limits, intensifying AEC‑Q200 qualification, and new sustainability mandates in the EU. - Hard numbers behind the shift

Detailed tables quantify 2025 market size and 2035 projections by technology, from MLCC and high‑voltage MLCC to polymer/hybrid aluminum, DC‑link film, tantalum and supercapacitors. The dossier contrasts differing “total market” definitions among major research houses and shows how that changes the view of opportunity sizing. - AI, EV and other application chapters

Application-focused sections dissect capacitor roles in AI data-center PDNs, 800 V EV powertrains and on‑board chargers, and Advanced base stations. Readers see which capacitor types win in each architecture – and why. - Technology landscape & roadmap

A full technology map compares MLCC families, polymer and hybrid aluminum, film, tantalum/niobium and supercapacitors across capacitance, voltage, ESR, temperature and volumetric efficiency. A dedicated positioning diagram shows how each technology sits in the voltage–frequency space, from RF matching networks to DC‑link energy storage and grid‑level buffering. - Qualification, compliance and derating

The dossier summarizes AEC‑Q200 Revision E implications for automotive capacitors, extended temperature and voltage stress regimes, and the resulting 12–18 month qualification cycles. It also covers updated RoHS/REACH and Digital Product Passport requirements, and provides concrete lead‑free derating guidelines that cut field failure rates for X7R, X5R and Y5V ceramics by ~86–94%.

Who should read it

This dossier is written for:

- Component manufacturers and distributors refining 2026–2030 product roadmaps for MLCC, polymer/hybrid aluminum, film and supercapacitors.

- OEM and Tier‑1 engineering teams designing AI servers, EV powertrains, OBC/BMS, industrial drives, solar inverters and other applications who need a consolidated view of capacitor options and trade‑offs.

- Sourcing, category and product managers responsible for mitigating lead‑time and qualification risk in strategic capacitor categories.

Why it is different from generic market reports

Unlike broad passive-component reports that focus on high-level market sizing, the 2025 Annual Capacitor Technology Dossier combines:

- Quantitative market and CAGR data across all major capacitor technologies.

- Detailed technology benchmarking (capacitance, voltage, ESR, temperature, volumetric efficiency).

- Application engineering guidance for AI, EV, 5G and grid-tied systems, including real power-rail and derating examples.

The result is a compact, high‑density reference that can be read in an afternoon and used throughout the year for strategy, design and sourcing decisions.

Availability

The 2025 Annual Capacitor Technology Dossier – “From Commodity to Strategic:Capacitors for AI, EV and other applications” is available now at 699EUR exclusively from passive-components.eu as a paid download.

To learn more and purchase your copy, visit the Technology Dossiers page on the passive-components.eu blog.